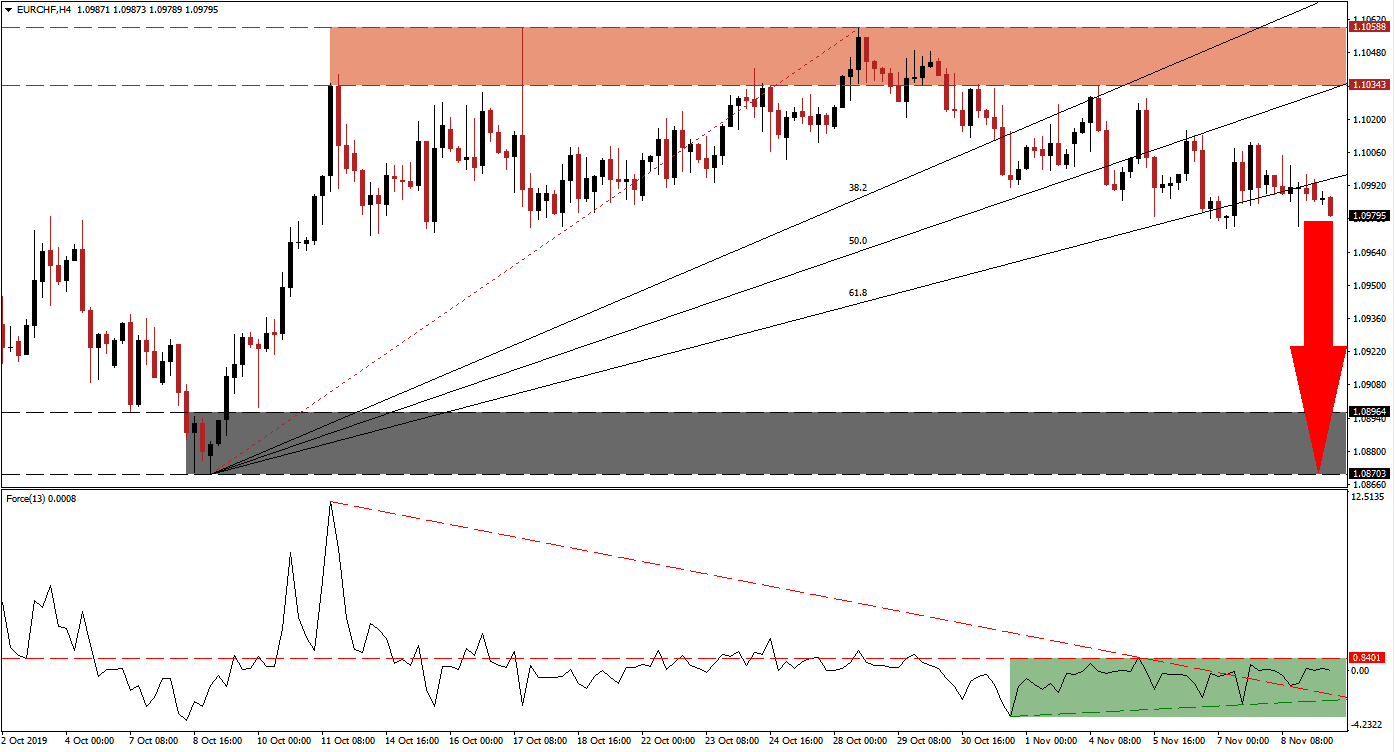

An IMF warning in regards to the European economy, echoed by ECB concerns about the lack of fiscal spending and the European Commission downgrade to the Eurozone economy, has resulted in a bearish momentum shift for the Euro. A renewed increase in worries about global trade has driven forex traders to safe-haven currencies such as the Swiss Franc and the combination of both resulted in a EUR/CHF breakdown sequence which took price action below its resistance zone and through its entire Fibonacci Retracement Fan. This currency pair is now trading below its 61.8 Fibonacci Retracement Fan Resistance Level and on track to accelerate to the downside. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, indicated the absence in bullish momentum in this currency pair after price action first moved into its resistance zone which served as an early warning sign. The Force Index collapsed from its peak and completed a breakdown below its horizontal support level which was turned into resistance. After the EUR/CHF moved below its 38.2 Fibonacci Retracement Fan Support Level, this technical indicator was trapped between resistance and its ascending support level as marked by the green rectangle. While the Force Index moved above its descending resistance level due to its prolonged sideways trend, a fresh breakdown is expected to follow.

As the resistance zone, located between 1.10343 and 1.10588 which is marked by the red rectangle, rejected a breakout attempt in the EUR/CHF on three occasions, bearish momentum expanded which led to the breakdown below this zone. Fundamental developments emerged which added to the selling pressure and price action started to descend through its Fibonacci Retracement Fan; this currency pair is now left without a meaningful support level until price action can reach its next support zone and a move by the Force Index into negative conditions is likely to lead the next wave of sell orders. You can read more about a support zone here.

Forex traders should monitor the intra-day low of 1.09738 which represents the low following the breakdown in price action below its 61.8 Fibonacci Retracement Fan Support Level which turned it into resistance. A reversal followed before the EUR/CHF moved lower once again. A breakdown below the previous intra-day low should provide the catalyst for this currency pair to accelerate down into its next support zone; this zone is located between 1.08703 and 1.08964 as marked by the grey rectangle. Depending on the magnitude of the sell-off, an additional breakdown cannot be ruled out.

EUR/CHF Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 1.09800

⦁ Take Profit @ 1.08700

⦁ Stop Loss @ 1.10100

⦁ Downside Potential: 110 pips

⦁ Upside Risk: 30 pips

⦁ Risk/Reward Ratio: 3.67

Should the move in the Force Index above its descending resistance level lead to a breakout above its horizontal resistance level, the EUR/CHF may retrace back into its resistance zone. Given the current fundamental picture, supported by the technical scenario, a breakout in this currency pair above its resistance zone is unlikely and any potential reversal into it should be viewed as a great opportunity to take a short position.

EUR/CHF Technical Trading Set-Up - Limited Price Action Reversal Scenario

⦁ Long Entry @ 1.10250

⦁ Take Profit @ 1.10550

⦁ Stop Loss @ 1.10100

⦁ Upside Potential: 30 pips

⦁ Downside Risk: 15 pips

⦁ Risk/Reward Ratio: 2.00