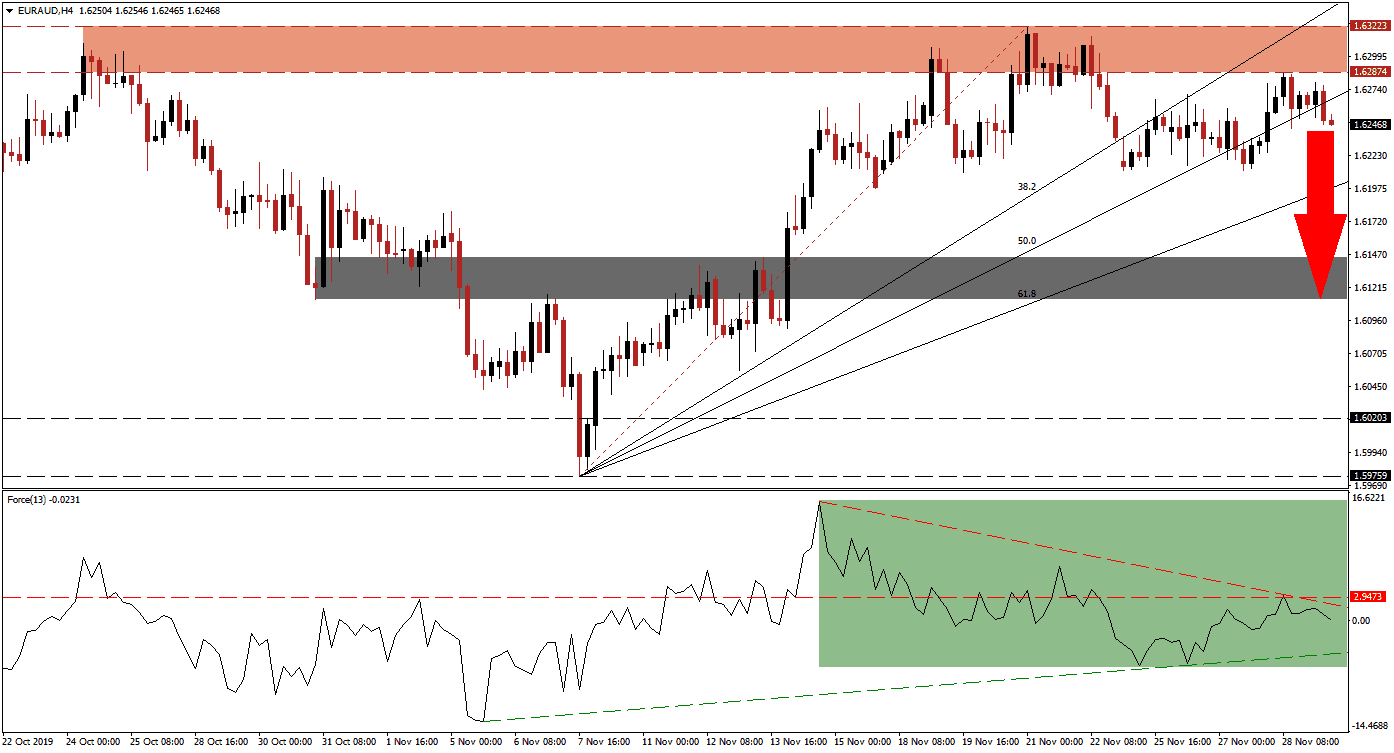

Bullish momentum in the EUR/AUD is fading and more downside is expected to follow. Yesterday’s Eurozone Business Climate Indicator came in weaker than expected for November and added to growing concerns about the Eurozone economy. Eurozone weakness trumped the signing of a bill into law by the US in support of pro-democracy protesters in Hong Kong, complication trade negotiations between the US and China; the Australian Dollar is the prime Chinese Yuan proxy currency and exposed to developments between the two largest economies. The breakdown in this currency pair below its resistance zone is now favored to accelerate to the downside.

The Force Index, a next-generation technical indicator, started to descend before the EUR/AUD moved into its resistance zone and a negative divergence served as the first warning sign that the uptrend is on the verge of collapse. The Force Index moved below its horizontal support level, turning it into resistance, as this currency pair started to break down, but managed to bounce higher after reaching its ascending support level. This technical indicator has now been rejected by its descending resistance level which crossed below its horizontal resistance level as marked by the green rectangle. This has additionally resulted in a push into negative conditions and placed bears in charge of price action. You can learn more about the Force Index here.

As the Fibonacci Retracement Fan sequence is passing through the resistance zone, located between 1.62874 and 1.63223 as marked by the red rectangle, bearish pressures are expanding. The ascending 38.2 Fibonacci Retracement Fan Resistance Level has already moved above this zone with the 50.0 Fibonacci Retracement Fan Resistance Level closing in on the bottom range of it; the EUR/AUD has just completed a breakdown below the 50.0 Fibonacci Retracement Fan Resistance Level. This resulted in an additional bearish momentum rise and a breakdown below its 61.8 Fibonacci Retracement Fan Support Level is anticipated to follow.

Forex traders ate advised to monitor the intra-day low of 1.62120, the low of the breakdown by this currency pair below its resistance zone. A sustained push below this level is expected to invite the next wave of sell orders that can take the EUR/AUD into its short-term support zone. This zone awaits price action between 1.61126 and 1.61443 as marked by the grey rectangle. Depending on fundamental developments, a breakdown into its next long-term support zone, located between 1.59759 and 1.60203, cannot be ruled out. You can learn more about a breakdown here.

EUR/AUD Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 1.62450

⦁ Take Profit @ 1.61150

⦁ Stop Loss @ 1.62850

⦁ Downside Potential: 130 pips

⦁ Upside Risk: 40 pips

⦁ Risk/Reward Ratio: 3.25

A breakout in the Force Index above its descending resistance level has the potential to pressure the EUR/AUD into a breakout attempt above its resistance zone. Given the present fundamental scenario, upside potential remains severely limited and the short-term technical picture favors an extension of the breakdown. The next resistance zone is located between 1.63991 and 1.64324, this should be viewed as an excellent short-selling opportunity in this currency pair.

EUR/AUD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 1.63300

⦁ Take Profit @ 1.64000

⦁ Stop Loss @ 1.63000

⦁ Upside Potential: 70 pips

⦁ Downside Risk: 30 pips

⦁ Risk/Reward Ratio: 2.33