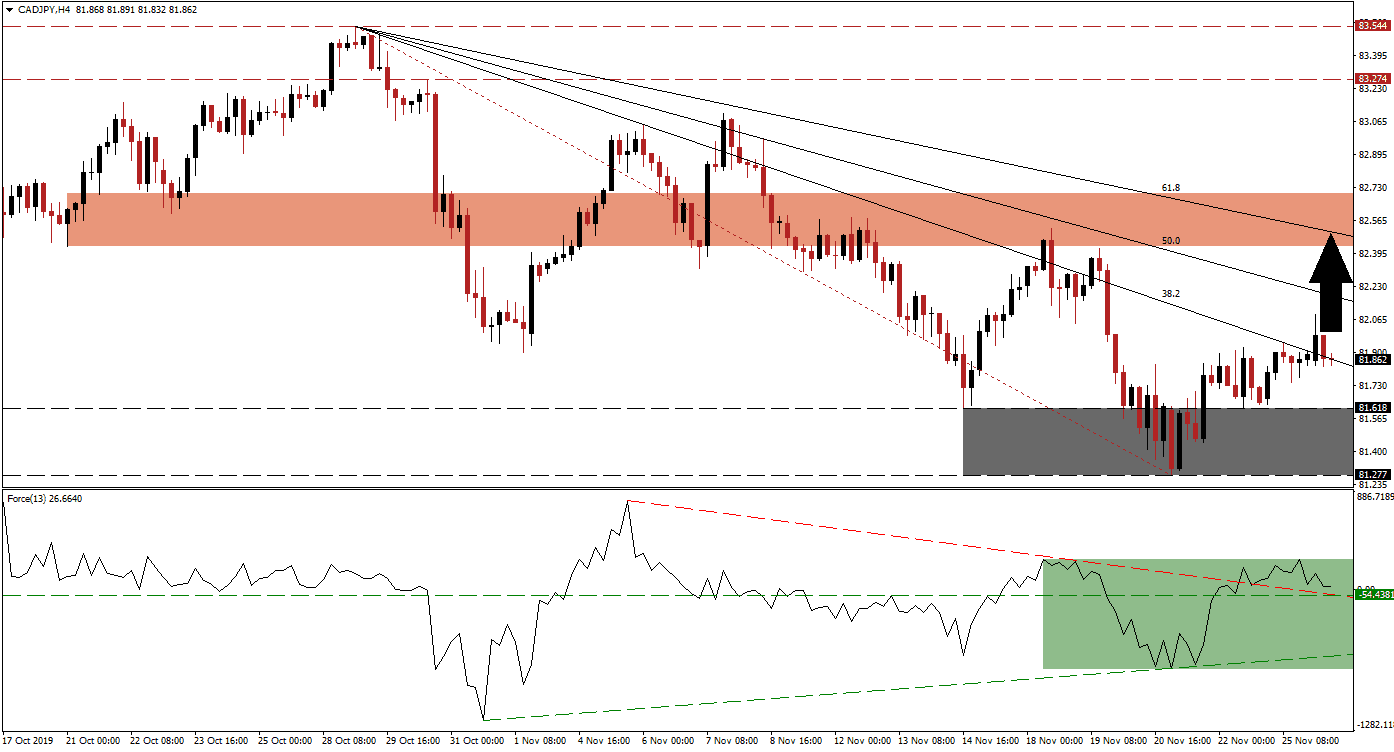

Canadian wholesale trade sales released yesterday surprised to the upside and provided the necessary catalyst to force a breakout in the CAD/JPY above its support zone. Bullish momentum carried price briefly above its descending 38.2 Fibonacci Retracement Fan Resistance Level before slipping below it. Developments regarding the US-China phase one trade deal since this weekend have been accepted as positive by the markets; this has led to an erosion of demand for the safe-haven Japanese Yen. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, confirmed the breakout in the CAD/JPY with a breakout above its horizontal resistance level that turned it into support. The rise in bullish momentum additionally elevated the Force Index above its descending resistance level, as marked by the green rectangle, and turned it into temporary support. This technical indicator is now trading in positive conditions which suggests that bulls are in charge of price action and this currency pair is expected to add more upside to the breakout above its support zone.

This currency pair may retrace down to the top range of its support zone, located between 81.277 and 81.618 as marked by the grey rectangle, before accelerating to the upside. Commentary out of the Bank of Canada in regards to a potential interest rate cut have weighed on the Canadian Dollar, but the impact is fading and better-than-expected economic data is expected to keep the Canadian central bank on the sidelines. Depressed oil prices and the sell-off in gold have kept a lid in this commodity currency, but an extension of the breakout n the CAD/JPY into its next short-term resistance zone should be expected. You can learn more about a breakout here.

One key level to watch is the intra-day high of 82.091 which marks the peak of the breakout, a sustained move higher should take this currency pair through its 50.0 Fibonacci Retracement Fan Resistance Level and into its short-term resistance zone. This zone is located between 82.430 and 82.702 as marked by the red rectangle; the 61.8 Fibonacci Retracement Fan Resistance Level represents the next major resistance for the CAD/JPY. A breakout would require a fresh fundamental catalyst and the next long-term resistance zone awaits price action between 83.274 and 83.544.

CAD/JPY Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 81.850

⦁ Take Profit @ 82.450

⦁ Stop Loss @ 81.650

⦁ Upside Potential: 60 pips

⦁ Downside Risk: 20 pips

⦁ Risk/Reward Ratio: 3.00

As long as the Force Index remains above its ascending support level, the bullish bias in the CAD/JPY remains intact. Volatility is expected to increase and economic data, especially out of Canada, should be carefully considered. A breakdown in this currency pair below its support zone, aided by more data suggesting the global economy is heading for a recession in 2020, will clear the path into its next support zone located between 80.264 and 80.667.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 81.150

⦁ Take Profit @ 80.650

⦁ Stop Loss @ 81.400

⦁ Downside Potential: 50 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.00