The Euro has gone back and forth during the trading session on Wednesday, as there is a lot of noise surrounding the Euro, and of course the US dollar. During the trading session on Wednesday we had the first public hearing in front of Congress about the potential Donald Trump impeachment, Jerome Powell was speaking in front of Congress, and a whole host of other noisy issues were affecting the markets. Essentially, this market continues to see a lot of choppy action as we are hanging about a large, round, psychologically significant figure. The 1.10 of course attracts a lot of attention and should continue to see a lot of back and forth in this general vicinity.

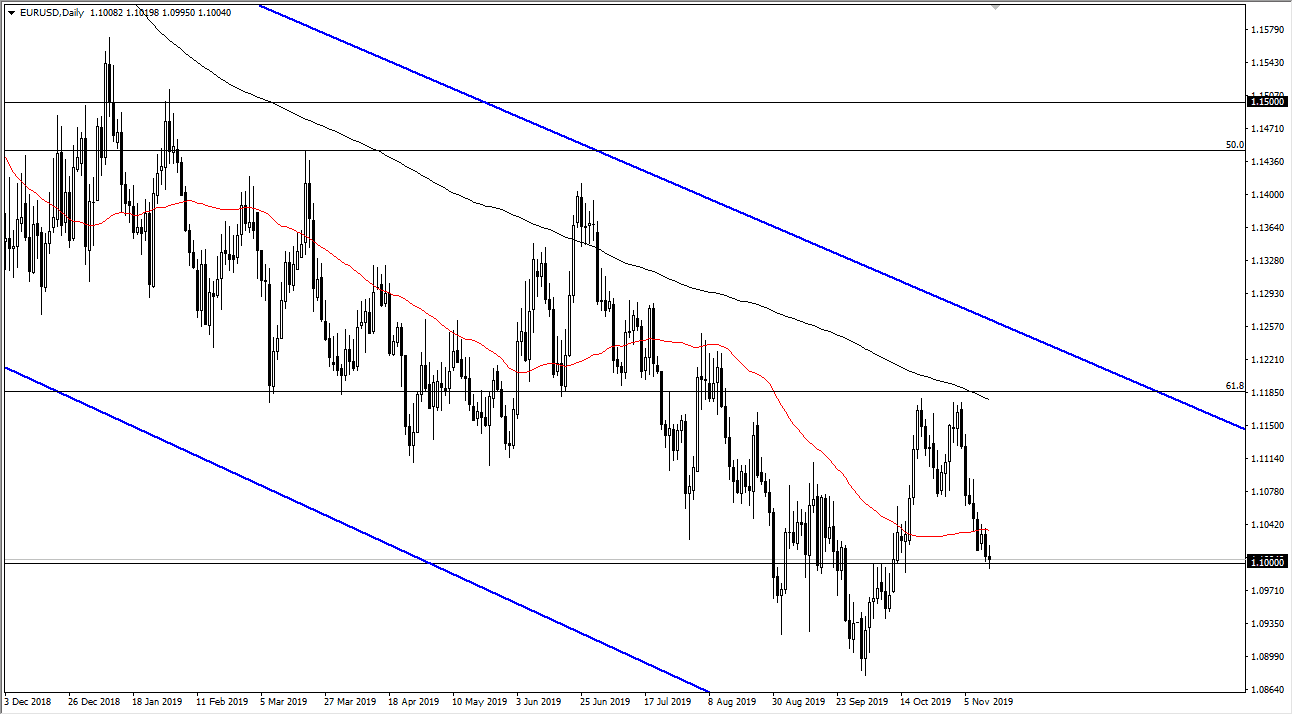

However, when you look at the longer-term chart it’s obvious that we are in a downtrend as we have recently broken through the 50 day EMA again, and if you look higher, you can see that we had formed a perfect “M pattern” at the 200 day moving average. The “M pattern” is a reversal signal that a lot of people will pay attention to as it is the same thing as a double top. Ultimately, the fact that we are broken through that low caught a lot of people on the wrong side of the trade, and that of course has more selling coming.

We look at the longer-term chart though, it seems as if every time we reached towards the 200 day EMA the sellers came back and of course the last couple of weeks haven’t been any different. This goes all the way back to two years ago, when we entered this descending channel that we are currently yen. On a breakdown below the lows of the trading session on Wednesday I fully anticipate that this pair will probably go looking towards the 1.09 level underneath. Below there, the pair could very well go to the 1.0750 level, as there is a big gap there on longer-term charts. Rallies are to be faded, and I have no scenario in which I’m willing to buy this currency pair, at least at the moment. If we broke significantly above that double top and the 200 day EMA, then I would have to do a bit more research into where I wanted to trade next. The last two years has paid off anybody willing to sell signs of exhaustion, and there’s nothing on this chart that tells me that’s changing.