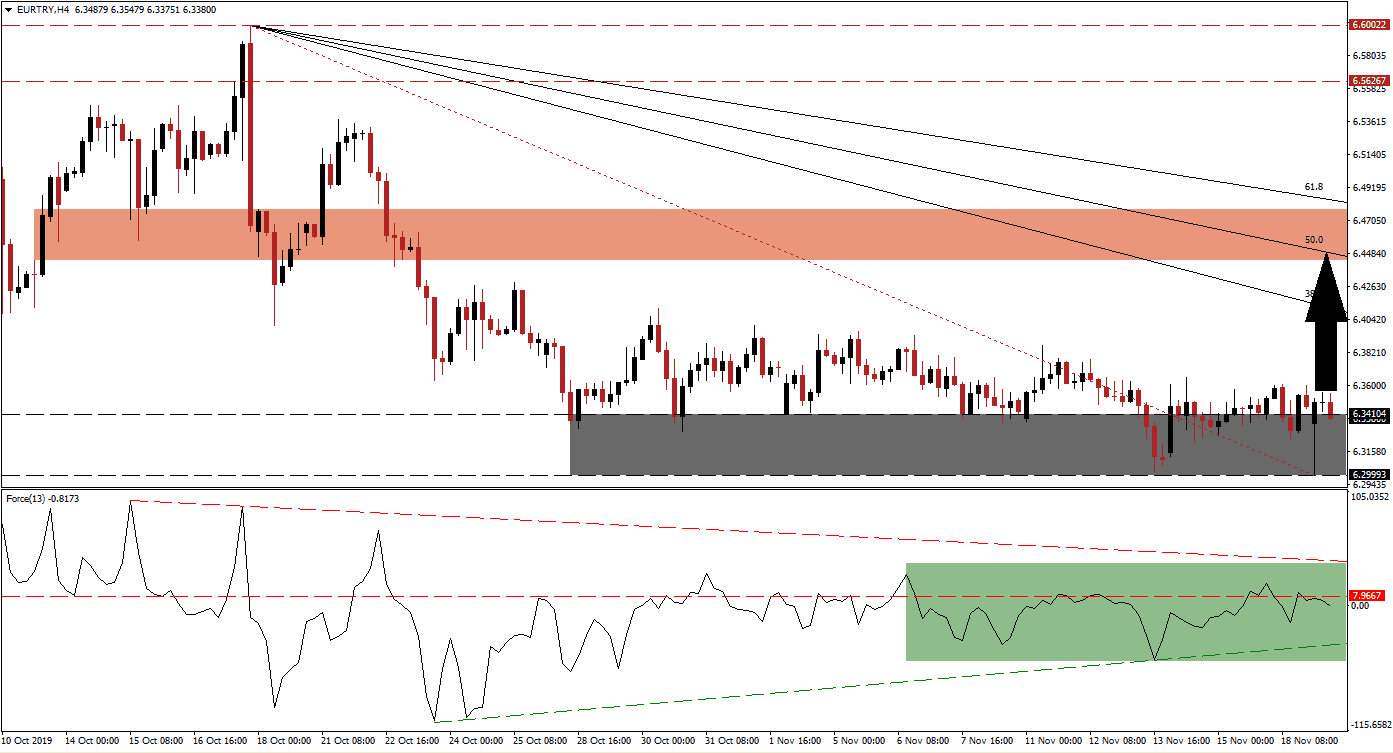

After a strong corrective phase, the EUR/TRY started to stabilize as it reached its support zone. Better-than-expected economic data out of the Eurozone last week helped eased bearish pressures on the Euro and created an environment for a short-term advance which is expected to keep the long-term downtrend intact. The sideways drift in price action, which was mostly located near the top range of its support zone, created a gap between this currency pair and its Fibonacci Retracement Fan sequence; a counter-trend advance is expected to close the gap and ensure the longevity of the bearish long-term trend.

The Force Index, a next-generation technical indicator, has gradually drifted higher and a positive divergence formed which suggests that a rally may be imminent. The Force Index remains below its horizontal resistance level and in negative conditions, as marked by the green rectangle, and bears remain in control of the EUR/TRY. The ascending support level is starting to provide upside pressure and this technical indicator is expected to push through its horizontal resistance level. Due to the proximity of the descending resistance level, a double breakout in the Force Index is likely to materialize, leading price action to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about the Force Index here.

Forex traders are advised to monitor the intra-day high of 6.38701 which represents the last instance when price action pierced the Fibonacci Retracement Fan trendline to the upside, before reversing into its support zone which led to a marginally lower low. The support zone is located between 6.29993 and 6.34104 as marked by the grey rectangle, and a push above the intra-day high of 6.38701 is expected to ignite a short-covering rally. This should close the gap to its 38.2 Fibonacci Retracement Fan Resistance Level from where a breakout in the EUR/TRY may follow unless a fresh fundamental catalyst emerges.

While Eurozone data surprised to the upside last week, it may have been an anomaly and more data points are required to assess the situation. The ECB has started the next round of quantitative easing which is pressuring the Euro to the downside at the same time the Eurozone is facing economic as well as political issues. An advance by the EUR/TRY into its short-term resistance zone, located between 6.44383 and 6.47731 as marked by the red rectangle, is expected to materialize; the 50.0 Fibonacci Retracement Fan Resistance Level is moving through this zone from where a breakout remains unlikely. You can read more about a breakout here.

EUR/TRY Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 6.34000

⦁ Take Profit @ 6.44850

⦁ Stop Loss @ 6.30850

⦁ Upside Potential: 1,085 pips

⦁ Downside Risk: 315 pips

⦁ Risk/Reward Ratio: 3.44

A breakdown in the Force Index below its ascending support level could be followed by a breakdown attempt in the EUR/TRY. The long-term trend favors more downside from a fundamental perspective, but the short-term technical picture suggests a move to the upside. A fundamental catalyst would be required to sustain a breakdown under current conditions. The next support zone awaits price action between 6.19748 and 6.23396.

EUR/TRY Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 6.27750

⦁ Take Profit @ 6.20750

⦁ Stop Loss @ 6.31000

⦁ Downside Potential: 700 pips

⦁ Upside Risk: 325 pips

⦁ Risk/Reward Ratio: 2.15