The Australian dollar has gotten absolutely hammered during the trading session on Thursday, as the unemployment figures out of Australia were a huge miss, showing just how much the US/China trade situation has caused absolute chaos with the Australian economy. With that being the case it’s likely that the market will continue to punish the Australian dollar, but I don’t necessarily think that the market is going to melt down from here. I think what we are looking at more than anything else is a return to demand, because at the end of the day this currency isn’t about Australia at all, at least not in the context of what’s going on around the world.

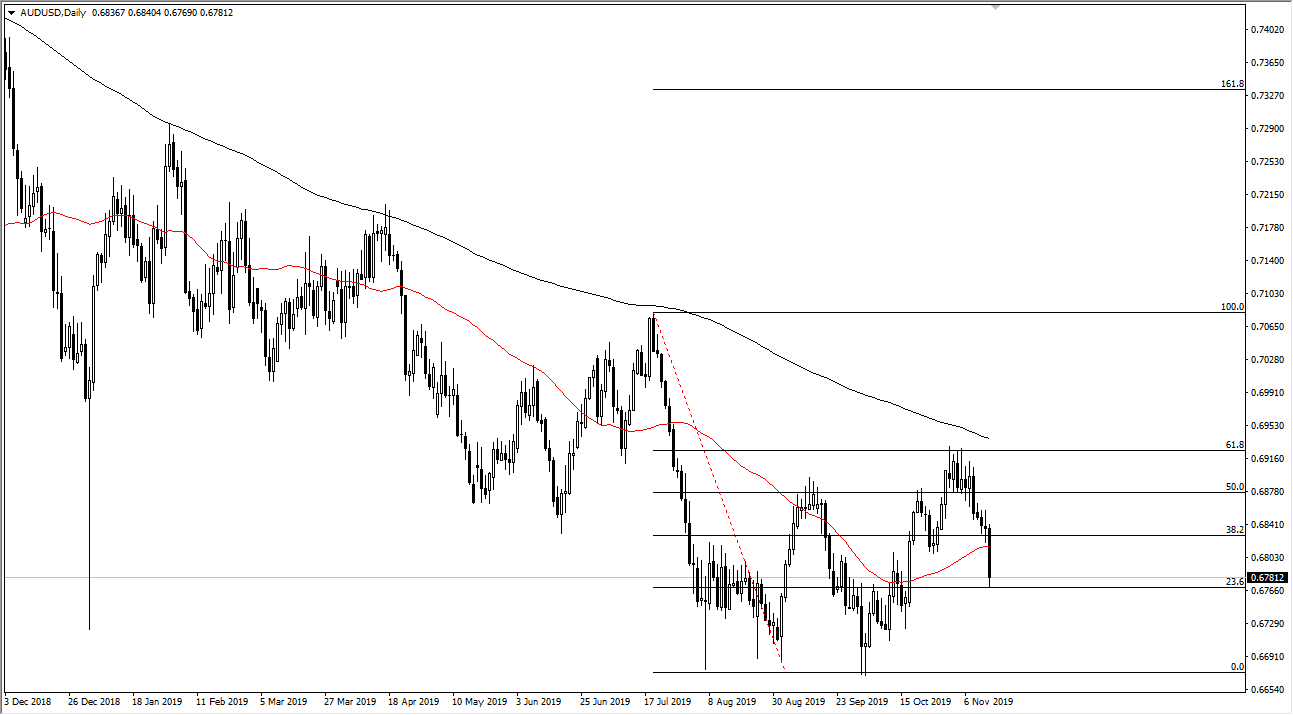

Looking at the chart, it’s easy to see that there has been significant support near the 0.67 level, as we have formed a bit of a double bottom, or perhaps even more stringent support than that. Obviously, if we were to break down below that level it would be an extraordinarily negative sign. At that point I would anticipate that the market could break down to the 0.65 level, an area that will have a certain amount of psychological importance attached to it. However, I find it to be very unlikely to happen, unless of course we get a complete shift in attitude.

One thing is for sure, the Australian employment figures don’t really matter, because of this is going to be about the trade situation so unfortunately the Australian dollar will trade upon headlines which of course seem to change at every given moment. It seems as if every time the market is ready to give up the idea of the US and China coming together, Donald Trump or even the Chinese at times, will tweet or announce something that gives hope. Hope means higher priced Australian dollar has Australia supplies China with so much of its raw materials for both construction and export driven manufacturing. As the Chinese Yuan is highly manipulated, the Australian dollar is the favorite vehicle for traders to play the China situation. At this point, there should be plenty of support underneath though, so I will be looking for short-term pullbacks that I can take advantage of. Ultimately, this is a very rough looking candle so I think that we will probably pull back, but I also think that there will be buyers underneath unless of course something changes.