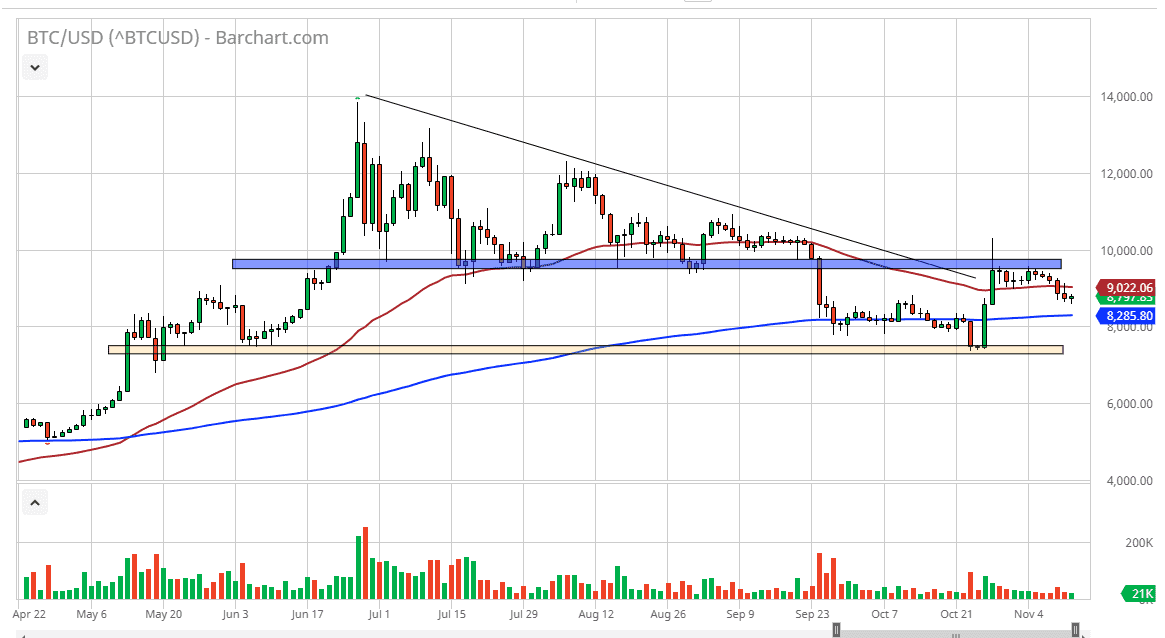

The bitcoin market has gone back and forth during the trading session on Tuesday, as we have shown a lot of volatility and therefore it’s likely that the market will continue to see a lot of choppiness more than anything else. At this point, the market is a bit indecisive, but as we have seen of the last couple of days, Bitcoin hasn’t exactly look healthy, and we are reaching down towards the 200 day EMA. The 200 day EMA is relatively flat, so that tells you just how indecisive the market is.

Looking at this chart, we are testing a lot of different levels, and quite frankly it’s nothing as far as clarity is concerned. Looking at this chart, the $10,000 level will of course offer a certain amount of psychological resistance, as it is a large, round, psychologically significant figure. Beyond that, it is also the bottom of the descending triangle that the market broke down from, so it should now be resistance. The market has broken through there, and now has tested it for sellers yet again. By doing so, it shows that there is a certain amount of weakness.

Looking at this chart, the market could very well reach towards the 200 day EMA, and possibly even towards the lows at the $7500 area in general. This doesn’t mean that it will be easy to break down through that area, but it certainly will be a bit of a magnet in general. At this point, this market continues to struggle in general, as the US dollar has been relatively strong. Unfortunately, far too many crypto currency traders don’t look at these markets as currency pairs, which is exactly what they are. With a strengthening US dollar, it will put downward pressure on Bitcoin in general.

The descending triangle that has been broken down through suggests that we are going to go down to the $4800 level, but it’s probably going to take a bit of momentum to make that happen, and possibly even a catalyst. All things being equal though, I think that every time the market rallies, you should be looking for selling opportunities until we get some type of daily close above the crucial $10,000 handle. If we do break above there, then it’s likely that we could go towards the $12,000 level above which is an area where we have seen sellers in the past.