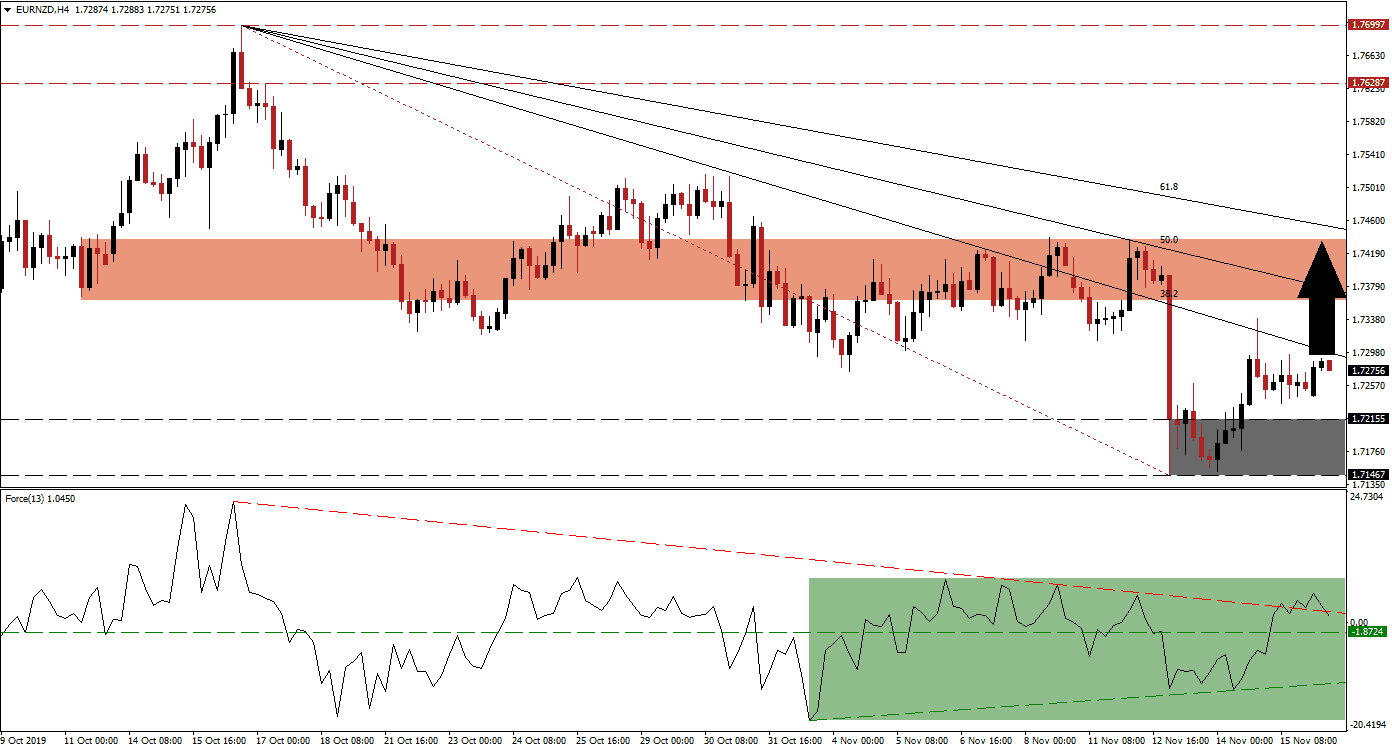

Selling pressure on the EUR/NZD has eased as the bullish impact of the surprise Reserve Bank of New Zealand’s decision to keep interest rates unchanged at 1.00% is fading. Price action was able to break out above its support zone and close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. The recovery in bullish momentum could lead to a double breakout above its 38.2 and 50.0 Fibonacci Retracement Fan Resistance Levels and take this currency pair back into its short-term resistance zone. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, confirmed the breakout in the EUR/NZD above its support zone with a breakout above its horizontal resistance level which turned it into support. The Force Index briefly pierced its descending resistance level, but was unable to sustain this move and reversed as marked by the green rectangle. This technical indicator remains in positive territory and suggests that bulls remain in charge of price action. A positive divergence formed as the Force Index reached its support zone which indicated a pause in the sell-off is imminent.

Price action may retrace down to the top range of its support zone before attempting a breakout sequence; the support zone is located between 1.71467 and 1.72155 as marked by the grey rectangle. While the long-term fundamental picture favors more downside in this currency pair, short-term developments suggest an extension of the breakout. Eurozone economic data came in better-than-expected while fundamental differences in the phase on trade truce between the US and China are evident. You can learn more about a breakout here.

A breakout in the EUR/NZD above its 38.2 Fibonacci Retracement Fan Resistance Level may also inspire a short-covering rally which is expected to drive this currency pair into its next short-term resistance zone. The 61.8 Fibonacci Retracement Fan Resistance Level is closing in on the top range of this zone, located between 1.73611 and 1.74368 as marked by the red rectangle. A move into this zone would keep the long-term downtrend intact. Forex traders should monitor the intra-day low of 1.73003, this level marks the last time price action advanced off of its Fibonacci Retracement Fan trendline and a move higher is likely to pull this currency pair into its short-term resistance zone.

EUR/NZD Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 1.72750

⦁ Take Profit @ 1.74150

⦁ Stop Loss @ 1.72300

⦁ Upside Potential: 140 pips

⦁ Downside Risk: 45 pips

⦁ Risk/Reward Ratio: 3.11

In case of a breakdown in the Force Index below its horizontal support level, aided by its descending resistance level, the EUR/NZD could move back into its short-term support zone from where a breakdown is possible. While the long-term outlook remains bearish, short-term factors suggest more upside; this would ensure the longevity of the downtrend. The next support zone is located between 1.70009 and 1.70368.

EUR/NZD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.71200

⦁ Take Profit @ 1.70350

⦁ Stop Loss @ 1.71600

⦁ Downside Potential: 85 pips

⦁ Upside Risk: 40 pips

⦁ Risk/Reward Ratio: 2.13