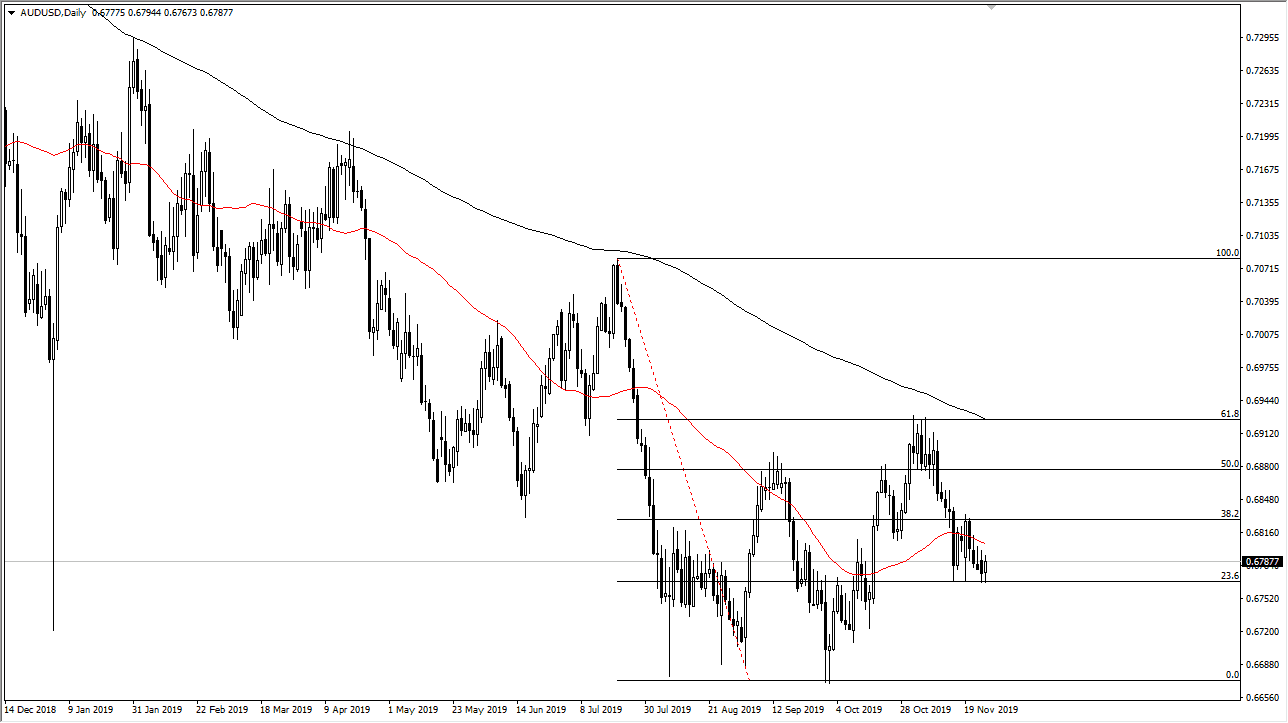

The Australian dollar went back and forth during the trading session on Tuesday, showing that we still essentially have nowhere to be due to the Australian dollar being held hostage by the US/China trade negotiations. The headlines continue to come out and then conflict itself, so it’s very likely that the market continues to see noisy trading.

The 0.6775 level underneath has offered support more than once, so now that I think if we were to break down below there it probably opens up the door to the 0.67 handle, an area that has already been a bit of a “double bottom.” That area being broken of course would allow the market to go much lower, perhaps down to the 0.65 handle. Ultimately, that would have something to do with a negative US/China headline, perhaps something that spooks the markets.

Ultimately, the 0.6825 level should offer resistance, but if we were to break above there it’s likely that the market then allows the Australian dollar to go to the 0.69 level which is going to be closer to the 200 day EMA given enough time. All things being equal, it’s very likely that the market will continue to be noisy and difficult to deal with, as it is so highly levered to the trade situation and that is a moving picture to say the least. I believe that the Australian dollar is worth watching, but not necessarily were trading right now. At this point, if we were to break out above the 200 day EMA it would be a major trend change and allow the Australian dollar to go much higher as it is cheap from historical standpoint.

If we do break down below the 0.67 handle it’s likely that the Aussie will go down to the 0.65 level which is a large, round, psychologically significant figure, and therefore an area where we would see a lot of interest in shorting, to get down to that big figure. This market continues to be one that I don’t put any money into, but I look at it as a significant signal as to how the market feels about the US/China situation. The better things are for the market, the better the Australian dollar will react. Alternately, if the trade situation gets worse, it’s likely that this market falls to even lower levels. I will keep you up-to-date as to what I’m doing here at Daily Forex.