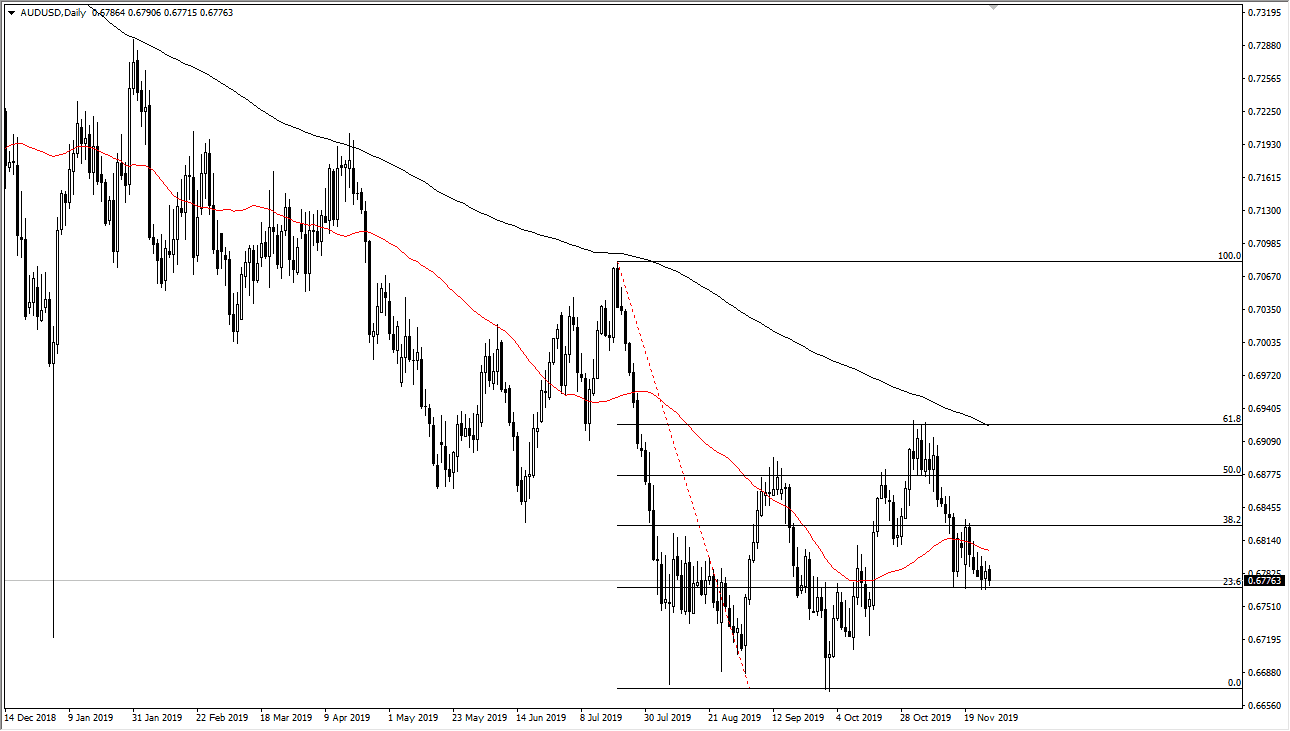

The Australian dollar is an absolute horrible currency to trade at this point. This is a market that is held hostage to the US/China trade situation, and I will be honest here: I checked this chart once a day at best. With that in mind, this could end up being one of the better trade eventually, but we are quite away from that happening. We need to see some type of resolution in the US/China trade situation in order to get some type of clarity in this pair. In the short term it looks as if we continue to bounce around in a very tight range, with the 0.6775 level offering support, and the 0.6825 level offering resistance. This market continues to be very noisy and difficult but given enough time we could move based upon a headline.

If we were to break down below the 0.6775 handle, it’s likely that the market could then go down to the 0.67 handle which of course has been a bit of a hard floor recently. If we were to break down below there, then it could wipe out the market and reach towards the 0.65 level. Alternately, if we were to break above the 0.6825 handle, the market probably goes looking towards the 200 day EMA near the 0.69 handle. The 61.8% Fibonacci retracement level above has offered massive resistance, so if we were to clear that, this market could go much higher. I like the idea of a possible bottom forming, but we obviously have a lot of work to do before that is confirmed. With that, I like the idea of waiting for some type of impulsive candlestick, possibly even on the weekly chart because once we do take off to the upside it is going to be a huge trend change in my estimation. In other words, you will have plenty of time to get involved because the pair is so historically cheap at the moment. That being said, if we do break down, I think at 200 point target will probably be about as good as it gets, because the 0.65 level has been important more than once historically. Typically, the 0.65 level is about as low as this pair goes, so unless something catastrophic happens between the Americans and the Chinese, we are probably eventually going to see this thing turnaround. In the meantime, though, it’s going to put you to sleep.