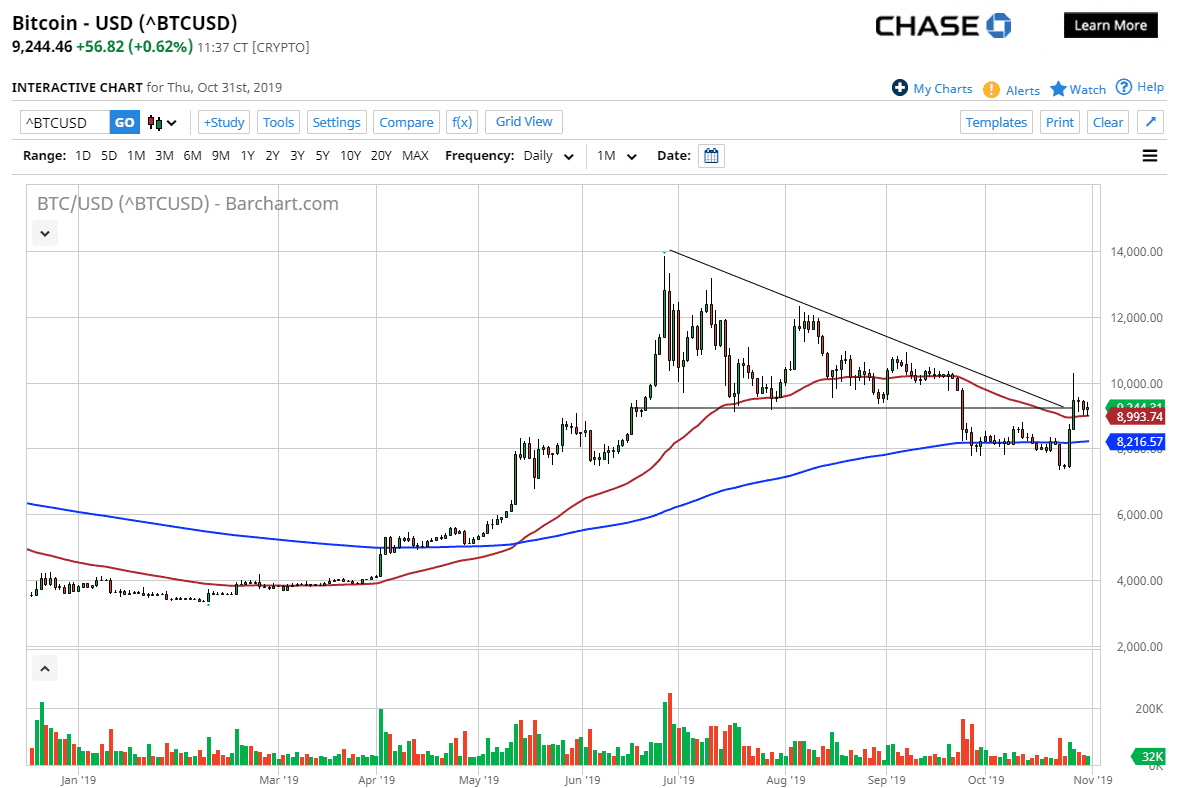

Bitcoin continues to be very quiet during trading on Thursday, as we have to make sense of the recent news about the Chinese and black chain. Over the previous weekend, the Chinese had suggested that the blockchain research will be expanded in that country, and as a bit of a knock-on effect, we have seen Bitcoin rally. However, since then the market has done absolutely nothing and even showed just how resistant that the $10,000 level was going to be. By pulling back the way we have from that level and reaching down towards the bottom of the previous descending triangle, this tells me that we aren’t ready to go higher.

The 50 day EMA underneath should be supportive, and if we can break down below there, it’s very likely that we could continue to go to the downside. At that point, the market probably goes down to the 200 day EMA underneath at the $8200 level. Breaking through their opens up the possibility of sending the market down to the $8000 level again, and then perhaps even lower than that. Based upon the descending triangle, the market should be going down to the $4800 level over the longer term and quite frankly there’s nothing on the chart that tells me anything different. With that in mind, the market is likely to continue to find sellers from a longer-term standpoint but in the short term it might be kind of quiet.

The fact that the market is quiet should be thought of through the prism of the fact that it simply isn’t ready to do anything. That tells you right there that there is a lack of interest in Bitcoin. Notice the volume underneath is extraordinarily light, and although there was a bit of a spike over the previous weekend during that announcement, the reality is that the spike pales in comparison to the surge in volume on the breakdown through the bottom of that descending triangle. At this point, shorting bitcoin makes the most sense, but I do recognize it may go sideways for a while as it does tend to simply do nothing for stretches of time. As far as buying is concerned, I would need to see a daily close above the $10,000 level to be interested in doing so, and at this point it doesn’t look likely to happen in the short term. That being said though, I would recognize it as a trend change if it does in fact happen.