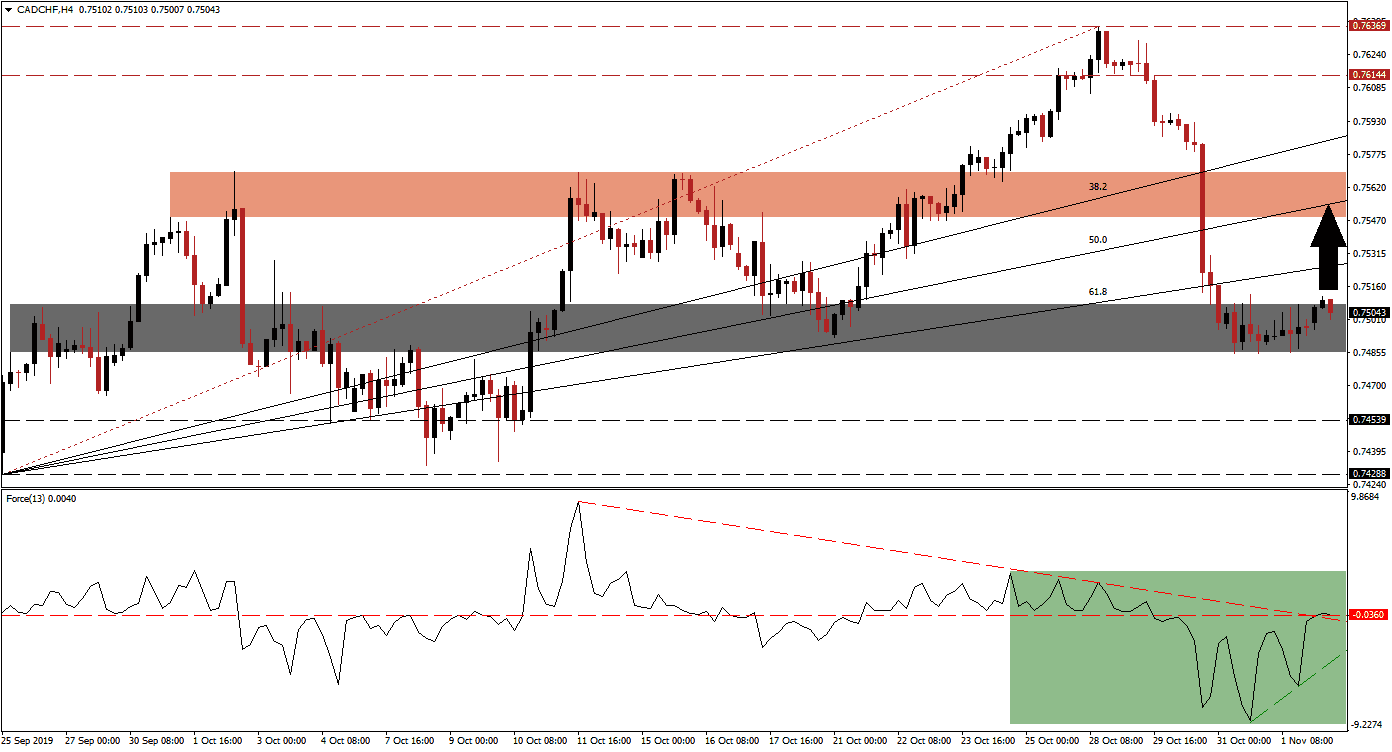

Following comments out of the Bank of Canada that an interest rate cut may follow soon, the Canadian Dollar collapsed as forex traders adjusted their positions; the safe-haven status of the Swiss Franc further accelerated the move to the downside. Price action was able to halt its breakdown sequence which took its from its long-term resistance zone, through its Fibonacci Retracement Fan sequence and into its short-term support zone; as a result of the sell-off a previous short-term support zone was converted into resistance. The CAD/CHF is now drifting higher which is expected to lead to a short-term reversal. You can learn more about support and resistance zones here.

The Force Index, a next generation technical indicator, shows the increase in bullish momentum and already pushed above its descending resistance level; it is now in the process of maintaining a breakout above its horizontal resistance level as marked by the green rectangle. It newly formed ascending support level is also exercising upside pressure. A move by the Force Index into positive territory will place bulls in charge of the CAD/CHF and is expected to initiate a push higher, partially powered by a short-covering rally. Positive news flow out of the ASEAN summit has also lifted optimism about the economy which should have a positive impact on commodity currencies.

After this currency pair reached the bottom range of its short-term support zone, located between 0.74855 and 0.75080 as marked by the grey rectangle, a drift higher followed which is now challenging the top range of it. The entire Fibonacci Retracement Fan sequence has already crossed above this short-term support zone and a second test of the breakdown in the CAD/CHF below this sequence should be expected. Forex traders are advised to monitor price action as it approaches the intra-day high of 0.75306 which represents the peak prior to the breakdown below its 61.8 Fibonacci Retracement Fan Support Level which turned the entire Fibonacci Retracement Fan into an ascending resistance level. A sustained move above this level is likely to result in fresh net buy positions.

Any breakout is expected to remain a short-term event which will keep the long-term downtrend in this currency pair intact. Upside potential is likely to peak inside its short-term resistance zone which is located between 0.75485 and 0.75690 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Support Level has just entered this zone and could reverse any short-term advance in the CAD/CHF. While the ASEAN summit has lifted confidence, the US-China trade war remains intact, Brexit and the UK election outcome uncertain while the Eurozone economy continues to slow down; this is expected to favor safe-have assets such as the Swiss Franc moving forward.

CAD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 0.75000

Take Profit @ 0.75500

Stop Loss @ 0.74850

Upside Potential: 50 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 3.33

Should the Force Index reverse and complete a breakdown below its descending resistance level which acts as short-term support, the CAD/CHF could follow through with a breakdown below its short-term support zone. This would clear the path for price action to descend into its next long-term support zone which is located between 0.74288 and 0.74539; more downside is likely, but a fresh fundamental catalyst required.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.74700

Take Profit @ 0.74300

Stop Loss @ 0.74850

Downside Potential: 40 pips

Upside Risk: 15 pips

Risk/Reward Ratio: 2.67