The Australian dollar tried to rally initially during the trading session on Tuesday, but then turned around to show signs of selling again. Ultimately, the market looks as if it is trying to find some type of support here, but there is a lot of trouble out there that could pop up as the Australian dollar is definitely a “risk on” currency. With the US/China trade talks still going on, and the almost never-ending gamesmanship being played by both countries, it’s difficult to imagine that this market will simply take off in one direction or the other for a bigger timeframe.

At this point, the market continues to chop around and move based upon the latest headline, and right now it appears that there is hope that the Americans may rollback some of the tariffs against the Chinese, and as a result it looks very likely that China may do a bit better as a result. If that is in fact going to be the case, then the Australian dollar will rally by proxy, as it is a currency that highly levered to the economic engine that is the mainland China. Beyond that, we also have the employment figures coming out on Thursday for Australia, and that will cause a significant amount of volatility when it comes to the Aussie as well.

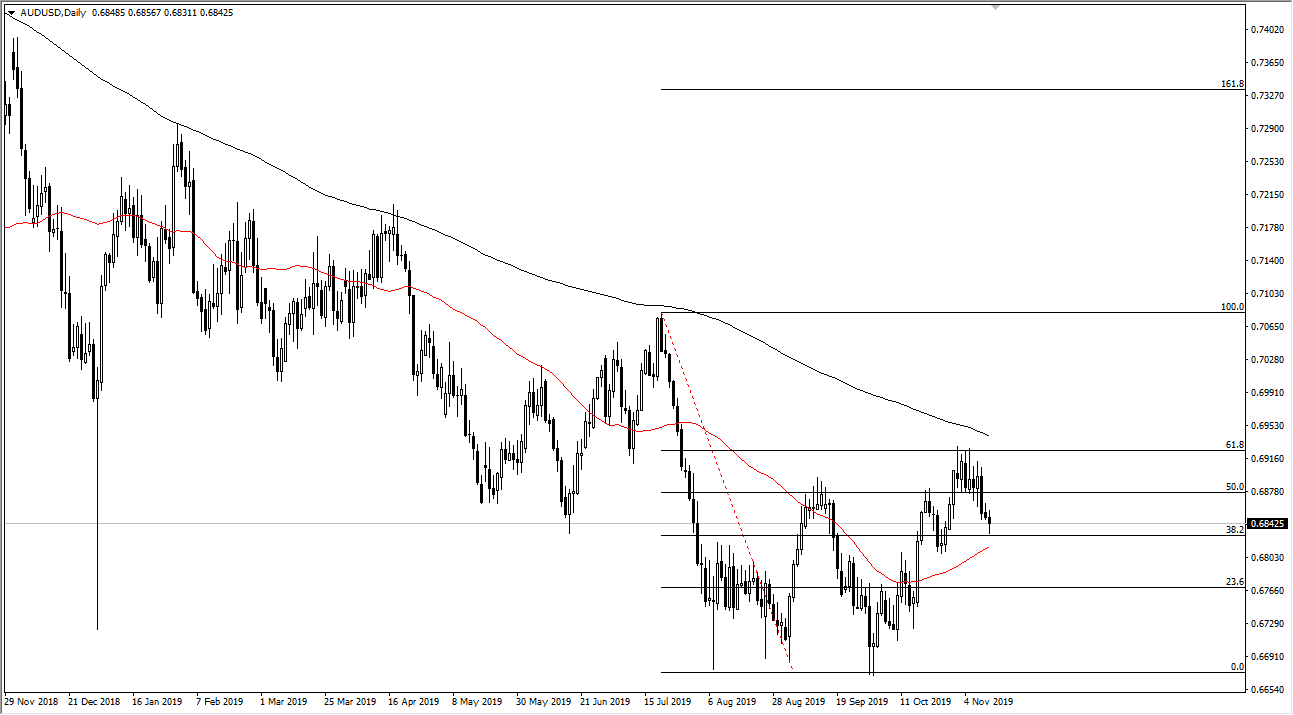

The 50 day EMA underneath is starting to turn higher and it’s likely that we are going to go to the upside. The 200 day EMA is above and is starting to slide lower, and now at this point it looks as if the market is starting to come to a head. We will eventually try to make a larger move, and if we can get some type of impulsive candlestick, then we can follow that for a bigger move. A break above the 200 day EMA would be a very bullish sign, perhaps sending the market towards the 0.71 level above. Alternately, if we were to break down below the 50 day EMA, it’s likely that the market will reach towards the 0.68 handle, and then eventually the 0.67 level which has been massive support, forming a bit of a double bottom recently. I think the one thing you can count on in this pair though is going to be choppiness, because quite frankly the Australian dollar is moving on almost anything but the Australian economy at this point in time.