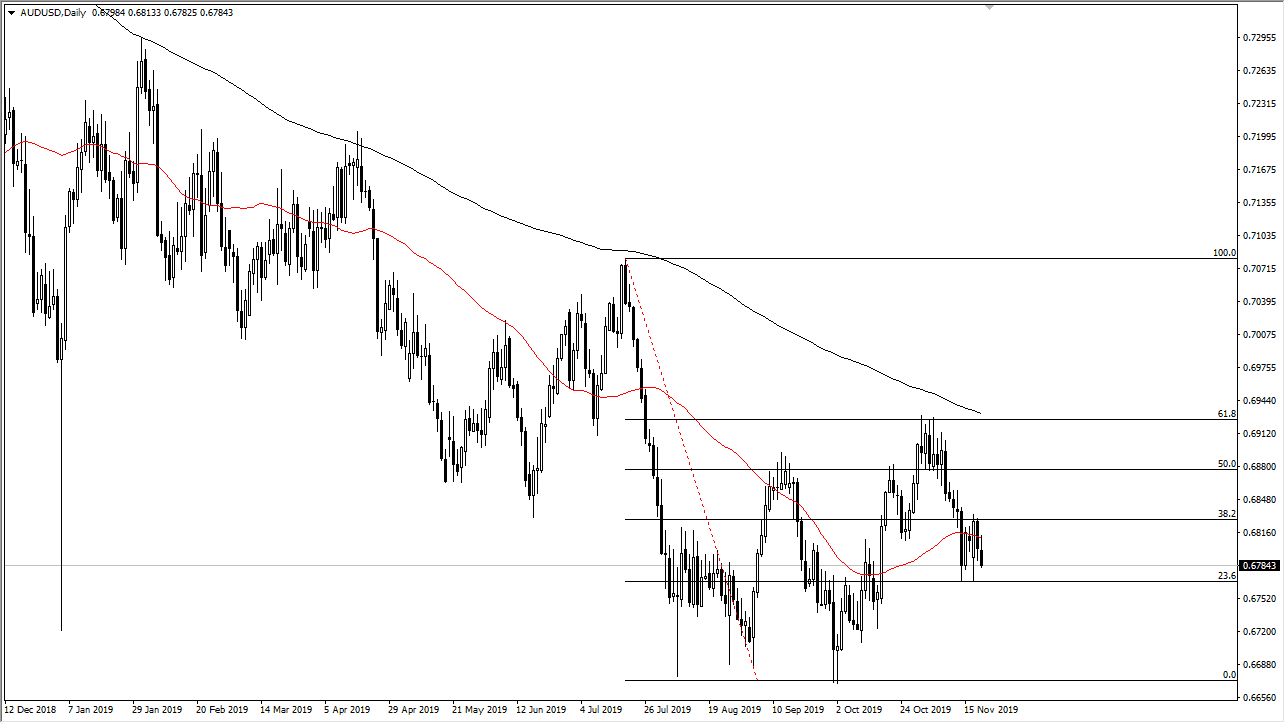

The Aussie dollar initially tried to rally during the trading session on Thursday but then rolled over again at the 50 day EMA. Regardless, there is a significant amount of short-term support below at the 0.6775 level underneath, which has previously been both support and resistance. Even if we were to break down below that level, I think there’s even more support down at the 0.67 level if we get down there.

The biggest problem Australia has right now it is China, or perhaps more to the point: the US/China trade situation. That continues to be market best, and as a result it’s difficult to get overly excited about the Australian dollar, as there is a significant headwind facing it in the form of the trade relations and the constant nonsense that crosses the headlines. At this point, it all comes down to whether or not the Americans and the Chinese will get to signing “Phase 1”, something that I’m not is entirely convinced about as some others, but obviously it needs to happen for more of a “risk on” type of attitude to take hold in the currency markets and by extension stock markets.

With that being the case, the market should have plenty of support all the way down to the 0.67 level eventually, but the question now is whether or not we get that in the form of buying, or short covering? What I mean by that is whether or not it is a sudden positive headline that has people short of the Aussie dollar jumping out of the market or is there something good coming out that can push this pair higher? Quite frankly, if we get good news out of the US/China trade situation I would prefer to buy the AUD/JPY pair as this one has been dead money for so long it’s difficult to imagine a lot of momentum flying into it.

If we were to break down below the 0.67 handle, that would be very negative and probably accompanied by some type of very bad headlines involving the US/China trade situation. All things being equal though, the market looks as if it will continue to go back and forth, and shopping around is probably a good thing as the market kills time in order to try to build some type of base to change the overall trend. That being said, short-term trading is probably as good as this gets right now.