While most cryptocurrencies bounced higher following a sharp sell-off led by Bitcoin, the bearish trend remains dominant. Ethererum remains straddled with fundamental issues that are hard if not impossible to address. Competition is advancing faster than the Ethereum Foundation can address technological problems and developers are leaving the project altogether. The ETH/USD managed a breakout above its support zone, in-line with the general upswing in the cryptocurrency market, but bullish momentum has already started to diminish, and the chances for a renewed push to the downside together with a breakdown below its support zone are increasing. You can learn more about a support zone here.

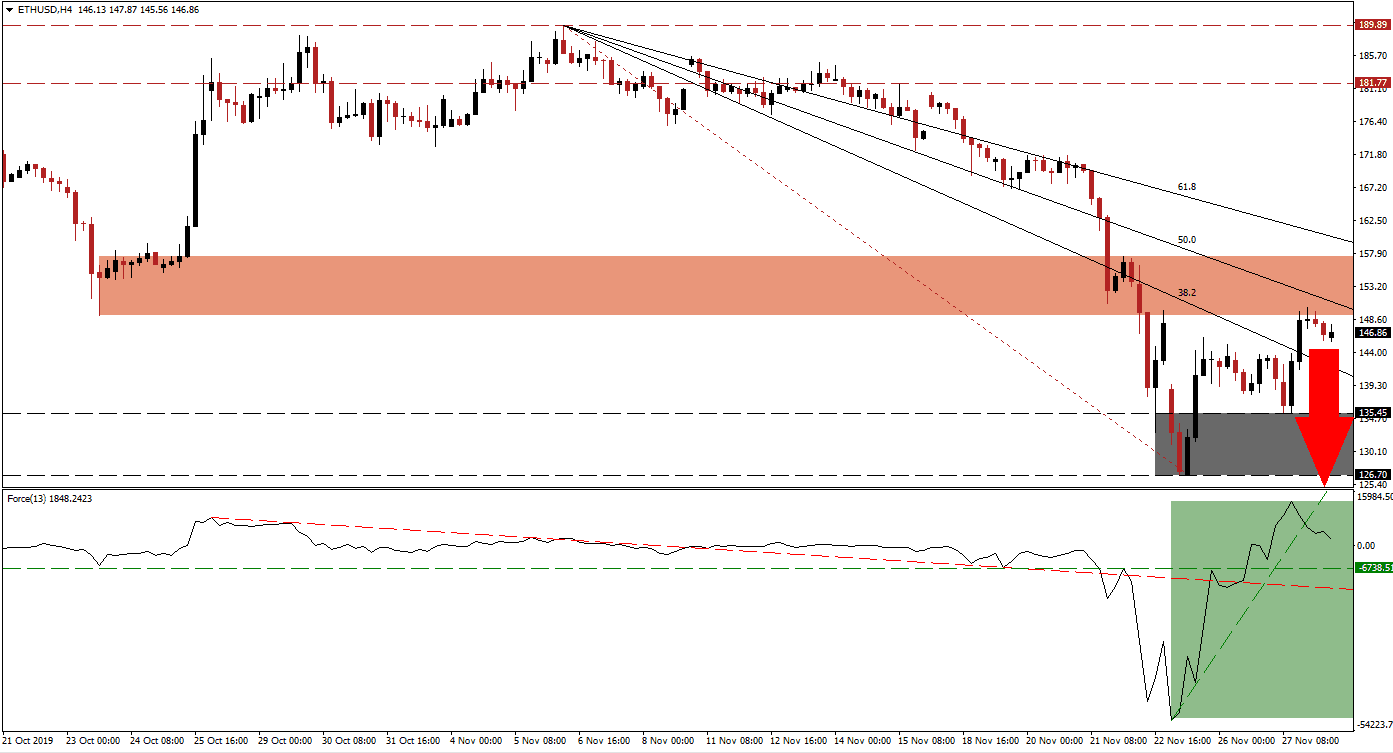

The Force Index, a next-generation technical indicator, confirmed the breakout in the ETH/USD above its support zone with a breakout of its own that turned its horizontal resistance level into support. Preceding this breakout, the Force Index eclipsed its descending resistance level that now acts as a temporary support level. Bullish momentum peaked and is reversing which led this technical indicator into a reversal below its steep ascending support level as marked by the green rectangle. The breakdown is expected to extend and push the Force Index into negative territory, placing bears in charge of this cryptocurrency pair.

Following the breakout in the ETH/USD above its support zone, the short-term resistance zone rejected an extension of the advance. The descending 50.0 Fibonacci Retracement Fan Resistance Level is currently passing through this zone, located between 149.22 and 157.50 as marked by the red rectangle, and increasing downside pressure. As the entire Fibonacci Retracement Fan sequence is closing in on the support zone, breakdown pressure is one the rise which could lead to an extended corrective phase. The price of this cryptocurrency pair is adjusting to fundamental reality, and the outlook remains distinctively bearish. You can learn more about the Fibonacci Retracement Fan here.

Volatility in the cryptocurrency market is expected to remain elevated as the final trading month approaches. The increase of professional market participants since the start of 2019 will additionally expose price action to year-end portfolio adjustments. The ETH/USD is on track to reverse back into its support zone, located between 126.70 and 135.45 as marked by the grey rectangle. Due to the fundamental bearish developments, a breakdown is expected to keep the sell-off intact until this cryptocurrency pair can reach its next support zone located between 106.73 and 112.19. This would close a previous price gap to the upside and take price action in the vicinity of its 2019 low of 95.99.

ETH/USD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 146.75

- Take Profit @ 106.75

- Stop Loss @ 158.00

- Downside Potential: 4,000 pips

- Upside Risk: 1,125 pips

- Risk/Reward Ratio: 3.56

In case of a reversal in the Force Index that results in a fresh high for this technical indicator and retakes its ascending support level, the ETH/USD may attempt a sustained breakout above its short-term resistance zone. With the structural issues surrounding Ethereum and significant competition grabbing market-share, any breakout in this cryptocurrency pair is expected to remain limited to the next long-term resistance zone between 181.77 and 189.89; this would represent an outstanding short-selling opportunity.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 172.50

- Take Profit @ 185.50

- Stop Loss @ 167.00

- Upside Potential: 1,300 pips

- Downside Risk: 550 pips

- Risk/Reward Ratio: 2.36