Selling pressure in the Swiss Franc started to ease which deflated bullish momentum in the EUR/CHF after it reached its short-term resistance zone. Elections in Hong Kong saw a strong turnout in favor of pro-democracy candidates and China announced tougher punishments for IP violations. Asian markets moved generally higher, but risks remain which are currently being discounted by markets. Uncertainty after the ECB leadership change remains at a decade high and price action will struggle to push through its short-term resistance zone given the current fundamental picture.

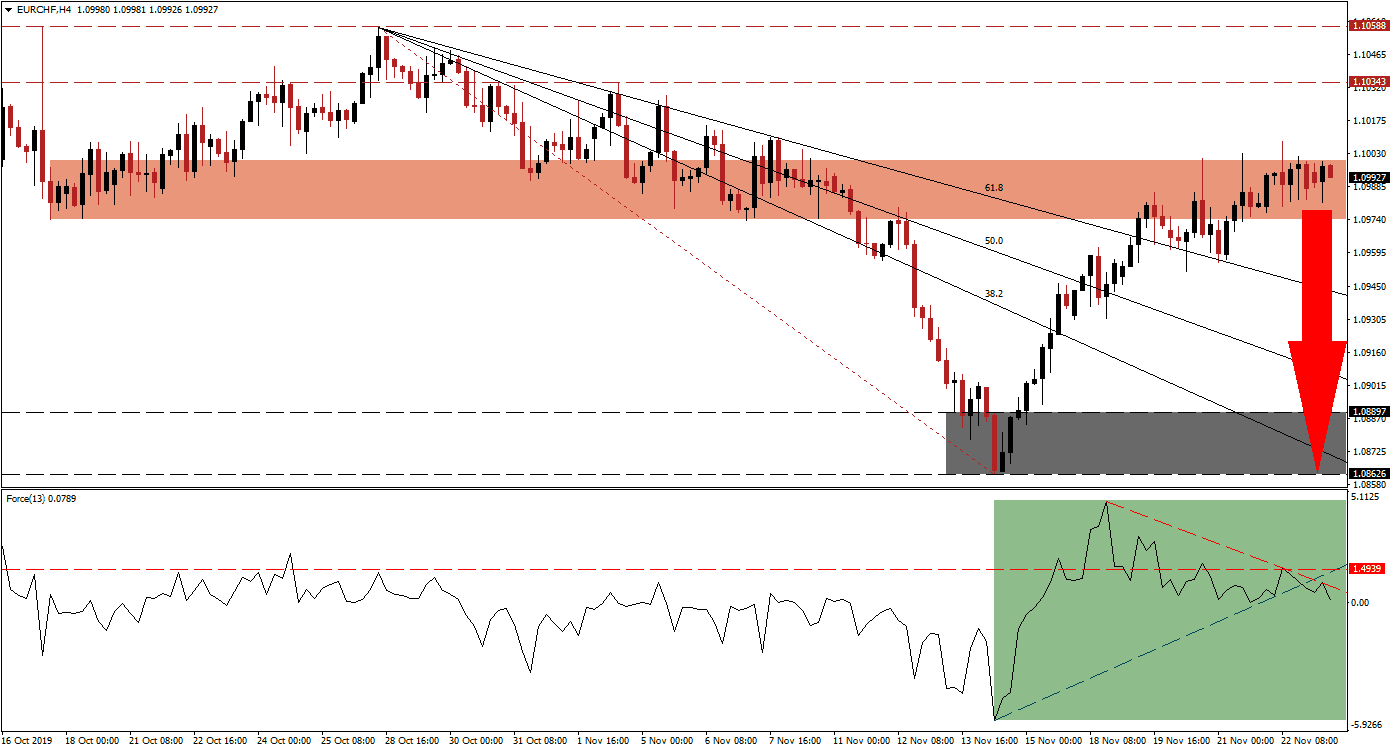

The Force Index, a next-generation technical indicator, suggests that a bigger sell-off is on the horizon for this currency pair. A negative divergence formed as price action ascended into its short-term resistance zone and the Force Index has now completed a double breakdown. After converting its horizontal support level into resistance, this technical indicator additionally moved below its ascending support level as marked by the green rectangle. A breakdown into negative territory is expected to follow and place bears in charge of the EUR/CHF, leading to a breakdown in this currency pair. You can learn more about the Force Index here.

Price action has struggled to push through its short-term resistance zone which is located between 1.09743 and 1.10001 as marked by the red rectangle. The emergence of bearish trading signals is expected to result in a breakdown and close the gap between the EUR/CHF and its descending 61.8 Fibonacci Retracement Fan Resistance Level. A profit-taking sell-off is additionally expected to contribute the required selling pressure to push this currency pair farther to the downside and into its next support zone.

Forex traders are advised to monitor the Force Index which is expected to lead price action into a breakdown. The 38.2 Fibonacci Retracement Fan Resistance Level is currently passing through the support zone, located between 1.08626 and 1.08897 as marked by the grey rectangle. The Fibonacci Retracement Fan is expected to guide the EUR/CHF to the downside following a breakdown below its short-term resistance zone. Today’s German IFO data may provide the next fundamental catalyst. You can learn more about the Fibonacci Retracement Fan here.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.09900

⦁ Take Profit @ 1.08650

⦁ Stop Loss @ 1.10150

⦁ Downside Potential: 125 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 5.00

A triple breakout in the Force Index, above its descending resistance level, its horizontal resistance level and its ascending support level which acts as temporary resistance, is likely to result in a breakout in the EUR/CHF. The next long-term resistance zone awaits price action between 1.10343 and 1.10588 from where more upside remains unlikely in the current fundamental conditions. This should be viewed as a solid short selling opportunity.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 1.10250

⦁ Take Profit @ 1.10550

⦁ Stop Loss @ 1.10100

⦁ Upside Potential: 30 pips

⦁ Downside Risk: 15 pips

⦁ Risk/Reward Ratio: 2.00