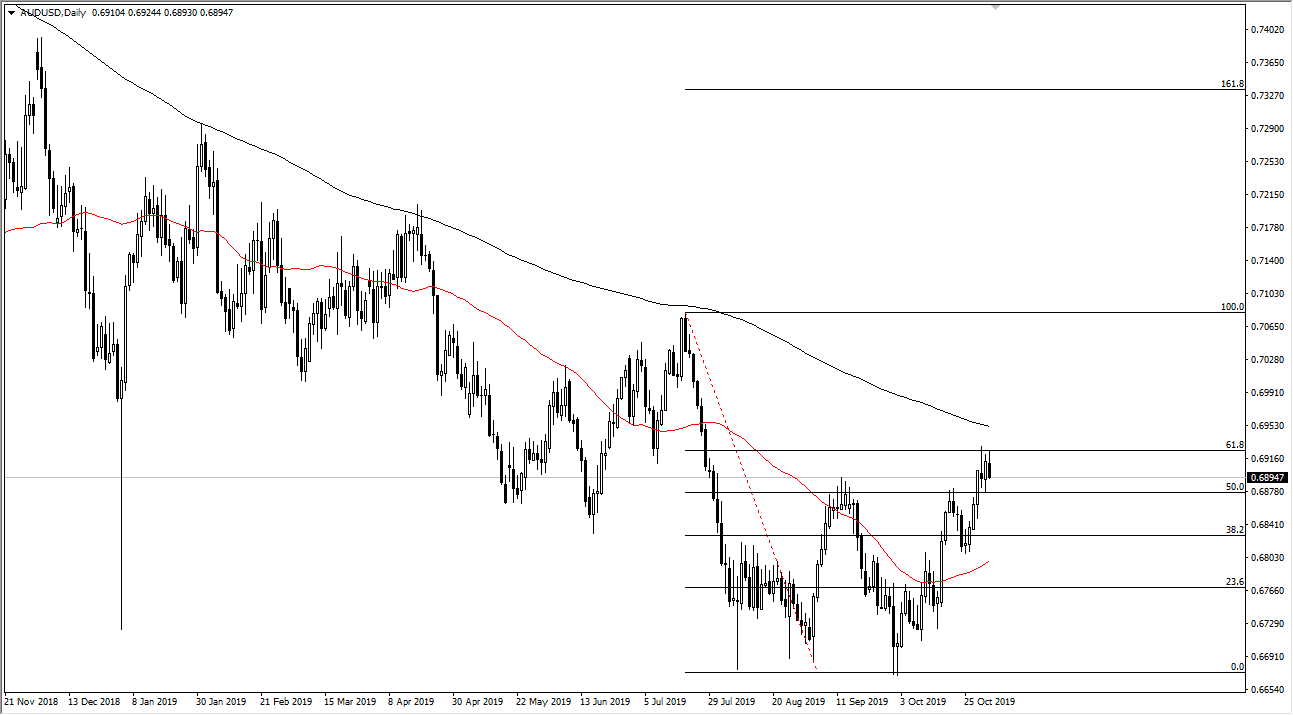

The Australian dollar has rallied a bit into the trading session on Monday but continues to find plenty of resistance above at the 61.8% Fibonacci retracement level. As a result, the looks likely that the market is going to continue to drift back and forth in this area. Ultimately, this is a market that should continue to show signs of exhaustion at these high levels, as the United States and China continue to bicker. However, if we get good news out of that scenario it should continue to move the Australian dollar higher. It should be noted that a lot of Wall Street traders were going on about the possibility of the trade agreement going forward, while the Australian dollar fell, so perhaps the currency market isn’t as convinced.

To the upside I believe that the 200 day EMA should continue to offer resistance as well, so if we were to break above there are a daily chart it would signify a new leg higher. Ultimately, this is a market that should continue to go higher, once we have that happen. Otherwise, the market then would probably go looking towards the 100% Fibonacci retracement level which is closer to the 0.71 handle.

The alternate scenario is that we break down and reach towards the 0.68 handle which is where the 50 day EMA is currently sitting. I suspect that we are going to continue to see a lot of choppiness regardless, so at this point I wouldn’t get overly married to any one particular position. Eventually we should get some type of impulsive candlestick that we can follow but right now I think this is but a microcosm of trading in general right now, as it seems like participants simply don’t know what direction to go. Headlines continue to push markets in both directions, not the least of which would be Brexit, the US/China trade wars, global slowing down, and a whole host of geopolitical issues. At this point, the Australian dollar is likely to see more rate cut coming out of the RBA, but then again so is the US dollar in terms of the Federal Reserve. I think we are going to continue to chop around with no convincing move in the short term, but once we get it, we can start following again. Until then, short-term back-and-forth trading is probably about as good as this gets - which has been the way for several months.