The Australian dollar has done nothing during the trading session on Monday, which isn’t much of a surprise as we continue to wait to see what the Americans are the Chinese are going to do. Recently, there had been a bit of hope edging into the market participants as the idea of the Americans reducing tariffs against the Chinese heading into the “Phase 1” signing. However, Donald Trump has stated since then that he has not made up his mind as to whether or not he is ready to cut those tariffs back, so at this point I believe that the market essentially is holding its breath right now.

Looking at the candlestick for the day, it’s a perfect microcosm for just how confused this pair is right now. It’s a neutral candlestick that has a very tight range. At this point, it looks likely that we will continue to see a lot of erratic behavior. When you look at the daily candlesticks previously, even though they look like they were somewhat negative over the course of a week or so, the reality is that market participants had been gone back and forth during that timeframe. All things being equal, the market probably continues to see a lot of this back and forth action, and of course Trump and the Chinese are helping the situation.

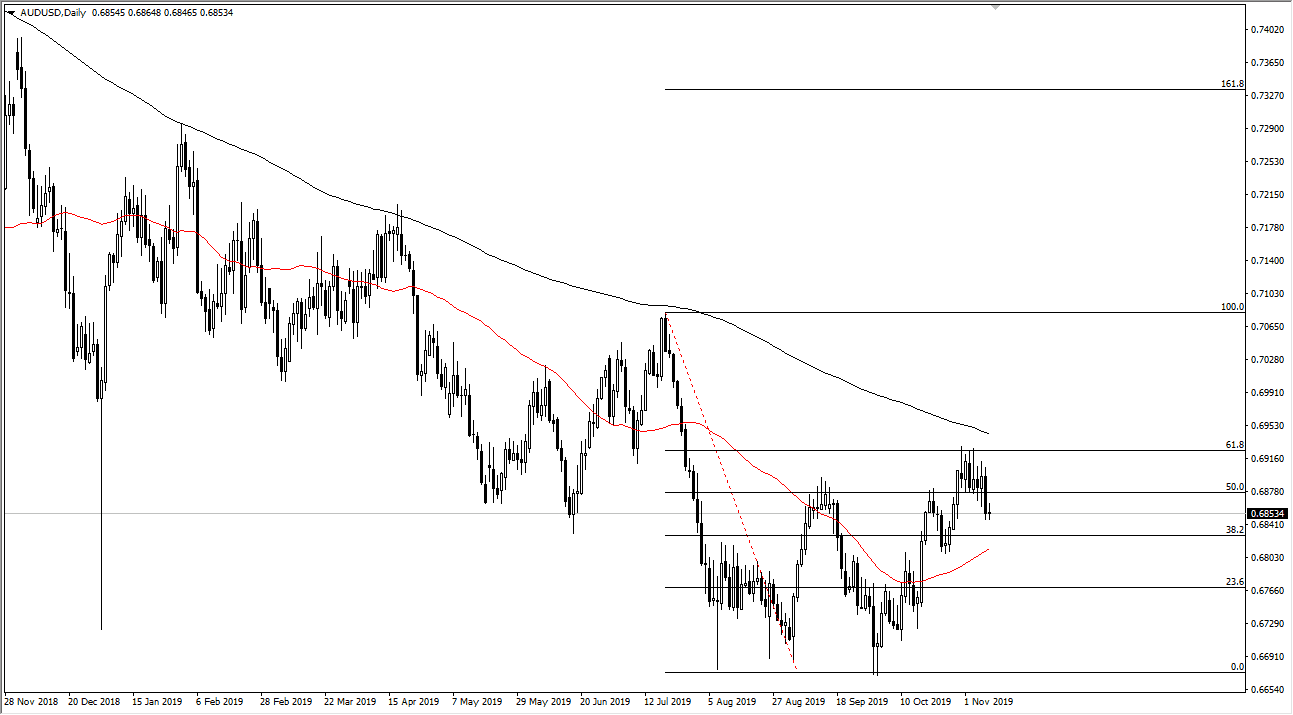

Australia continues to suffer at the hands of the US/China trade situation, as Australia is highly levered to the Chinese economy, as the supply so much in the way of materials for both construction and manufacturing. Ultimately, this is probably going to be more susceptible to bad news than good, because although we have seen a lot of good headlines come from time to time, the reality is that the market has been disappointed almost every time those have occurred. If that’s going to be the case, then it’s very likely that the markets will continue to favor the downside overall. That doesn’t mean that it’s an easy trade to sell the Australian dollar, but looking at the 200 day EMA, it is above and causing resistance. Because of that I look at the short-term charts for signs of exhaustion to sell the Aussie, but I’m not looking for anything more than a quick scalper here and there. At this point, a longer-term trade set up just isn’t there and I don’t know if it’s coming in the short term.