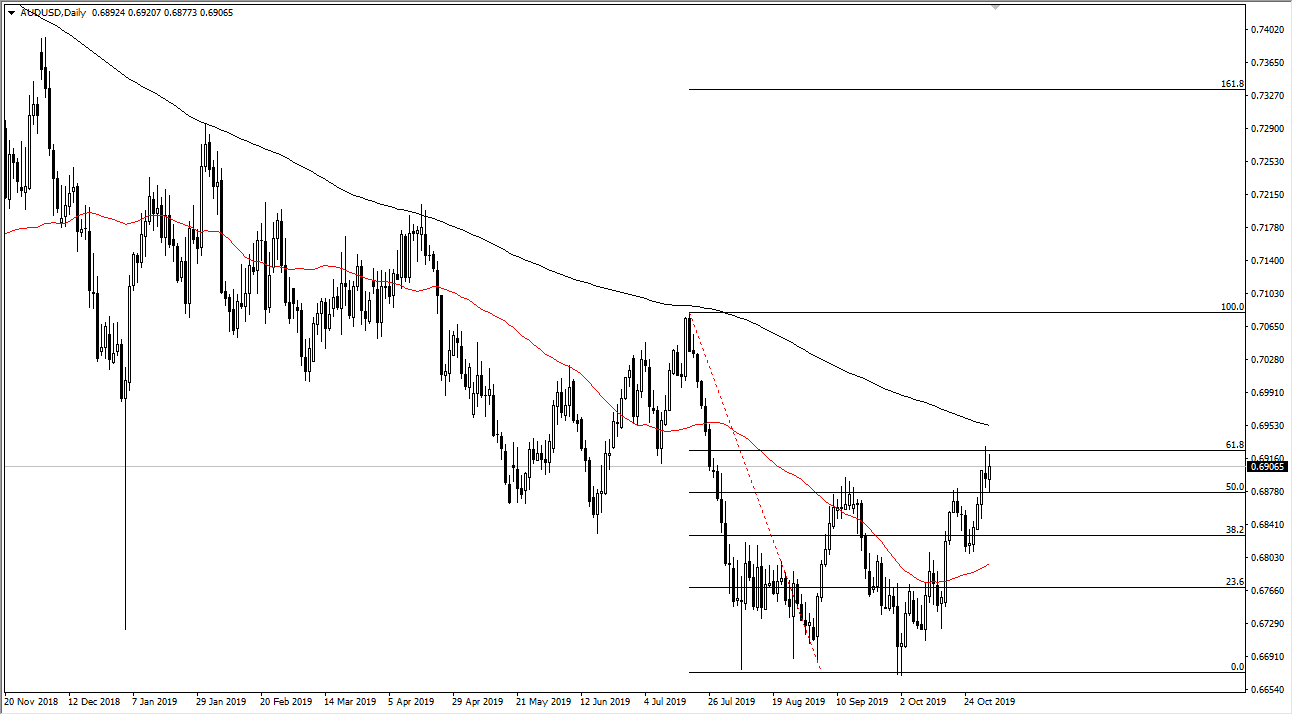

The Australian dollar has rallied slightly during the trading session on Friday but continues to find resistance near the 0.69 level. This is an area that has caused issues in the past, both as support and resistance. Beyond that, the market finds itself near the 61.8% Fibonacci retracement level, which is an area that attracts a lot of attention by itself. Furthermore, the market also has the 200 day EMA sitting just above that is starting to slump lower, and then suggest that perhaps there will be sellers just above there as well. With all of this, I think that the market will eventually pull back.

That being said, the market has made a “higher high”, and that of course is a very bullish sign longer-term. Regardless, the market has gotten a little bit ahead of itself in the short term and that might be what I’m seeing here in the form of a potential pullback. Furthermore, the market is very sensitive to the US/China trade situation, which at this point seems to be getting a little bit better. It isn’t that the deal is imminent, just that things aren’t getting worse and that of course is somewhat positive in and of itself.

The 50 day EMA is starting to curl higher, and that is a good sign as it has offered significant support underneath. All things being equal though it’s very likely that this market needs to pullback due to the recent overbought condition. That doesn’t mean that we can’t go higher, just that momentum needs to be built up. Beyond that, as you can see recently, we had broken down from the 0.71 level and it was several black candles in a row. That shows just how much bearish pressure there has been recently.

That being said, it should be noted that the market looks as if it is China for some type of basing pattern from the longer-term standpoint. However, even with that potential basing pattern we have seen this before and the market continued to go lower even after several attempts at doing this exact same thing. Trading with the longer-term downtrend makes the most sense, especially if we get more “risk off” out there. Remember, the Australian dollar is highly sensitive to risk appetite, so the overall attitude is important. The US/China trade headlines will continue to come and push this market back and forth, so keep that in mind as well.