Economic data out of Australia showed that its manufacturing sector barely escaped contraction while inflation slowed down in the third-quarter. Lifting the overall trading mood during the Asian trading session was an upside surprise in the Chinese manufacturing sector, but Hong Kong entered a recession. With forces pulling and pushing the Australian Dollar, the top Chinese Yuan proxy currency, in both directions, the EUR/AUD is expected to enjoy a short-term advance; partially powered by a short-covering rally. The Eurozone economy remains weak and the new ECB bond buying program started today. You can read more about a short-covering rally here.

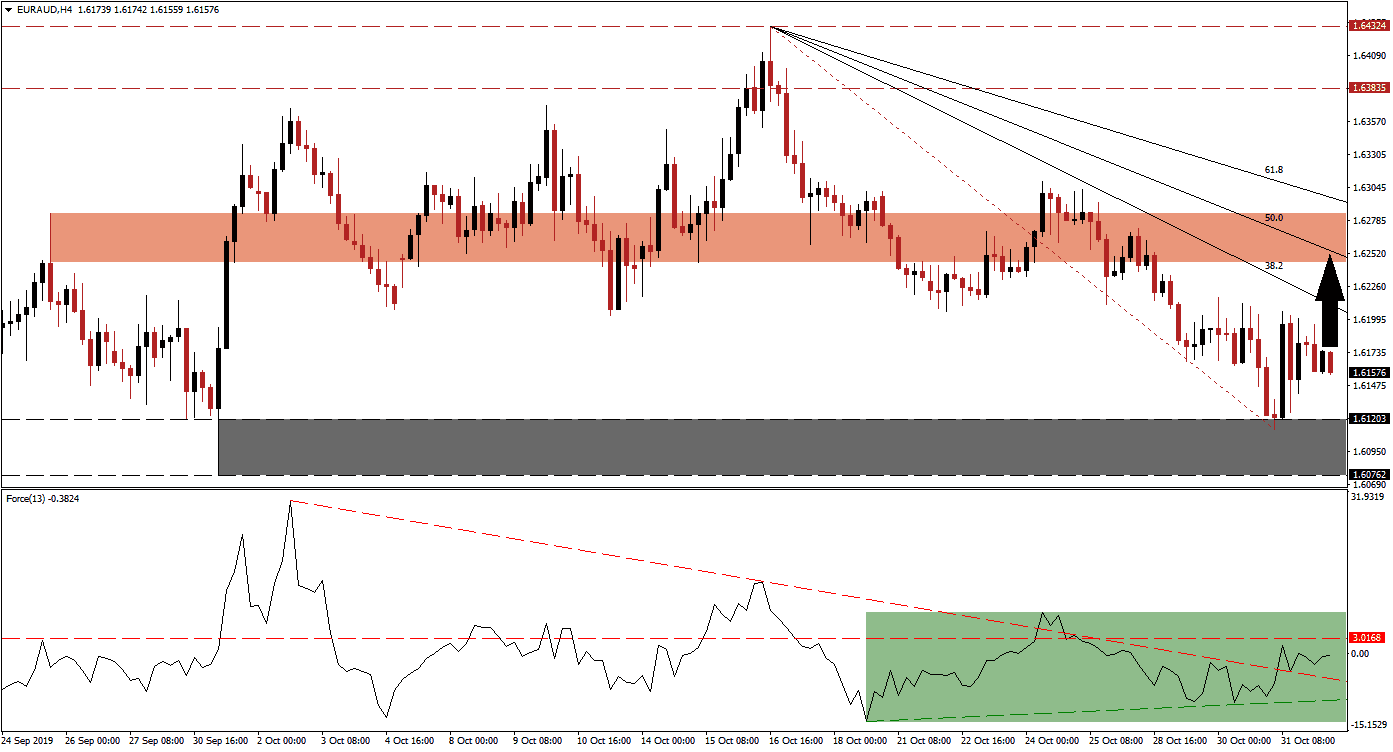

The Force Index, a next generation technical indicator, was able to recover after it reached its ascending support level and as the EUR/AUD reached the top range of its support zone. Another bullish development emerged after the Force Index eclipsed its descending resistance level which now acts as support; this is marked by the green rectangle. Price action is currently sandwiched above its support zone and below its 38.2 Fibonacci Retracement Fan Resistance Level and a breakout in this technical indicator above its horizontal resistance level, turning it back into support, is likely to lead price action higher.

After the EUR/AUD reached its support zone, located between 1.60762 and 1.61203 as marked by the grey rectangle, the Fibonacci Retracement Fan sequence was re-drawn. With the long-term downtrend intact, the technical picture suggests a short-term counter-trend advance as bullish momentum is on the rise. A breakout in the Force Index above its horizontal resistance level will also take this technical indicator into positive territory and place bulls in charge of price action. The Fibonacci Retracement Fan sequence is expected to limit overall upside potential and the fundamental scenario suggests more long-term downside in this currency pair. You can read more about the Fibonacci Retracement Fan here.

Forex traders are advised to monitor the intra-day low of 1.61688, together with the Force Index; this level marks the last time price action reached its Fibonacci Retracement Fan trendline before a minor pause resulted in a lower low. A move above this level should lead the EUR/AUD back into its short-term resistance zone which is located between 1.62454 and 1.62839 as marked by the red rectangle; the descending 50.0 Fibonacci Retracement Fan Resistance Level is moving trough this zone and close to the bottom range while the 61.8 Fibonacci Retracement Fan Resistance Level is closing in on the top range, a breakout is unlikely to materialize.

EUR/AUD Technical Trading Set-Up - Price Action Reversal Scenario

- Long Entry @ 1.61600

- Take Profit @ 1.62500

- Stop Loss @ 1.61350

- Upside Potential: 90 pips

- Downside Risk: 25 pips

- Risk/Reward Ratio: 3.60

Failure by the Force Index to push higher could result in a renewed breakdown below its descending resistance level, which acts as temporary support, and challenge its ascending support level. A breakdown in the EUR/AUD may follow, especially if price action will move below the intra-day low of 1.61126; this marks the low of the current corrective phase and the end point of the re-drawn Fibonacci Retracement Fan sequence. The next support zone is located between 1.59054 and 1.59870.

EUR/AUD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.60650

- Take Profit @ 1.59850

- Stop Loss @ 1.60950

- Downside Potential: 80 pips

- Upside Risk: 30 pips

- Risk/Reward Ratio: 2.67