The Australian dollar has gone back and forth during the trading session on Monday again, as the trade war continues to cause major issues. The initial reaction was positive in the sense that the Chinese suggested that the phone call over the weekend was “constructive”, only to have government officials from China later suggest that perhaps they were a bit more “pessimistic” when it came to signing the Phase 1 part of the trade deal.

The Australian dollar is highly sensitive to China has Australia produces massive amounts of hard commodities that the Chinese use for both manufacturing and construction. Australia hasn’t had a recession and 30 years as they have been so highly levered to China, but unfortunately for Australia, the trade war is hitting China when it has the most amount of troubles that it’s had over the last several decades. At this point, the market is likely to continue to see a lot of noise, and of course a lot of headline risk. Quite frankly, with the way algorithmic traders function these days, a tweet from the right account could make a huge difference.

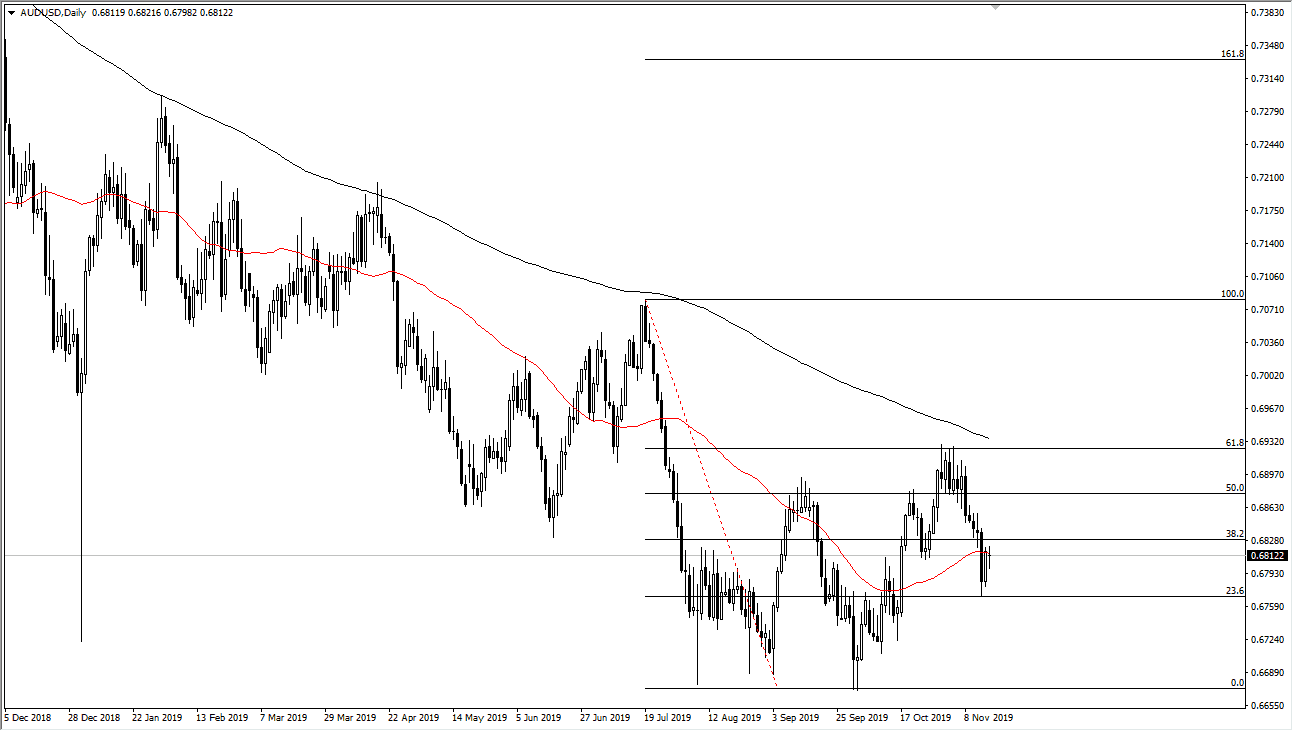

Looking at the chart, you can see that we are dancing around the 50 day EMA, an area that will cause quite a bit of reaction in both directions. Ultimately, this market has been making higher lows as of late, so there is the possibility that people are trying to bet on the Americans and Chinese coming together. At the very least, I believe the part of the reaction is due to the idea that the trade war situation isn’t getting any worse. Granted, it hasn’t gotten much better but at least it has an escalated from here.

The 200 day EMA above will continue to offer resistance, so it’s difficult to imagine a scenario where we just simply slice right through it. Given enough time, it’s likely that we will probably rally, but I don’t think we can rally that far. The Australian dollar has been very difficult to trade for some time, and unfortunately it doesn’t look like it’s going to get any better anytime soon. Looking at this choppiness, it’s going to be best probably left alone, unless of course you are a longer-term trader that can hang on to a lot of volatility and reach for larger returns. All things being equal, this is a market that looks as if it is trying to form a base but it’s going to continue to be very noisy.