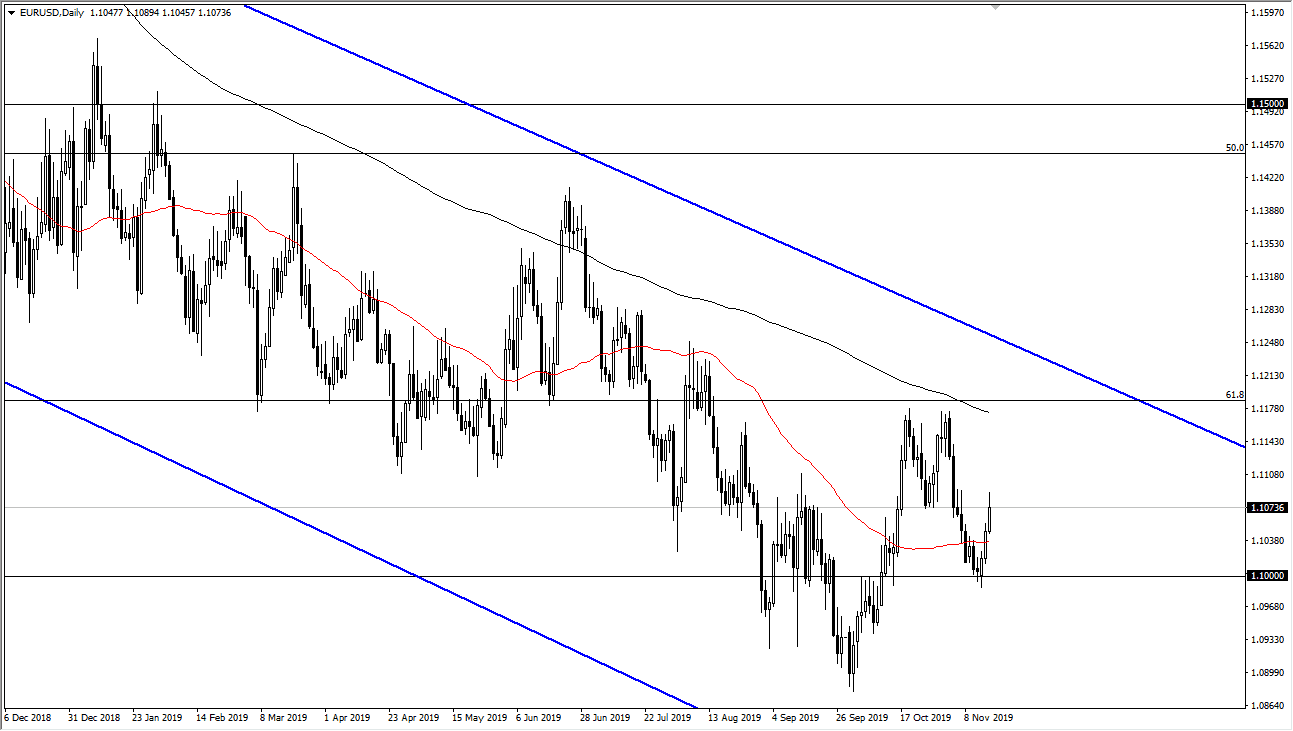

The Euro rallied a bit during the trading session on Monday to kick off the week, reaching towards the 1.11 level. However, the market looks very likely to continue to see sellers in that area as it is the bottom of the “M pattern” that the market broke down from initially. At this point, it’s very likely that the market will continue to focus on the large round figures again, with the 1.11 level making quite a bit of sense as the market seem to be very technically driven at this point. However, when you look at the longer-term chart, it’s obvious that we have been in a downtrend and that has not changed.

Granted, the last three candlesticks have been bullish but there is so much in the way of resistance above it’s difficult to imagine that the rally will last for any significant amount of time. The 200 day EMA sits just above the recent “M pattern”, forming a bit of a double top. The 200 day EMA is starting to slope lower again, so therefore I think it’s only a matter of time before the sellers get involved in start shorting again. This doesn’t mean that I simply jump in and start shorting right away, but I do recognize that it is going to be much easier to sell rallies to show signs of exhaustion more than anything else in this market.

As far as buying is concerned, we would need to at the very least close above the 200 day EMA, and quite frankly I would like to see some type of weekly close above there to get serious about buying the Euro. We are in the descending channel, and that has not changed despite the last three trading sessions. To the downside, I would anticipate that the 1.10 level will continue to be targeted, and eventually we will break down below there to go looking towards 1.09 level after that. When you look at the longer-term chart, the 1.0750 level features a gap that will probably be targeted longer-term but obviously with the way this pair moves, it’s going to take a long time to get there. I continue to fade rallies that show signs of exhaustion, and of course sell fresh, new lows as the negativity should continue and of course the US dollars been strengthening due to the fact that the Federal Reserve is on the sidelines while the ECB is likely to loosen.