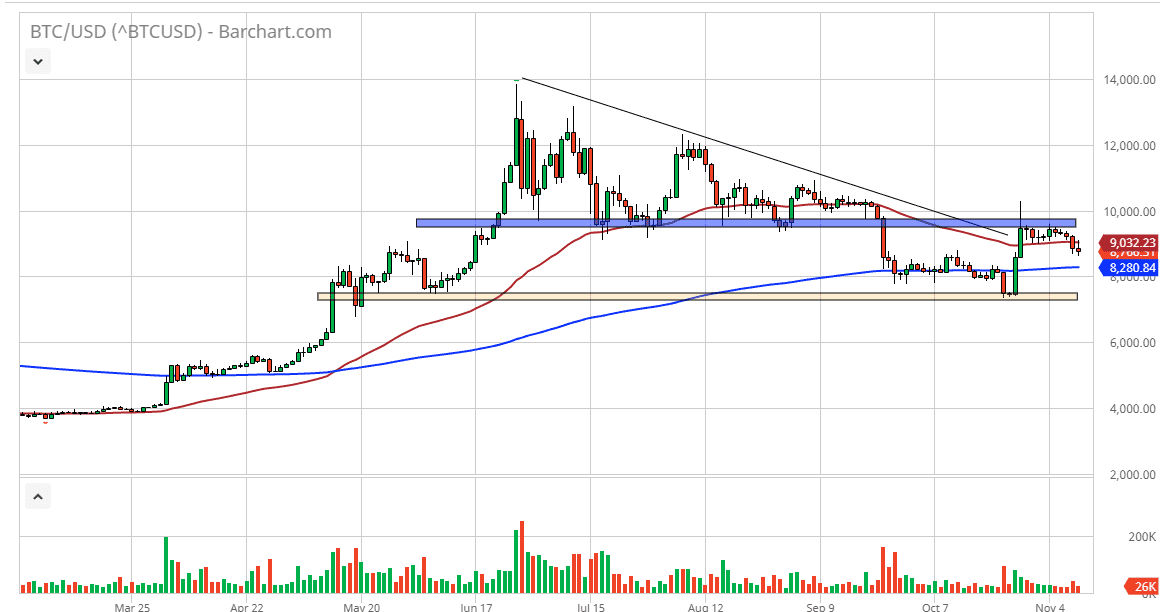

Bitcoin attempted to rally during the Monday session but found enough resistance at the 50 day EMA to rollover and form a week looking candle. This is just another negative sign in this market that simply cannot hang on to gains. Ultimately, the 200 day EMA below at the $8280 level will be the initial target, but I fully anticipate that this market will slice through there without much fanfare.

I believe in fading rallies every time they occur on short-term charts, because quite frankly the $10,000 level offers significant resistance. This is an area that previously had been support and resistance from multiple moves, but not the least of which has been the bottom of the descending triangle. By breaking through that level and then rallying straight back into it to find sellers again it has for the most part confirmed the break of the descending triangle. This measures for a move down to the $4800 level, which is can it take a certain amount of momentum to get there, but clearly Bitcoin is struggling overall.

Don’t be wrong, I do think that there is a lot of work needed to do in order to break down to that level, and I think there will be several bounces between now and then. However, it’s likely that signs of exhaustion will continue to cause a major selling opportunity for those who are shorter-term traders as well as those who are longer-term traders willing to add to positions. At this point, it’s unlikely that the market will be able to go much higher, as the $10,000 level has offered so much in the way of resistance.

I don’t necessarily think that we break down below the $4800 level but if we were to do so that would be a very negative sign. If that happens, Bitcoin could really unwind. Ultimately though, if we were to turn around a break above the $10,000 level on a daily close, that could open up the market for a move towards the $12,000 level which should be a significant amount of resistance based upon previous trading action. Ultimately, this market continues to have quite a bit of negativity attached to it, as the US dollar has been strengthening overall. In that environment, I struggle to see the upside for Bitcoin anytime soon. Obviously there can always be a news headline that moves things, but right now it doesn’t look like Bitcoin can hold gains at all.