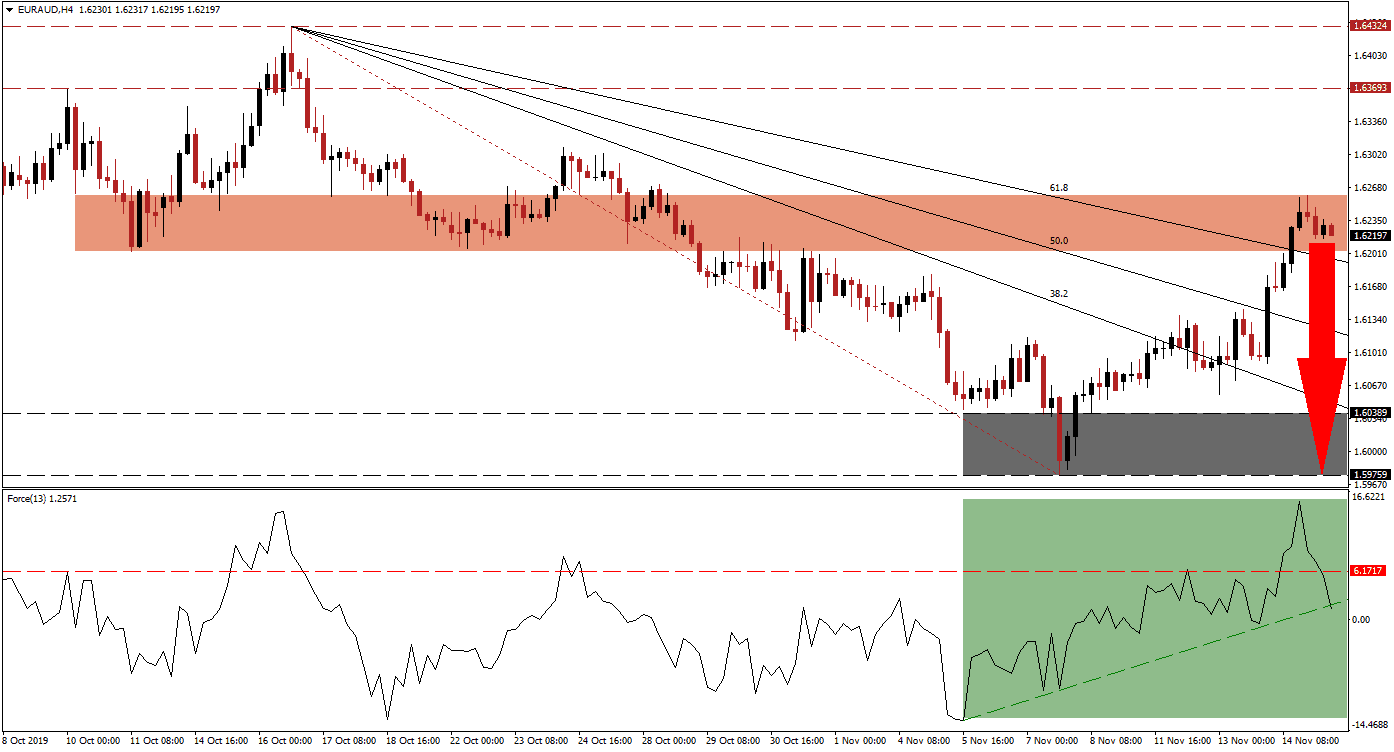

A disappointing Australian employment report that showed unexpected job losses has pushed the Australian Dollar to the downside. Adding to economic worries are bush fires that have blanketed the country, while the US-China phase one trade discussions have shown signs of bigger-than-expected disagreements. This has resulted in a EUR/AUD advance which took-off from inside its support-zone, accelerate through its entire Fibonacci Retracement Fan sequence, and turned it from resistance into support. The advance was halted as price action reached its short-term resistance zone and bearish pressures started to mount. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, confirmed the rally in the EUR/AUD and accelerated to a new high. The advance took it above its horizontal resistance level, but following the breakout in this currency pair above the 61.8 Fibonacci Retracement Fan Resistance Level, the Force Index plunged below its horizontal resistance level as bearish momentum surged. This technical indicator has now pushed below its ascending support level, as marked by the green rectangle, and is now expected to move into negative territory. This will place bears in charge of price action and a breakdown sequence is likely to follow.

As the short-term resistance zone, located between 1.62034 and 1.62601 as marked by the red rectangle, ended the rally in the EUR/AUD, a lower high was formed and the long-term downtrend remains intact. Forex traders should monitor the Force Index, as a push into negative conditions is expected to lead price action into a breakdown. Given the close proximity of the bottom range of the short-term resistance zone to the descending 61.8 Fibonacci Retracement Fan Support Level, a double breakdown is expected to materialize. You can learn more about a resistance zone here.

Despite the concerns surrounding the Australian economy, the Eurozone economy has bigger issues to attend to. Australia is also set to benefit from the RECP trade deal, expected to be signed in 2020, and make it part of a 15 country trade pact bigger in size than that of the Eurozone which currently remains the largest one. The expected breakdown sequence should take the EUR/AUD back into its support zone which s located between 1.59759 and 1.60389 as marked by the grey rectangle; the 38.2 Fibonacci Retracement Fan Support Level is closing in on the top range of this zone.

EUR/AUD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.62200

⦁ Take Profit @ 1.59800

⦁ Stop Loss @ 1.62750

⦁ Downside Potential: 240 pips

⦁ Upside Risk: 55 pips

⦁ Risk/Reward Ratio: 4.36

Should the Force Index reverse and move above its ascending support level, followed by a sustained breakout above its horizontal resistance level, the EUR/AUD could attempt a breakout above its short-term resistance zone. Long-term fundamentals favor more downside in price action, supported by technical developments. The next long-term resistance zone is located between 1.63693 and 1.64324 which represents a great short-selling opportunity.

EUR/AUD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 1.63150

⦁ Take Profit @ 1.64100

⦁ Stop Loss @ 1.62750

⦁ Upside Potential: 95 pips

⦁ Downside Risk: 40 pips

⦁ Risk/Reward Ratio: 2.38