The Australian dollar has initially tried to rally during the trading session on Friday, then broke down as word got out that Donald Trump suggested that the idea of rolling back tariffs wasn’t necessarily a given yet, and if that’s the case going into the weekend it’s difficult to be overly bullish about anything. At this point, keep in mind that the Australian dollar will continue to be highly sensitive to the US/China situation as Australia supplies China with many of its raw materials, not only in construction but in manufacturing.

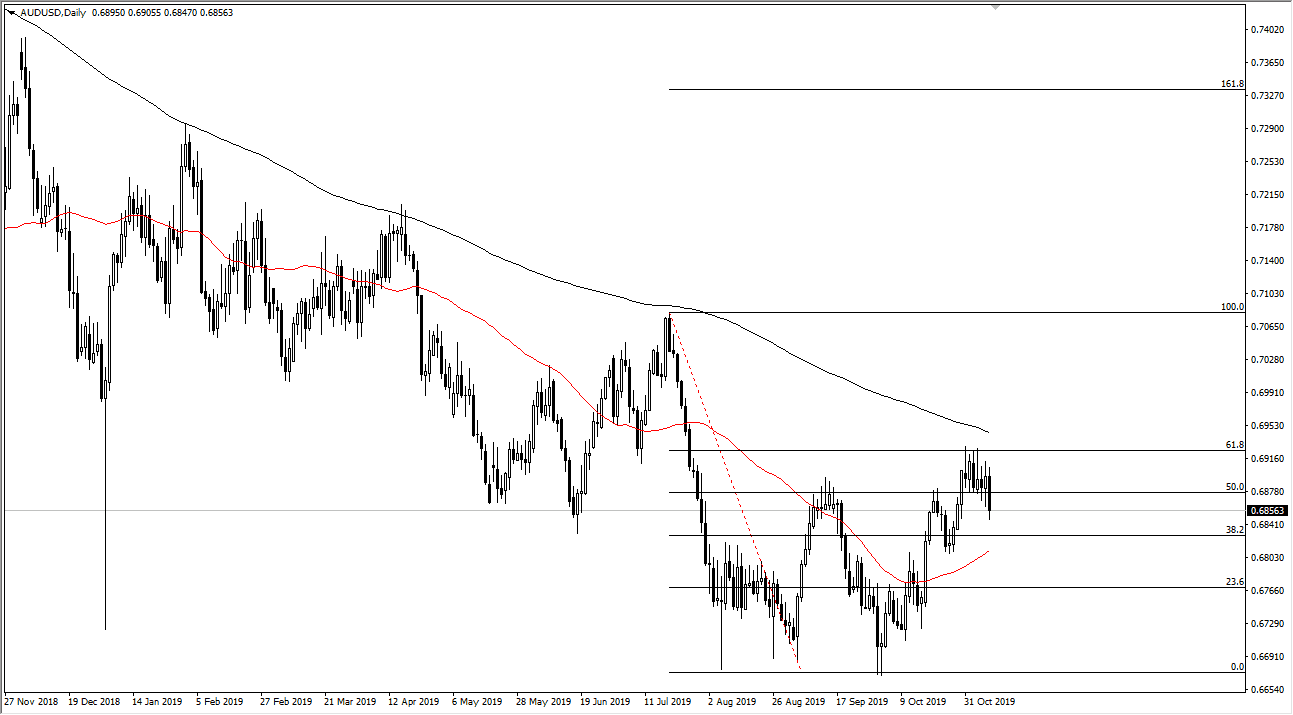

You can see that the 61.8% Fibonacci retracement level has offered resistance at the 0.69 area, so at this point it’s likely that the market has seen the top in the short term. Going into the weekend a lot of caution would have been on the minds of traders, and as a result it’s likely that the marketplace will continue to wilt, and then eventually react towards whatever headline comes next.

The US/China trade talks continue to be a big game of “chicken” between Trump and the Chinese, and so far nobody’s truly willing to blink. With this, the market is likely to react to rallies for short-term selling. I don’t think that the market breaks down drastically, but at this point it’s likely that the 50 day EMA underneath will continue to attract some attention as well. The candlestick for the trading session on Friday was rather negative and did break the back of a couple of hammers from both Wednesday and Thursday. That’s a sign that the markets are certainly getting more bearish, and it has broken through a significant amount of short-term support. All things being equal, it’s very likely that the market continues to grind lower and tests the 0.68 level. The US dollar continues to strengthen in general, as the US economy continues to strengthen. Ultimately, there are a lot of concerns out there that have more of a “risk off” feel to it as well, and ultimately, this is a market that seems to be showing just how money is flying into the United States based upon stock markets as well. Expect a lot of choppiness and volatility, so at this point position sizing will be crucial but it certainly seems to be easier to sell this pair right now.