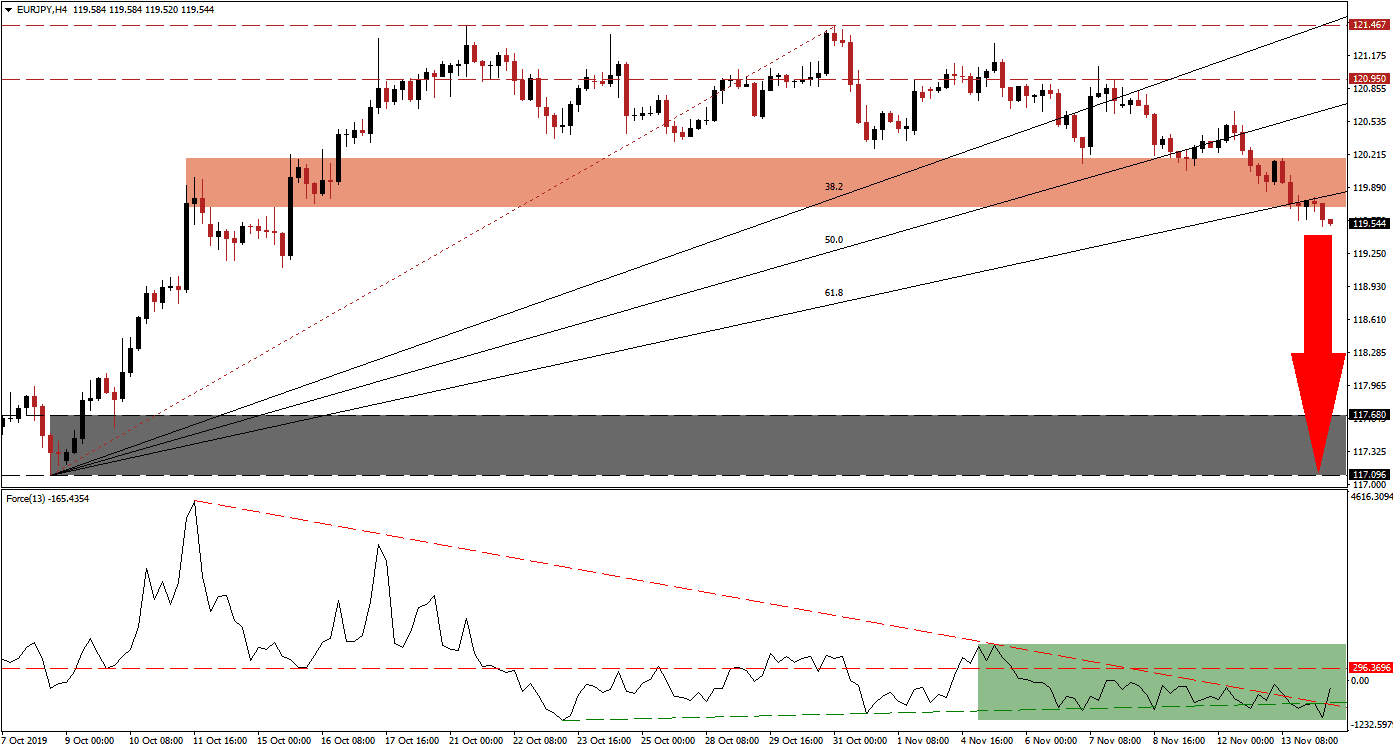

Trade fears are on the rise once again as the US and China appear to have a growing list of disagreements over how the phase one trade deal should look like. The US is pushing for more concessions while refusing to roll-back existing tariffs while China is unwilling to commit to a set sum on agricultural purchases and stated it should be determined by supply and demand. This has boosted safe-haven assets like the EUR/JPY which just completed a breakdown below its ascending 61.8 Fibonacci Retracement Fan Support Level and turned the entire Fibonacci Retracement Fan sequence into resistance.

The Force Index, a next-generation technical indicator, descended below its horizontal support level and turned it into resistance after the EUR/JPY completed the first breakdown below its long-term resistance zone. The Force Index has largely remained below resistance as price action entered its breakdown sequence, but after a brief move below its ascending support level, it has now eclipsed it and moved above its descending resistance level as marked by the green rectangle. Any upside in this technical indicator is expected to be limited to its horizontal resistance level and the Force Index remains in negative territory which places bears in charge of price action. You can learn more about the Force Index here.

After reaching the top range of its long-term resistance zone, located between 120.950 and 121.467, this currency pair created a series of lower highs and lower lows which represents a bearish chart formation. This morning’s breakdown below its short-term support zone turned it into a resistance zone between 119.702 and 120.172 as marked by the red rectangle; the 61.8 Fibonacci Retracement Fan Resistance Level is passing through it. Following the double breakdown, the path for the EUR/JPY is clear to the downside and into its next long-term support zone.

Since trade fears are on the rise and global economic data continues to show a bearish bias, Germany is expected to confirm that it entered a recession, Euro weakness is expected to add more downside pressure on this currency pair. The next support zone is located between 117.096 and 117.680 as marked by the grey rectangle; depending on fundamental developments a breakdown may emerge and extend the sell-off. Forex traders should monitor the intra-day low of 119.112 which marks the low of a previous reversal, a move lower is expected to lead to new net short positions in the EUR/JPY. You can learn more about a support zone here.

EUR/JPY Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 119.550

⦁ Take Profit @ 117.100

⦁ Stop Loss @ 120.200

⦁ Downside Potential: 245 pips

⦁ Upside Risk: 65 pips

⦁ Risk/Reward Ratio: 3.77

In case of a breakout in the Force Index above its horizontal resistance level, aided by its shallow ascending support level, the EUR/JPY may attempt to convert its short-term resistance level back into support. Upside potential is likely to remain limited to its long-term resistance zone, but fundamental as well as technical indicators favor an extension of the breakdown. Any advance into its long-term resistance zone should be viewed as an excellent short-selling opportunity.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 120.550

⦁ Take Profit @ 121.450

⦁ Stop Loss @ 120.200

⦁ Upside Potential: 90 pips

⦁ Downside Risk: 35 pips

⦁ Risk/Reward Ratio: 2.57