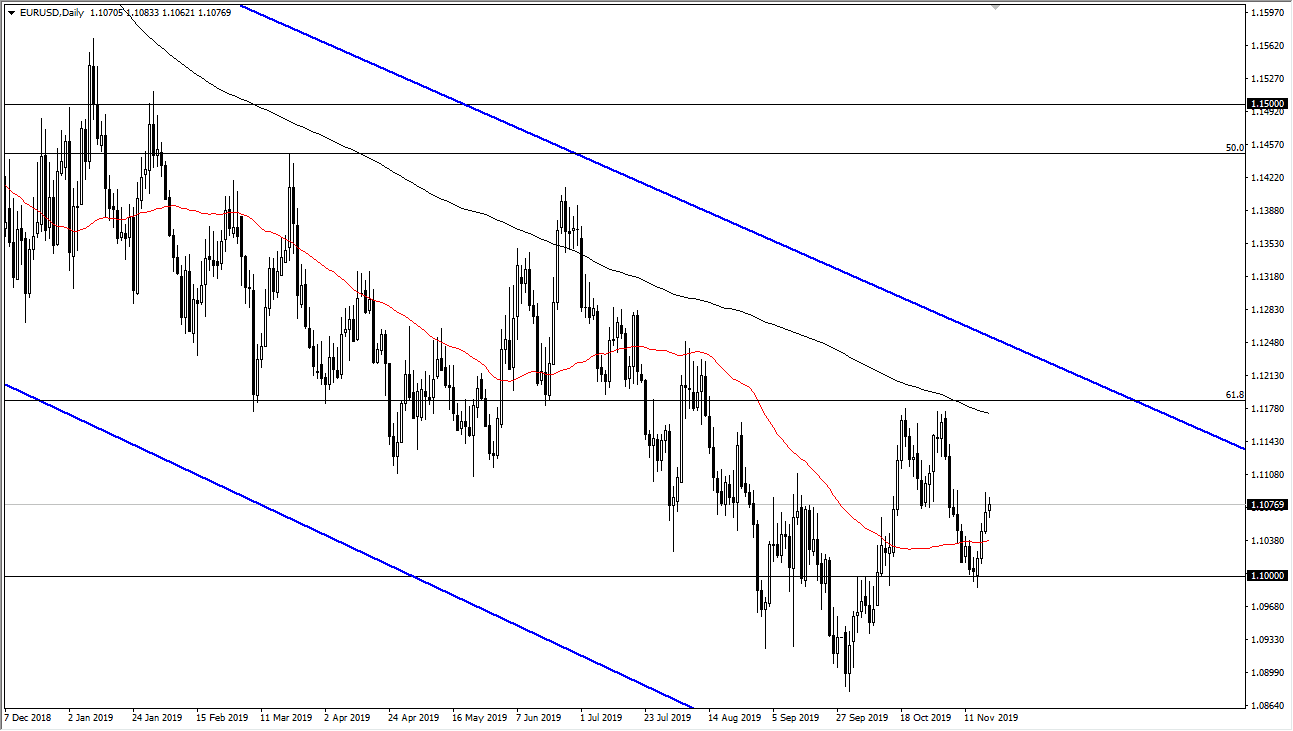

The Euro initially tried to rally during the trading session on Tuesday but did run into a bit of sluggish opposition near the 1.11 level. This is an area that has been rather difficult for the market to break above as of late, and previously was support. The fact that we are broken down below it is a sign that it should continue to have a lot of noise at this level, so I think at this point it makes quite a bit of sense that we rollover. Beyond that, the market will continue the longer-term downtrend that we have seen for three years, and I believe at this point the initial target will be the 50 day EMA perhaps even the 1.10 level underneath.

At this point, it makes sense that we simply continue the overall negativity that we have seen for some time, and therefore it’s hard to imagine a scenario where everything suddenly changes. The European Central Bank is looking to loosen monetary policy yet again and add to its balance sheet and that of course is the same thing as loosening monetary policy.

That being said, the Federal Reserve is on the sidelines and essentially doing nothing, although that of course is up to debate. The market seems to be willing to give the Federal Reserve a bit of a break on the repo operations and ignore the fact that they are doing quantitative easing. If that’s the case still, it’s likely that the market should continue to be negative when it comes to the Euro, and quite frankly to be honest the European Union has a lot of economic issues out there. With that being the case it’s likely that the market will continue to favor the greenback over the Euro until we can get some type of settlement of financial issues and to exactly what it is the central bank is going to be doing as far as adding assets to the balance sheet. Ultimately, this is a market that will eventually break down below the 1.10 level, and then go looking towards the 1.09 level underneath which was the most recent low. Below there, the market then goes looking towards the 1.0750 level which was the scene of a major gap. This gap tends to get filled, but it may take quite some time to get down there as this pair is very slow moving.