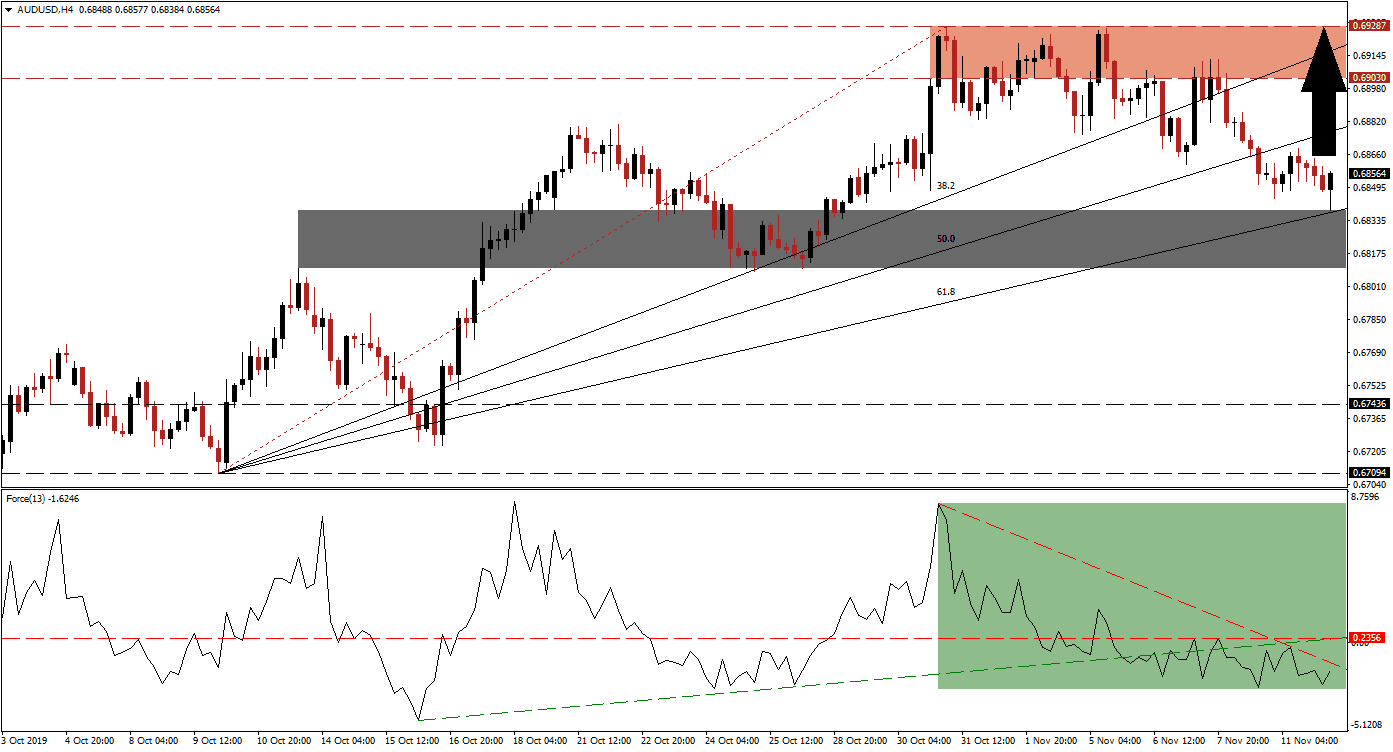

Australian economic released this morning showed an improvement in business conditions and confidence which halted the short-term correction in the AUD/USD. US-China trade fears have increased over the weekend, but this currency pair found support at its ascending 61.8 Fibonacci Retracement Fan Support Level which just crossed above its short-term support zone. Bearish momentum is fading and price action may reverse back into its resistance zone, partially powered by a short-covering rally as Australian as well as Chinese data support more upside; the Australian Dollar is the top Chinese Yuan proxy currency.

The Force Index, a next-generation technical indicator, shows the loss in bullish momentum after the AUD/USD reached its resistance zone. As price action entered a sideways trend and a breakout was rejected twice, the Force Index descended from its peak and completed a breakdown below its horizontal support level, turning it into resistance. This technical indicator also pushed below its ascending support level and is now faced with its descending resistance level as marked by the green rectangle. Bearish momentum started to recede as price action approached its short-term support zone and the Force Index is expected to initiate a breakout sequence, leading this currency pair higher. You can learn more about the Force Index here.

Preceding the descend, was a push higher which materialized from the short-term support zone, located between 0.68101 and 0.68384 as marked by the grey rectangle. The AUD/USD is once again expected to use this zone to advance. US economic data has been mixed and the drop in consumer credit should be noted as it could spill over to retail spending data. Forex traders should now watch for the Force Index to move into positive territory which will put bulls in charge of price action, this is likely to initiate the spark for the next move to the upside.

A double breakout in the AUD/USD, above its 50.0 and 38.2 Fibonacci Retracement Fan Resistance Levels should take this currency pair back into its resistance zone. This zone is located between 0.69030 and 0.69287 as marked by the red rectangle; the ascending 38.2 Fibonacci Retracement Fan Resistance Level is currently passing through this zone. With the support of the Fibonacci Retracement Fan sequence, a breakout in this currency pair above its resistance zone may follow, the next resistance zone is located between 0.70469 and 0.70810. You can learn more about a breakout here.

AUD/USD Technical Trading Set-Up - Price Action Reversal Scenario

⦁ Long Entry @ 0.68550

⦁ Take Profit @ 0.69250

⦁ Stop Loss @ 0.68350

⦁ Upside Potential: 70 pips

⦁ Downside Risk: 20 pips

⦁ Risk/Reward Ratio: 3.50

Should the descending resistance level push the Force Index deeper into negative conditions, the AUD/USD may be pressured into a breakdown below its short-term support zone. A fresh fundamental catalyst would be required to sustain a breakdown and the next long-term support zone awaits price action between 0.67094 and 0.67436; this should be viewed as a good buying opportunity in this currency pair.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 0.67900

⦁ Take Profit @ 0.67400

⦁ Stop Loss @ 0.68150

⦁ Downside Potential: 50 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.00