Japanese retail sales plunged in October at a rate twice of the September expansion. This has kept the EUR/JPY inside its short-term resistance zone with an increase in bearish momentum. The Japanese consumer is known for wild swings in spending patterns and with the Eurozone economy struggling to perform and global trade uncertainty elevated, this currency pair is ripe for a breakdown and a profit-taking sell-off. Safe-haven inflows as 2019 winds down are additionally expected to boost the Japanese Yen. You can learn more about a profit-taking sell-off here.

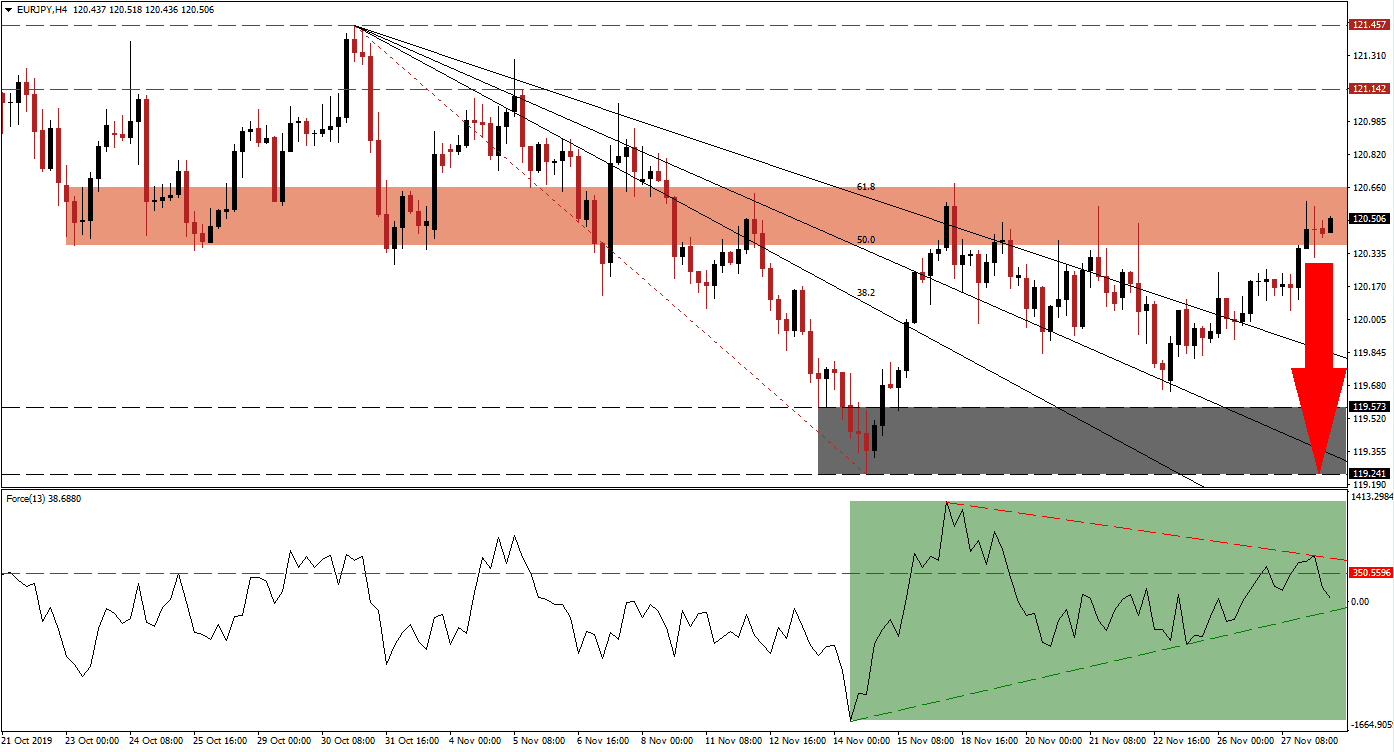

The Force Index, a next-generation technical indicator, peaked after the EUR/JPY initially reached its short-term resistance zone; the following breakdown and reversal resulted in a lower high in this currency pair as well as in the Force Index. A descending resistance level formed and pressured this technical indicator below its horizontal support level, turning it into resistance as marked by the green rectangle. The Force Index is now expected to move below its ascending support level and into negative territory. This would place bears in control of price action and is expected to lead a breakdown in this currency pair.

Economic data out of Japan has prevented a sustained breakdown from materializing, but the rise in bearish momentum is favored to outlast bullish attempts to push for more upside. The Fibonacci Retracement Fan is moving farther away from the EUR/JPY and a breakdown below its short-term resistance zone, located between 120.374 and 120.661 as marked by the red rectangle, should close it. The descending 50.0 Fibonacci Retracement Fan Support Level reversed two breakdown attempts, but may now pull this currency pair to the downside with it. You can learn more about the Fibonacci Retracement Fan here.

One key level to monitor is the intra-day low of 120.313, the low of the previous move in this currency pair below its short-term resistance zone. A breakdown below this level is expected to further fuel the corrective phase. The 50.0 Fibonacci Retracement Fan Support Level, presently moving through the support zone located between 119.241 and 119.573 as marked by the grey rectangle, is favored to attract a sell-off in the EUR/JPY. Given the long-term fundamental scenario, a breakdown below this support zone cannot be ruled out.

EUR/JPY Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 120.500

⦁ Take Profit @ 119.250

⦁ Stop Loss @ 120.850

⦁ Downside Potential: 125 pips

⦁ Upside Risk: 35 pips

⦁ Risk/Reward Ratio: 3.57

In the event of a breakout in the Force Index above its double resistance level with a sustained position above its descending resistance level, the EUR/JPY could attempt to extend its advance. Upside potential remains limited to its next long-term resistance zone located between 121.142 and 121.457; this represents an excellent short-selling opportunity in this currency pair.

EUR/JPY Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 121.050

⦁ Take Profit @ 121.450

⦁ Stop Loss @ 120.850

⦁ Upside Potential: 40 pips

⦁ Downside Risk: 20 pips

⦁ Risk/Reward Ratio: 2.00