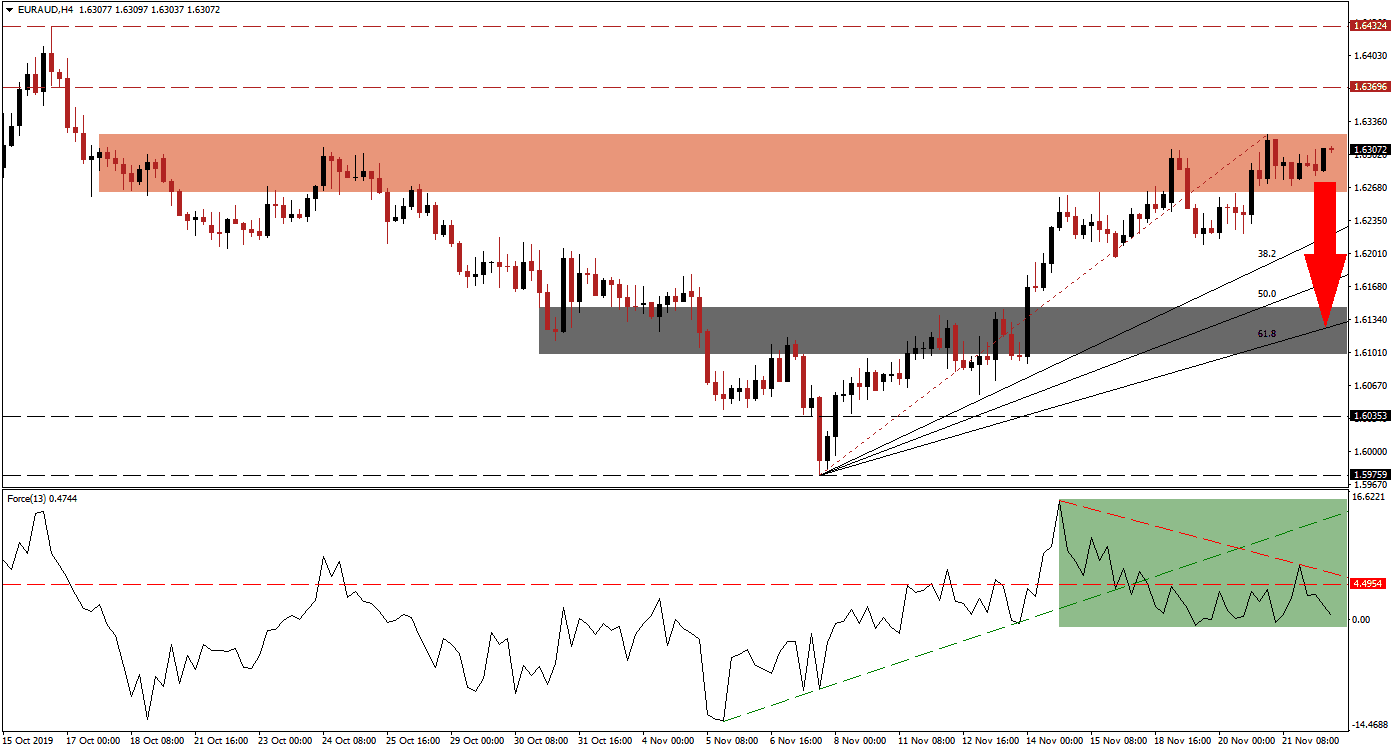

Bullish momentum is fading after the EUR/AUD reached its short-term resistance zone. The Australian Dollar came under pressure after a dismal October employment report which allowed this currency pair to recover from its support zone. This morning’s Australian PMI data slipped below 50.0 in all three sub-components, but the Australian Dollar remained stable as forex traders now await Eurozone PMI reports. The Fibonacci Retracement Fan sequence was re-drawn to provide a more accurate future outlook of where price action is headed.

The Force Index, a next-generation technical indicator, shows the presence of a negative divergence which represents and early warning signals that a directional change is imminent. As the EUR/AUD advanced into its short-term resistance zone, the Force Index completed a breakdown below its horizontal support level and turned it into resistance; this also led to a move below its ascending support level which now acts as temporary resistance. A breakout attempt was rejected by its descending resistance level as marked by the green rectangle and this technical indicator is now anticipated to slide into negative territory, placing bears in charge of price action. You can learn more about the Force Index here.

More upside in price action remains limited with bullish momentum fading inside the short-term resistance zone located between 1.62637 and 1.63223 as marked by the red rectangle. Any breakout attempt will run into the long-term resistance zone which awaits the EUR/AUD between 1.63696 and 1.64324. Forex traders should monitor the Force Index as a push below the 0 centerline may ignite a profit-taking sell-off. Adding to bearish developments is the move in this currency pair below its Fibonacci Retracement Fan trendline after price action recorded a higher high inside its short-term resistance zone.

Today’s Eurozone PMI data is expected to provide a short-term volatility boost, but the resistance zone is expected to force the EUR/AUD into a reversal unless economic data surprises to the upside. A price action reversal, following a confirmed breakdown, has a clear path into its next short-term support zone that is located between 1.60986 and 1.61464 as marked by the grey rectangle; the ascending 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone. You can learn more about a support zone here.

EUR/AUD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.63100

⦁ Take Profit @ 1.61300

⦁ Stop Loss @ 1.63550

⦁ Downside Potential: 180 pips

⦁ Upside Risk: 45 pips

⦁ Risk/Reward Ratio: 4.00

Should the Force Index manage a breakout above its descending resistance level, the EUR/AUD could attempt a breakout above its short-term resistance zone. Given the long-term fundamental outlook, supported by the short-term technical picture, the upside potential remains limited to the top range of its long-term resistance zone. A move approaching that range should be considered a solid short-selling opportunity.

EUR/AUD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 1.63800

⦁ Take Profit @ 1.64300

⦁ Stop Loss @ 1.63550

⦁ Upside Potential: 50 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.00