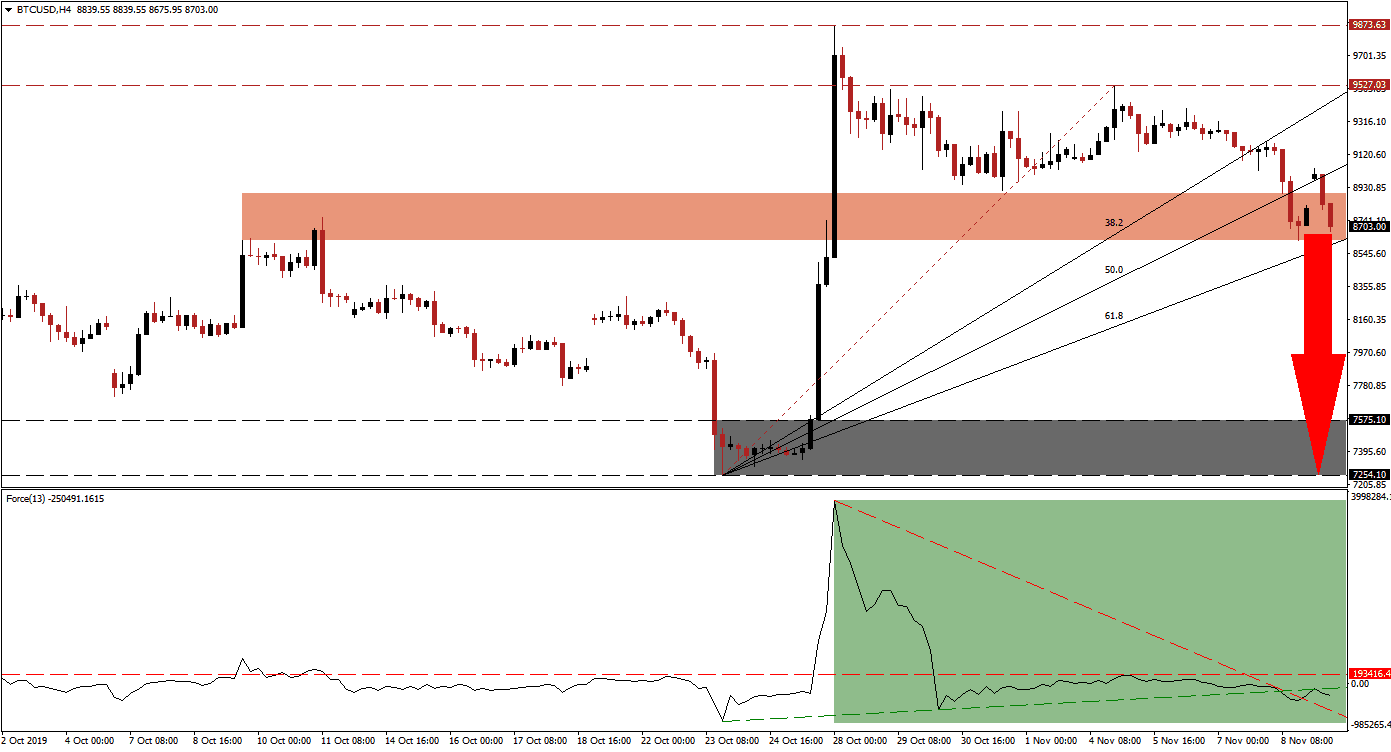

Following the brief spike higher which led to the 4th best daily gain in Bitcoin’s history, bearishness has returned; the sharp advance was triggered by a misinterpretation of comments made by Chinese President Xi in regards to blockchain technology. After price action in BTC/USD surged into its resistance zone, bullish momentum quickly collapsed and a reversal into its short-term support zone followed. Another advance was rejected by the bottom range of its resistance zone and a breakdown below its ascending 50.0 Fibonacci Retracement Fan Support Level turned the short-term support zone into resistance.

The Force Index, a next-generation technical indicator, shows the abrupt loss in bullish momentum as the BTC/USD reached its resistance zone. Bearish momentum accelerated quickly as price action initiated its first reversal and the Force Index completed a breakdown below its horizontal support level, turning it into resistance. Another bearish development materialized when the Force Index pushed below its ascending support level. The long sideways trend resulted in a move above its descending resistance level, as marked by the green rectangle, but a fresh breakdown is expected to lead this cryptocurrency to a breakdown of its own. You can learn more about the Force Index here.

Bearish momentum gathered steam after price action moved below the Fibonacci Retracement Fan trendline which, together with the breakdown below its 50.0 Fibonacci Retracement Fan support level, converted the short-term support zone into resistance. This zone is located between 8,622.22 and 8,894.80 as marked by the red rectangle. The 38.2 and the 50.0 Fibonacci Retracement Fan Resistance Levels have already crossed above this zone with the 61.8 Fibonacci Retracement Fan Support Level entering it; this has further increased breakdown pressures in the BTC/USD.

Price action is expected to complete a breakdown below its 61.8 Fibonacci Retracement Fan Support Level which will clear the path for this cryptocurrency to descend into its next support zone. The Force Index remains in negative territory which places bears in control of price action and the next support zone is located between 7,254.10 and 7,575.10 as marked by the grey rectangle. Further downside below this support zone is unlikely without a fresh fundamental catalyst, but developments in the central bank digital currency (CBDC) sector should be monitored closely. You can learn more about a support zone here.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 8,715.00

⦁ Take Profit @ 7,255.00

⦁ Stop Loss @ 9,100.00

⦁ Downside Potential: 146,000 pips

⦁ Upside Risk: 38,500 pips

⦁ Risk/Reward Ratio: 3.79

In the event of a breakout in the Force Index above its ascending support level, which represents temporary resistance, and its horizontal resistance level, the BTC/USD could attempt a breakout sequence which will take it back into its long-term resistance zone. This zone is located between 9,527.03 and 9,873.63, below the next key psychological resistance level of 10,000.00.

BTC/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 9,250.00

⦁ Take Profit @ 9,750.00

⦁ Stop Loss @ 9,025.00

⦁ Upside Potential: 50,000 pips

⦁ Downside Risk: 22,500 pips

⦁ Risk/Reward Ratio: 2.22