The Australian dollar has rallied a bit during the trading session on Friday, wiping out quite a bit of the losses from the Thursday session. Remember, the Australian employment figures came out rather soft during the Thursday session, and that cause chaos in the Aussie. However, what’s more important to the Australian dollar than Australia itself is the US/China trade war right now. Larry Kudlow suggested that perhaps the two sides are getting closer to an agreement, and of course the market bought right into it. As a result, the Australian dollar rallied as it is considered to be a “risk asset” because Australia has a heavily commodity laden economy.

That’s essentially the crux of this pair, you are betting on what’s going to happen next in the US/China trade situation. If there is more likelihood of resolution, that tends to favor the Australian dollar as they will supply China with most of its construction materials and more importantly in this case: raw materials for manufacturing. The Australian economy is highly levered to China, so that of course has its own effect on the economy itself.

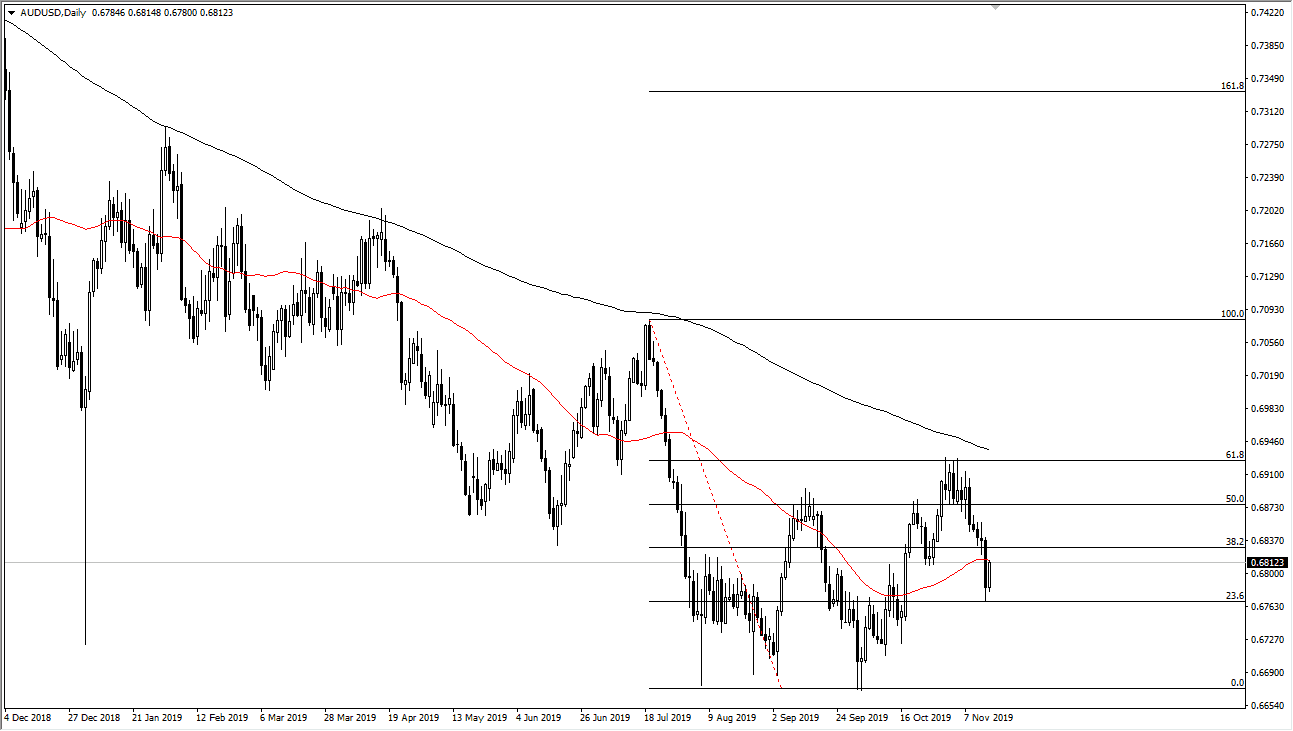

It is worth noting that the most recent low, assuming that the Thursday candlestick was a low, was higher than the potential double bottom underneath at the 0.67 handle. The 50 day EMA is offering a bit of resistance though, although previously it had been supported as early as 24 hours ago. If the market can wipe out the candlestick from the Thursday session, I would assume that’s a very bullish sign and we would probably go looking towards the 200 day EMA above which is painted in black. Clearing that level then gives a signal that perhaps the trend is changing overall is a lot of longer-term traders will look at the 200 day EMA as a sign as to what the long-term trend in fact is. By breaking above there it would have a lot of traders out there willing to cover short, and perhaps even start thinking about buying long positions here. We are historically cheap, and as a result it would not take much to turn this market around in the form of the deal between the Americans and the Chinese, more or less just that there was one. If we break down below the 0.67 handle, it would be relatively catastrophic for the Australian dollar, perhaps reaching as low as 0.65 given enough time.