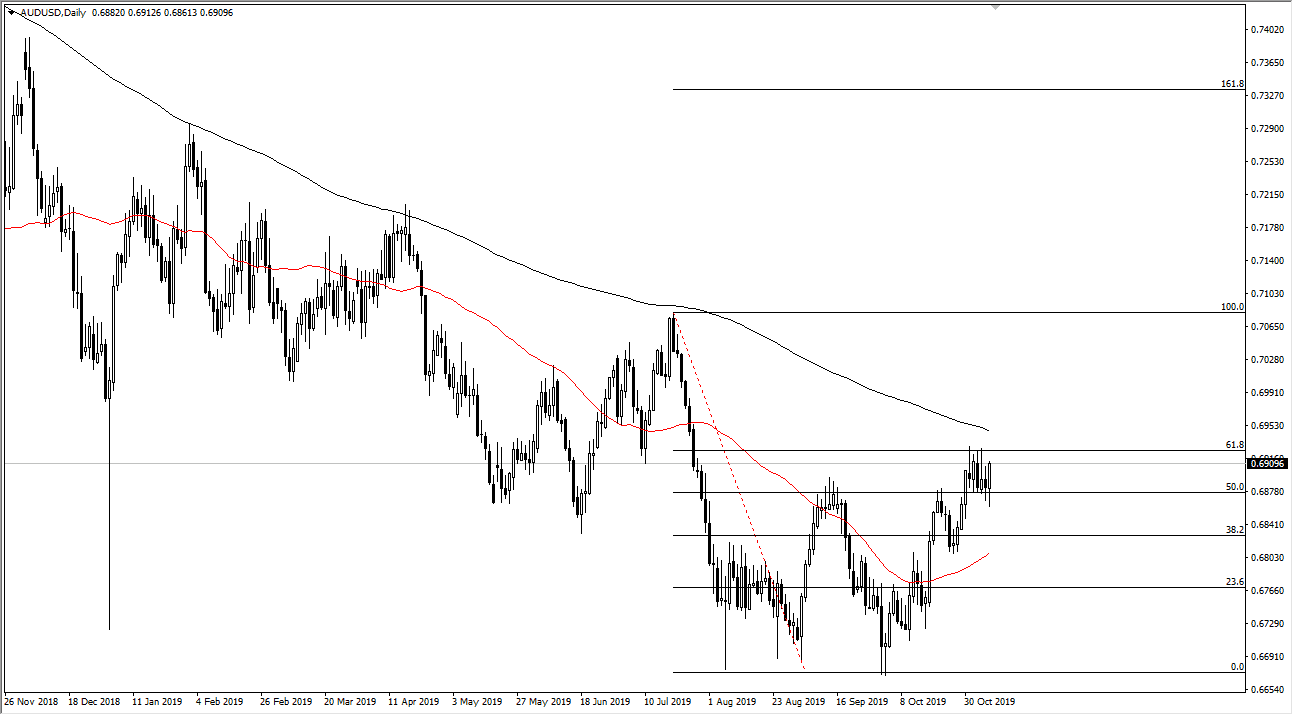

The Australian dollar initially broke down during the trading session on Thursday but have turned around after headlines came out that the Americans and the Chinese are likely to cut tariffs going forward in preparation of signing the “Phase 1” part of a deal. That is obviously very bullish, so at this point it makes quite a bit of sense that the market could reach towards the highs of the last several days, which coincides just below the 200 day EMA. Beyond that, the 61.8% Fibonacci retracement level is also in the same area, so at this point I feel that the market has a huge fight on its hands.

However, if the US/China trade situation continues to get better, that might be exactly what the Aussie needs in order to break out to the upside finally. If and when it does, the market could go as high as the 0.71 level over the next several sessions as it would open up the move towards the 100% Fibonacci retracement level. Between now and then, the market is likely to simply chop around, as not only do we have major resistance above, we also have a significant amount of support underneath. This sideways action of course has an influence on how the market will trade over the next couple of days but pay attention to both the supporting resistance levels, because once we break through one of those levels, the market is likely to make a significant move.

Unfortunately, this is all about headlines involving the United States and China, so therefore it is a bit difficult to predict any type of move in this market until we get the catalyst for one direction or the other. If we do break down below, it opens up the door down to the 0.67 handle longer-term, but unfortunately if we were to break down below and lower than current consolidation, that is probably going to be an extraordinarily negative turn of events. With this being the case, you would have to be cautious about potential headlines, but as things stand right now it looks very likely that we are going to continue seeing a lot of volatility and therefore you will need to keep your position size relatively small until we get a significant impulsive candlestick to tell us which direction we can start trading in for a larger and longer-term move.