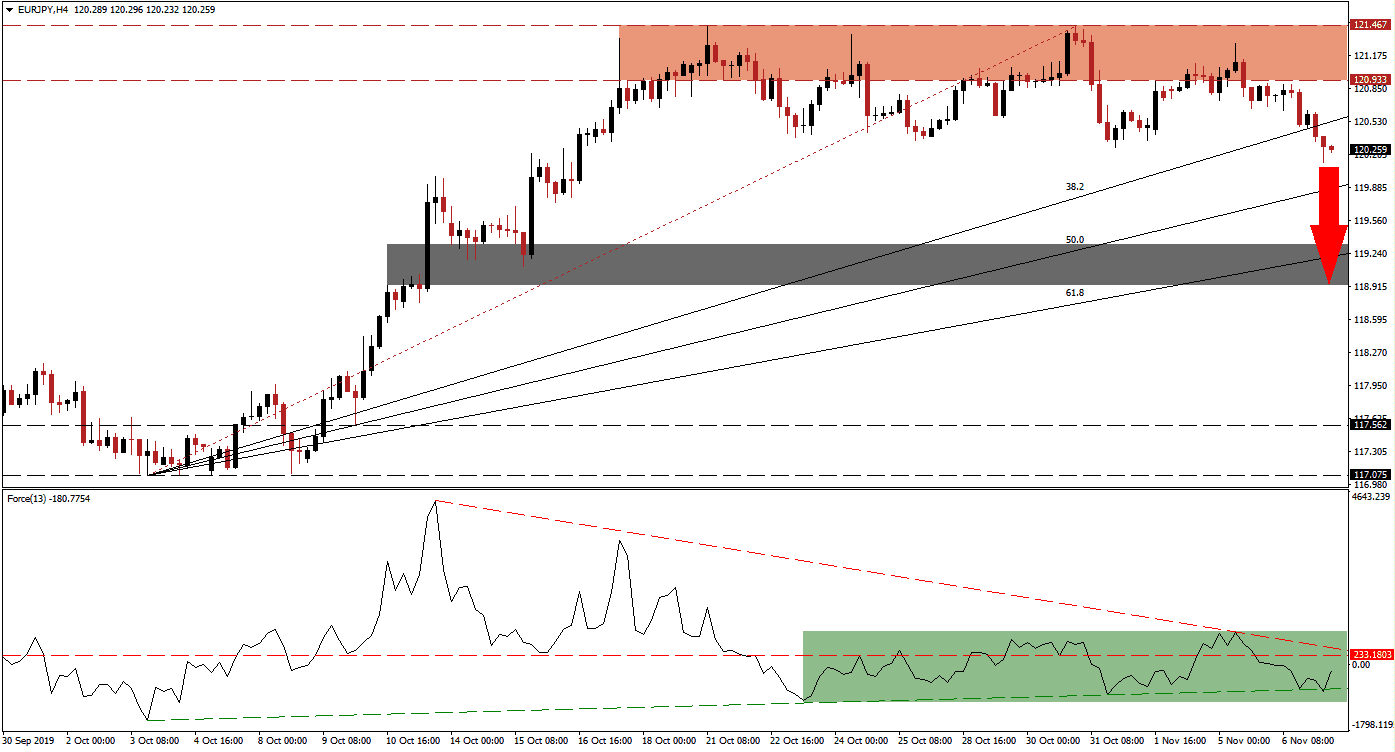

After an extended period of risk-on across financial markets, traders started to take a closer look at red flags which remain across economies. This resulted in capital inflows into the Japanese Yen, a safe haven currency, and initiated a breakdown in the EUR/JPY. Following a strong advance, this currency pair was confined to a sideways range as its resistance zone rejected four breakout attempts. During this period the Fibonacci Retracement Fan approached and increased pressures on price action; this resulted in a double breakdown, below its resistance zone and below its 38.2 Fibonacci Retracement Fan Support Level which turned it into resistance. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, confirmed the sideways trend in the EUR/JPY and remained confined between its descending resistance level and its ascending support level; spending most of the time below its horizontal resistance level. The descending resistance level is on the verge of a crossover below its horizontal resistance level, as marked by the green rectangle, and this technical indicator may advance into this double resistance level before another move to the downside is expected. The Force Index also remains in negative territory which places bears in charge of price action.

An early warning signal that the uptrend is on the verge of collapse was generated after the EUR/JPY pushed below its horizontal resistance zone and reversed back into it while creating a lower high. The breakdown which followed also initiated a profit-taking sell-off which is now gathering momentum to the downside. Adding to the increase in bearish pressures were the four failed breakout attempts by this currency pair from inside the resistance zone , located between 120.933 and 121.467 as marked by the red rectangle. Given the magnitude of downside pressure, the breakdown sequence is likely to extend.

Fundamental factors, such as doubts about the phase one trade truce between the US and China as well as mixed economic reports which a bearish bias, further add a catalyst for price action to resume its corrective phase. The next short-term support zone awaits the EUR/JPY between 118.934 and 119.332 as marked by the grey rectangle; the ascending 61.8 Fibonacci Retracement Fan Support Level is nestled inside this zone. A breakdown below this support zone cannot be ruled out and the next long-term support zone is located between 117.075 and 117.562. You can learn more about a support zone here.

EUR/JPY Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 120.250

⦁ Take Profit @ 119.000

⦁ Stop Loss @ 120.600

⦁ Downside Potential: 125 pips

⦁ Upside Risk: 35 pips

⦁ Risk/Reward Ratio: 3.57

Volatility across the global financial system is expected to pick-up and while this supports a weaker EUR/JPY, short-term price spikes may appear. A double breakout in the Force Index, above its horizontal resistance level and above its descending resistance level may pressure price action back into its resistance zone. The strength of its resistance zone is likely to prevent further upside and forex traders should consider any advance as a solid short-selling opportunity.

EUR/JPY Technical Trading Set-Up - Limited Price Action Reversal Scenario

⦁ Long Entry @ 120.850

⦁ Take Profit @ 121.300

⦁ Stop Loss @ 120.650

⦁ Upside Potential: 45 pips

⦁ Downside Risk: 20 pips

⦁ Risk/Reward Ratio: 2.25