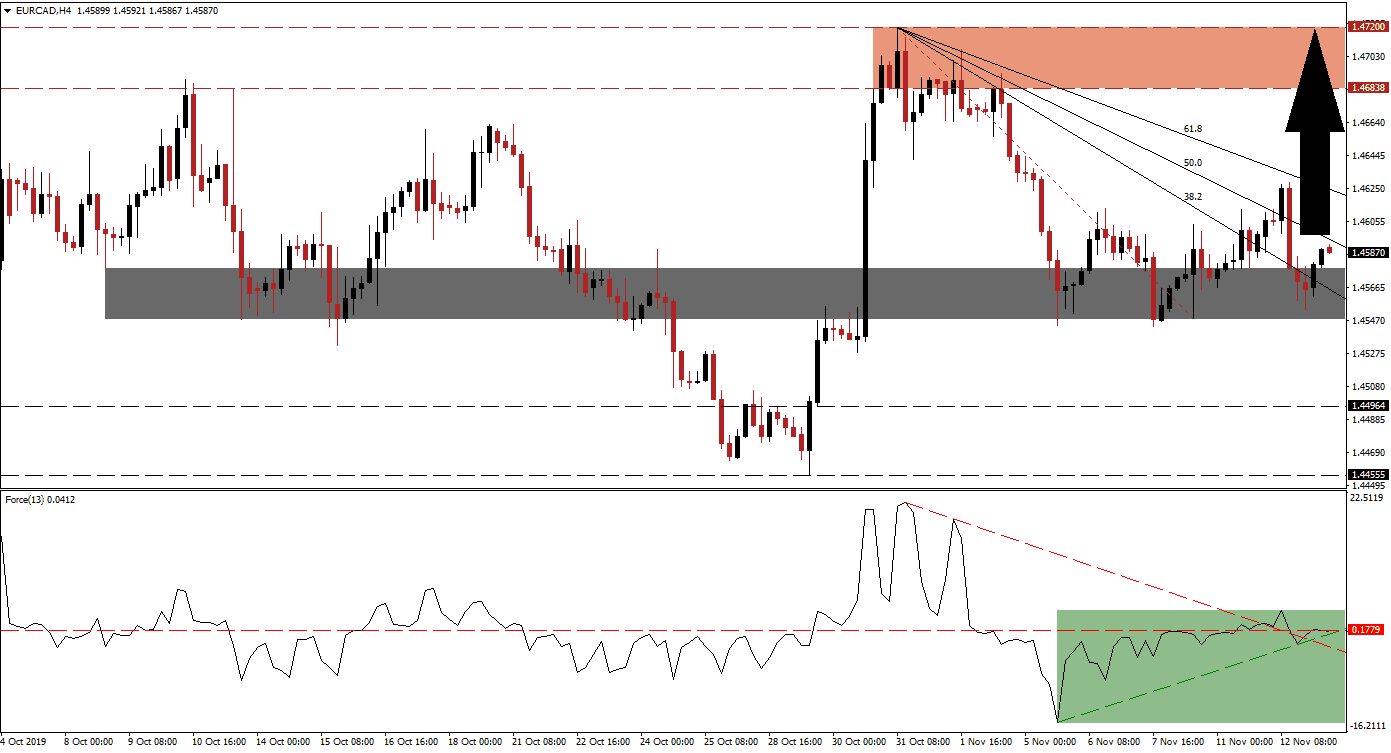

Better-than-expected economic data out of Germany and the Eurozone that was printed yesterday allowed the EUR/CAD to pause its sell-off. Bullish momentum expanded which led to a breakout in this currency pair above its short-term support zone. Today’s industrial production data out of the Eurozone may provide the next fundamental catalyst for price action, and while long-term issues for the Euro remain due to structural economic as well as political problems, a breakout sequence above its Fibonacci Retracement Fan could push price action back into its resistance zone. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, shows the increase in bullish momentum after the EUR/CAD initially moved into its short-term support zone. An ascending support level formed and the Force Index has now pushed above its descending resistance level while attempting to convert its horizontal resistance level back into support. Another bullish development occurred when the ascending support level crossed above its descending and horizontal resistance levels as marked by the green rectangle, while this technical indicator advanced into positive conditions which put bulls in charge of price action.

Following the breakout in this currency pair above its short-term support zone, located between 1.45477 and 1.45775 as marked by the grey rectangle, the descending 38.2 Fibonacci Retracement Fan Resistance Level was converted back into support. Forex traders are now advised to monitor the intra-day high of 1.46036 which represents the peak of a candlestick that formed the bottom range of the short-term support zone as well as the end-point of the re-drawn Fibonacci Retracement Fan sequence. A breakout above this level will also take the EUR/CAD above its 50.0 Fibonacci Retracement Fan Resistance Level. You can learn more about a breakout here.

Price action will be challenged by its descending 61.8 Fibonacci Retracement Fan Resistance Level, but bullish momentum is expected to suffice for a final breakout in price action which will clear the path into its next resistance zone. A sustained breakout in the Force Index above its horizontal resistance zone may trigger a short-covering rally which will provide the final catalysts for the EUR/CAD to test the strength of its resistance zone once again; this zone is located between 1.46838 and 1.47200 as marked by the red rectangle.

EUR/CAD Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 1.45850

⦁ Take Profit @ 1.47100

⦁ Stop Loss @ 1.45450

⦁ Upside Potential: 125 pips

⦁ Downside Risk: 40 pips

⦁ Risk/Reward Ratio: 3.13

Should the Force Index fail to push above its horizontal resistance level and reverse back down below its descending resistance level, which currently serves as support, the EUR/CAD could be pressured into a double breakdown. This is likely to take price action back into its long-term support zone which is located between 1.44555 and 1.44964 from where more downside potential is limited.

EUR/CAD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.45200

⦁ Take Profit @ 1.44650

⦁ Stop Loss @ 1.45450

⦁ Downside Potential: 55 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.20