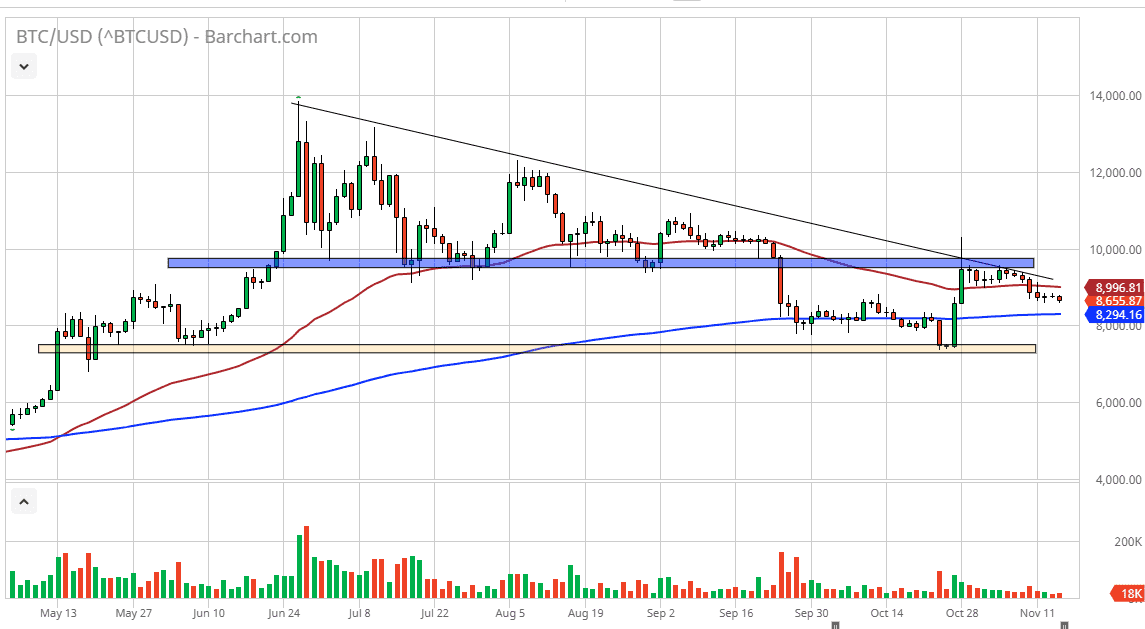

The Bitcoin market fell a bit during the trading session on Thursday again, as we continue to see a lot of lackluster trading. Volume is almost nothing, and as a result it looks as if Bitcoin isn’t attracting much attention from traders around the world. We had recently started to sell off, and now it looks like we are in fact trying to drift lower again, and therefore I think it’s only a matter of time before we reach the crucial 200 day EMA.

Looking at the chart, you can see that the 200 day EMA is closer to the $8300 level, and of course there is a certain amount of psychological importance attached to the $8000 level just below. At this point, the market is very likely to continue to see a lot of noise, but I think ultimately if the market was to reach down towards their probably will break through there and go towards the $7500 level which was the most recent low. In this environment, rallies are to be sold as a continue to be faded anyway, with the 50 day EMA at the $9000 level offering resistance. Beyond that resistance is the downtrend line that I have marked on the chart, which has yet to be violated on a daily close.

Looking at the chart, it’s obvious that we had broken through a significant descending triangle previously, and we have even reached back towards the bottom of the descending triangle before rolling over again. That descending triangle measures for a move down to the $4800 level, which quite frankly isn’t a huge surprise considering just how bearish this move has been over the last several months. Beyond that, volume continues to drop in the Bitcoin market and that almost always accompanies lower prices as seen over the last couple of years. At this point, it’s not until the market can break above the $10,000 level on a daily close that I would be impressed with any type of bullish momentum. Bitcoin continues to struggle, and I think it will be very bearish for the next couple of weeks at the very least. That being said though, we have to stay agile enough to recognize that a break above the $10,000 level could change everything and send the market looking towards the $12,000 above, but we need some type of catalyst to make that happen.