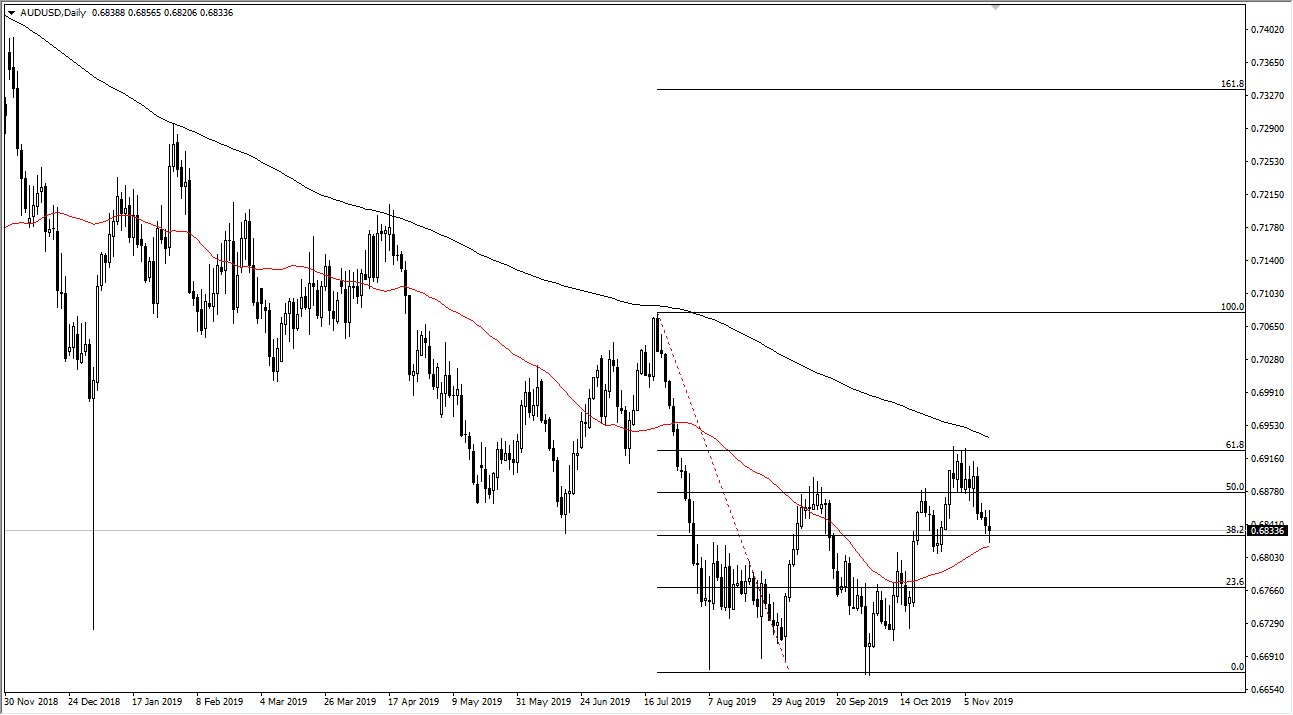

The Australian dollar has gone back and forth during the trading session on Wednesday, as we continue to dance around the 50 day EMA. The 50 day EMA bringing buyers and is a good sign as it should signify that shorter-term traders are starting to jump in and try to push this market higher. After all, the market has recently made a “higher high” and is trying to make a “lower low.” You can also make an argument that we have formed a double bottom down at the 0.67 handle, so this could be the beginning of a trend change. It’s a bit early to call that, but once we get a daily close significantly above the 200 day EMA above, that would be an extraordinarily bullish sign and probably signal that the buyers are in control again.

The Australian dollar is highly sensitive to the US/China trade situation and of course overall the Chinese economy itself. After all, the Australians are a major producer of hard commodities that the Chinese use for exports and construction, and if the Chinese economy does better, so does the Australian economy. That being said, the Chinese economy has been slumping for a whole host of reasons, not the least of which is the trade war. If that’s going to continue to be the case it does certainly weigh upon the Aussie dollar. That being said, this pair is currently trading on the trade war expectations more than anything else, so if we get some type of good news out of that situation is very likely that this market will continue to rise.

If the market does break above the 200 day EMA on a daily close, then I fully anticipate that the Australian dollar will go looking towards the 0.71 level. Breaking above there would bring in longer-term “buy-and-hold” money, thereby driving the market to at least the 0.75 handle. To the downside, if we were to break down below the 50 day EMA the next target would be the 0.6750 level, followed by that previously mentioned 0.67 handle. Breaking that would be catastrophic for the Australian dollar but considering we are at historic lows, it’s very likely that we have at least made a serious attempt to try to put in the bottom. That being the case, I like the idea of picking up value but recognize that there is a lot of headwinds above.