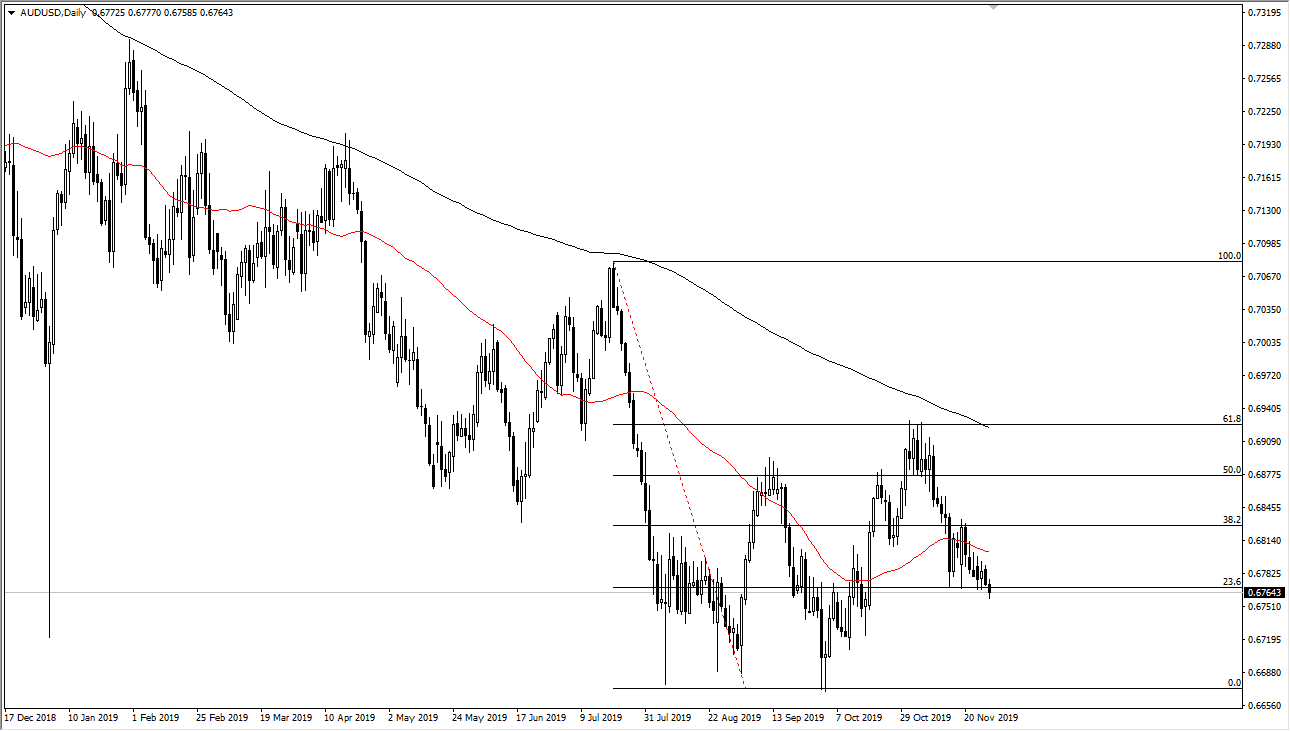

Unfortunately, the Australian dollar is highly levered to the US/China trade situation, which of course is all over the place. That being said though, we did see an initial fall in the Aussie dollar after the bill supporting Hong Kong that came out of Congress was signed by Donald Trump. That being said though, we have seen a little bit of a bounce since then and we continue to hover around the 0.6775 level.

This is an area that has been supportive in the past as well as resistive. If we can break down below, we could go as low as the 0.67 handle, but I think that level is going to be almost impossible to break down through unless of course we get a complete collapse in the US/China trade talks. With that, if we were to break down below that level then it’s likely that the markets are going to unwind down to the 0.65 handle, which is historically crucial.

To the upside we have the 50 day EMA and if we can break above there it’s likely that the market will continue to go higher, perhaps reaching towards the 0.69 level. A break above the 200 day EMA on a daily close would also be very bullish, and therefore could send this market into a complete reverse of the trend. Don’t be wrong, I don’t think it’s going to be easy and we need some type of good news out of the US/China trade situation to make that happen. All things being equal though, it’s likely that the market will find its way much higher, reaching to the 0.70 level initially, and then beyond. That being said though, the Australian dollar has been something that I have monitored but haven’t traded any time recently.

If and when the US/China trade situation gets resolved, this will be the best market to be involved in would be my guess. The Australian dollar is historically cheap, and therefore I think it will attract a lot of attention. All things being equal, I do expect a bounce sooner or later but there’s no need to jump into this market right now as we can see there is a lot of noise just above and it’s not worth risking any trading capital at this point. However, I will keep you up-to-date at what I am doing here at Daily Forex.