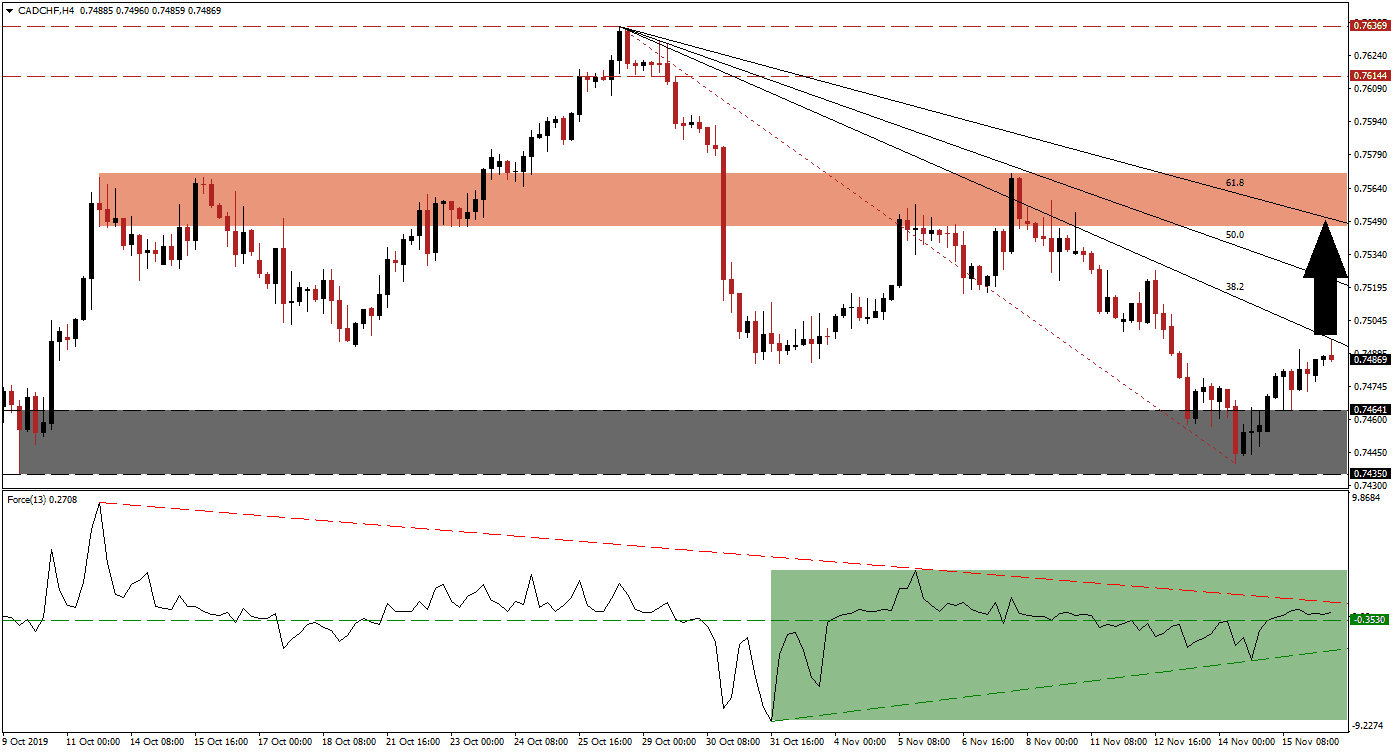

As the risk-on mood is temporarily decreasing demand for safe-haven assets like gold and the Swiss Franc, more upside is expected in the CAD/CHF after the breakout above its support zone. Price action is now challenging its 38.2 Fibonacci Retracement Fan Resistance Level, and as bullish momentum is on the rise, a breakout is likely to extend the upside potential in this currency pair. This is expected to remain a short-term development as the long-term outlook remains to the downside due to the elevated degree of uncertainties surrounding the health of the global economy.

The Force Index, a next-generation technical indicator, indicates the presence of a positive divergence which represents a bullish trading signal. This preceded the breakout in the CAD/CHF above its support zone, and the Force Index confirmed the breakout with one of its own; this converted the horizontal resistance level into support. This technical indicator is now approaching its descending resistance level as marked by the green rectangle, a move above it is expected to lead price action to the upside. The breakout in the Force Index above its horizontal resistance level also elevated this technical indicator into positive conditions, suggesting bulls are now in charge of price action. You can learn more about the Force Index here.

A light economic calendar will allow forex traders to focus purely on price action which favors existing trends to extend. The breakout in the CAD/CHF also resulted in a marginally higher low inside its support zone, located between 0.74350 and 0.74641 as marked by the grey rectangle. Forex traders are now advised to monitor the intra-day low of 0.74997 from where price action briefly advanced before being rejected by its 38.2 Fibonacci Retracement Resistance Level; a breakout above it is expected to initiate a short-covering rally and drive price action farther to the upside.

Short-term upside potential should take the CAD/CHF back into its short-term resistance zone which is located between 0.75467 and 0.75705 as marked by the red rectangle; the descending 61.8 Fibonacci Retracement Resistance Level is in the process of moving below this zone which is expected to end the advance in this currency pair. The Canadian Dollar is facing a central bank that opened the door to an interest rate cut which is limiting upside potential from a fundamental perspective, at least until the next Bank of Canada meeting. You can learn more about a resistance zone here.

CAD/CHF Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 0.74850

⦁ Take Profit @ 0.75450

⦁ Stop Loss @ 0.74650

⦁ Upside Potential: 60 pips

⦁ Downside Risk: 20 pips

⦁ Risk/Reward Ratio: 3.00

In the event of a reversal in the Force Index, which will lead to a double breakdown below its horizontal resistance level as well as below its ascending support level, the CAD/CHF is favored to reverse into its support zone and pressure for a breakdown. This would extend the long-term downtrend in this currency pair and the next support zone is located between 0.73594 and 0.73865.

CAD/CHF Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.74250

⦁ Take Profit @ 0.73750

⦁ Stop Loss @ 0.74500

⦁ Downside Potential: 50 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.00