The Aussie dollar has been noisy during the trading session yet again on Monday, as we continue to chop around in general. At this point, the 50 day EMA is starting to drift a bit lower and has offered resistance in the last couple of days. At this point, the market should continue to show a bit of negativity, as the US/China trade situation continues to cause a lot of issues. Beyond that, the Australian economy is dealing with a slowdown in Asia, which of course has a direct influence on how Australia operates. In a recent report, if the Chinese GDP were to drop by 5%, the Australian economy would lose 2.5% GDP. This is how much leverage there is between the Australian economy and Chinese economy.

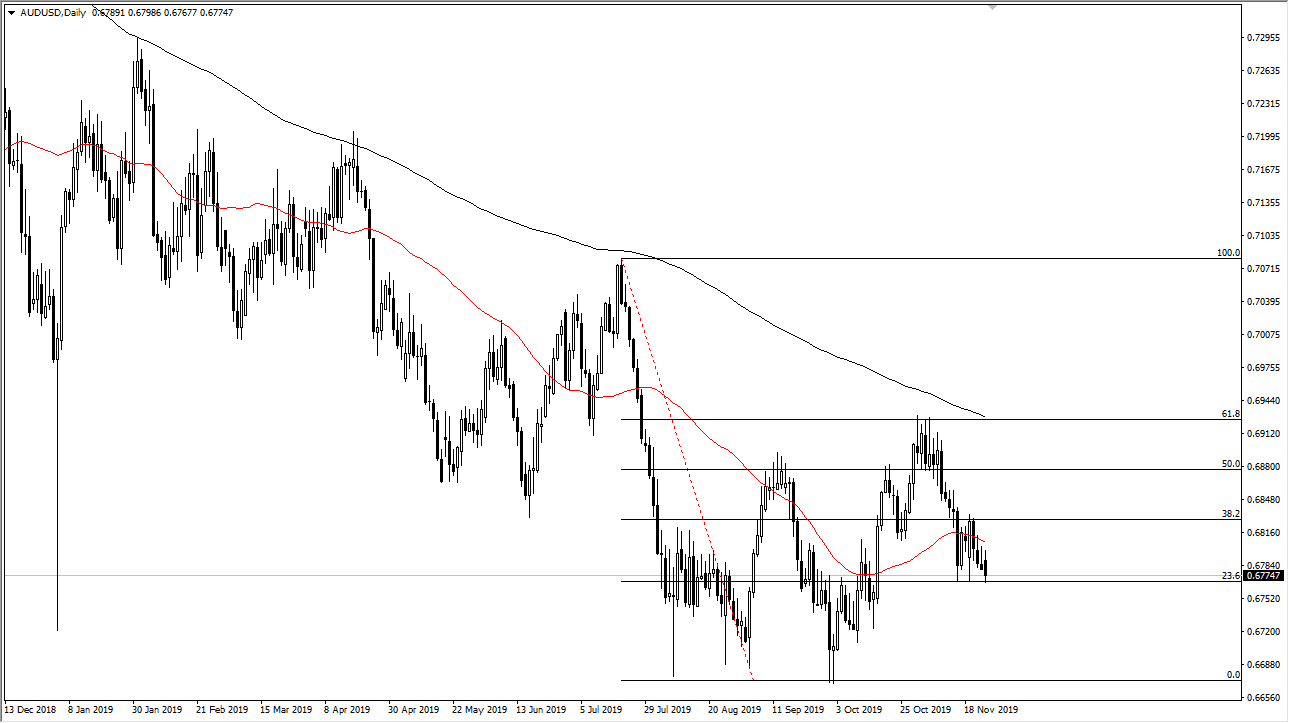

Looking at this chart, you can see that the 0.6775 level has offered significant support, which because it was previous resistance. That being said though, it does look like we are going to continue to bounce around in this general vicinity, but it also looks as if we are trying to break through it. If we do, that opens up the door to the 0.67 handle underneath which is the double bottom, but if we were to break down below there, it would be extraordinarily negative and could send this market down to the 0.65 handle.

To the upside, if we were to break above the 0.6725 handle, the market should then go higher, perhaps reaching towards the 0.69 level. The 200 day EMA is starting to grind a bit lower and should offer significant resistance. I think if we were to break above there on a daily close, and perhaps with some type of catalyst as well in the form of excitement with the US/China trade situation, then we could go much higher, perhaps reaching towards the 0.71 handle. That seems to be a bit difficult though, as there is so much in the way of noise above, and there isn’t much in the way of clarity at this point, so keep in mind that the noise in the chop should continue to be a major issue. That being said, pay attention to the levels mentioned previously, as it gives you an opportunity to find a bit of clarity. Until then, expect a lot of back and forth trading based upon headlines.