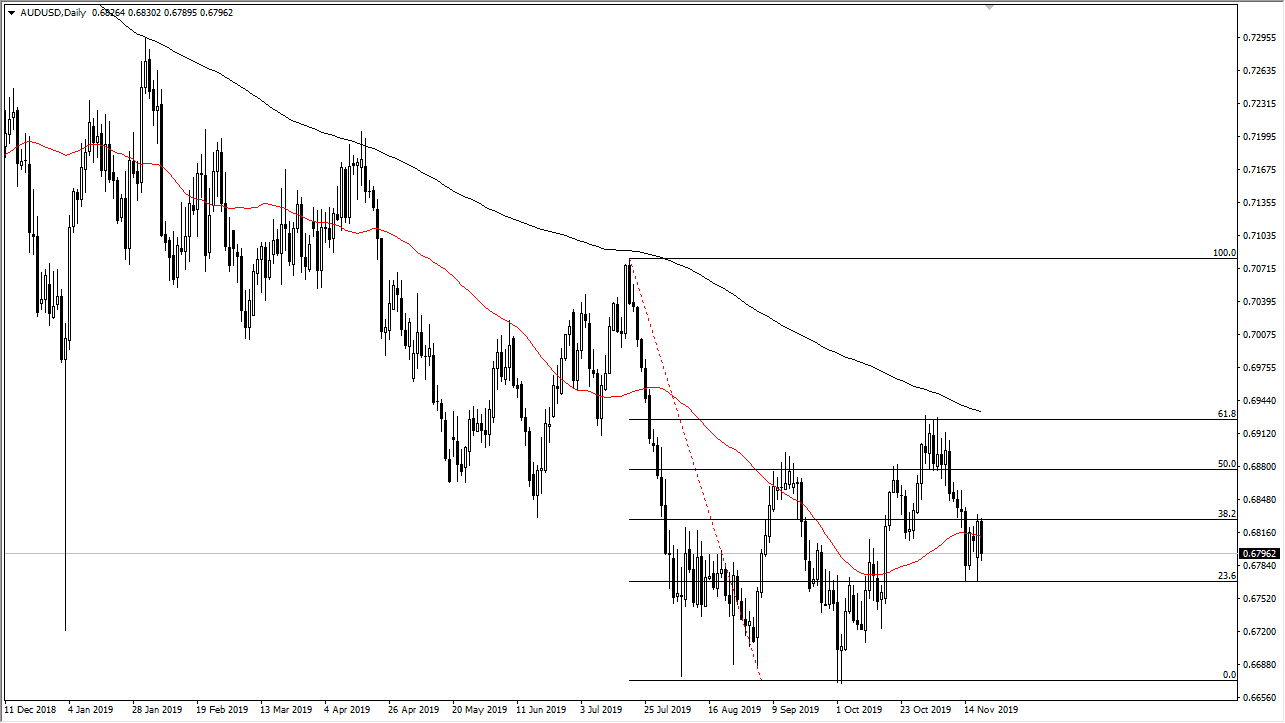

The Australian dollar pulled back a bit during the trading session on Wednesday, breaking down below the 50 day EMA as we get more of a “risk off” type of situation coming out of the trading session. Looking at this chart, it’s obvious that we have seen a bit of support recently at the 0.6775 level, as we have bounced from there twice. It looks as if we are trying to form some type of square or rectangle, as the market doesn’t really know what to do at the moment with all of the various headlines between the US and China. The trade war continues, and the Australian dollar course is highly sensitive to that trade war, so keeping that in mind it’s likely that we could get sudden spikes or drops based upon a random headline.

Ultimately, to the upside we have seen a bit of resistance near the 0.6830 level but breaking above their opens up the door to continue the sawtooth pattern that we have started to form. I think at this point it’s likely that the market could go looking towards the 200 day EMA above, and then possibly even higher than that. I don’t like the idea of trying to short this market as much anymore, although I am the first person to tell you that I don’t necessarily believe in the US/China trade situation. With that being said, I think it will be very choppy and erratic, but it certainly looks as if we are trying to form some type of bottoming pattern as we had recently formed a massive “double bottom” in the charts down at the 0.67 handle.

All things being equal, if we can get some type of “Phase 1” deal signed, that should be good for the Australian dollar. If we don’t, that’s where troubles could come into play but at this point, I suspect this is still going to be a short-term trading type of environment, so movement will be somewhat limited. At this point I believe that the market is likely to continue to offer 30 PIP ranges or so and therefore you should be quick to take your profit or loss as the market has been very choppy to say the least that I don’t see that getting any better anytime soon as headlines continue to cross the wires. The latest one of course was that the Chinese were unhappy about the US Congress passing a resolution recognizing their support for the Hong Kong protesters.