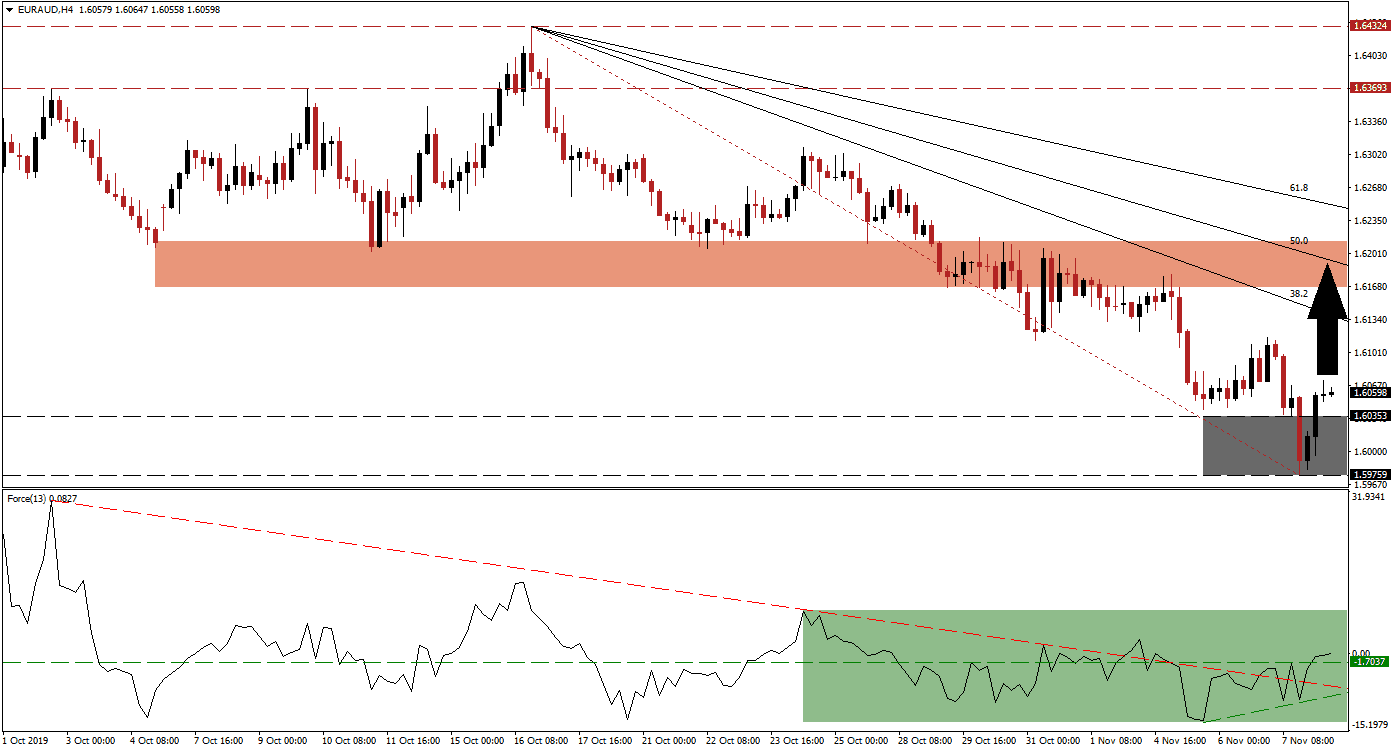

After the European Commission lowered its growth forecast for 2019 and 2020 and the IMF issued a warning on the European economy as a whole, the Euro was faced with an accelerated sell-off. The Fibonacci Retracement Fan supported the corrective phase, but a rise in bullish momentum emerged after the EUR/AUD reached its support zone. This resulted in a spike above it and a short-covering rally is likely to follow which will elevate this currency pair into its short-term resistance zone; this will keep the long-term downtrend intact and the sell-off may resume.

The Force Index, a next-generation technical indicator, shows the formation of a positive divergence prior to the breakout in the EUR/AUD above its support zone. The rise in bullish momentum also lifted the Force Index above its descending resistance level and resulted in a breakout above its horizontal resistance level which now serves as support; this is marked by the green rectangle. The breakout above its horizontal resistance level also elevated this technical indicator into positive territory which placed bulls in charge of price action. You can learn more about the Force Index here.

After the downtrend in the EUR/AUD showed signs of exhaustion following the breakdown below its short-term support zone which turned it into resistance, a counter-trend advance was shaping up. The current long-term support zone, located between 1.59759 and 1.60353 as marked by the grey rectangle, has reversed a number of sell-offs since the start of 2018 which makes it even more relevant. Forex traders should monitor the intra-day high of 1.61159 which marks the high of the previous bounce higher after price action reached the top range of its support zone, a breakout above this level should take this currency pair into its short-term resistance zone.

While the build-up in bullish momentum is expected to push price action into its short-term resistance, located between 1.61668 and 1.62138 as marked by the red rectangle, the EUR/AUD is likely to extend its long-term downtrend a the fundamental scenario points towards more weakness in this currency pair. The descending 50.0 Fibonacci Retracement Fan Resistance Level is passing through the short-term resistance zone and is increasing downside pressure; the 38.2 Fibonacci Retracement Fan Resistance Level has already crossed below resistance. You can read more about the Fibonacci Retracement Fan here.

EUR/AUD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 1.60550

- Take Profit @ 1.61700

- Stop Loss @ 1.60200

- Upside Potential: 115 pips

- Downside Risk: 35 pips

- Risk/Reward Ratio: 3.29

In the event of a reversal in the Force Index which will lead to a breakdown below its horizontal support level, the EUR/AUD may reverse into its support zone. As long as this technical indicator can remain above its ascending support level, the short-term uptrend remains intact. The next support zone, following a breakdown, awaits price action between 1.58934 and 1.59209.

EUR/AUD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.59600

- Take Profit @ 1.59000

- Stop Loss @ 1.59850

- Downside Potential: 60 pips

- Upside Risk: 25 pips

- Risk/Reward Ratio: 2.40