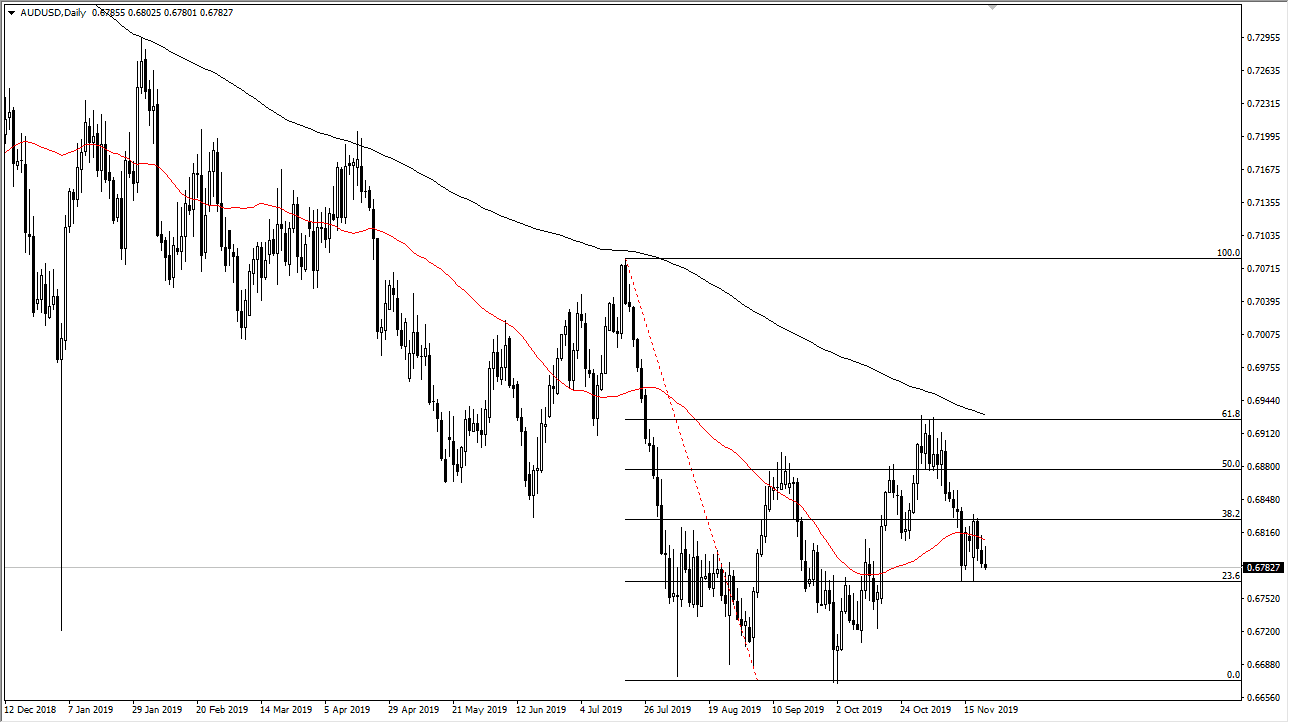

The Australian dollar initially tried to rally during the trading session on Friday but gave back the gains in order to form a bit of a shooting star shaped candlestick. That being the case, it’s likely that we will see another push lower, but even if we do push lower from here, it’s likely that the market participants will find plenty of support underneath. That support can be found at the 0.6750 level, and then possibly even lower than that at the 0.67 handle which has been massive support.

Speaking of the 0.67 handle, that’s an area where we have seen a bit of a “double bottom” on the higher time frames and is currently trying to form itself as a “floor” in the market and perhaps even a scene where the trend change finally happens. However, there is a lot of noise out there that will continue to throw this market around, as the Australian dollar is highly sensitive to the Chinese economy. As the US and China are in the midst of a trade war, it’s no surprise that the Australian dollar is a bit erratic.

If we can get good headlines out of there, then it should send the Australian dollar much higher. This is because Australia provides so much of the raw materials for China to do manufacturing and construction, and the idea is of course that the Chinese economy should continue to strengthen if the trade war starts to go away. After all, tariffs are not good for export driven economies, and that should help down the road. That being said, the markets have been extraordinarily volatile when it comes to headlines, and it’s likely that we will continue to see a lot of that noise in this pair. Given enough time, it’s possible that we could turn around and break towards the 200 day EMA and a daily close above the 200 day EMA could be the beginning of a new trend higher. For what it’s worth, we have made a double bottom followed by several higher lows recently, so it is at least starting to look like we are trying to turn things around. That being said if we were to break down below the 0.67 handle, then it’s likely that the pair could go down to the 0.65 handle, which of course is a large, round, psychologically significant figure that should be paid attention to buy traders around the world.