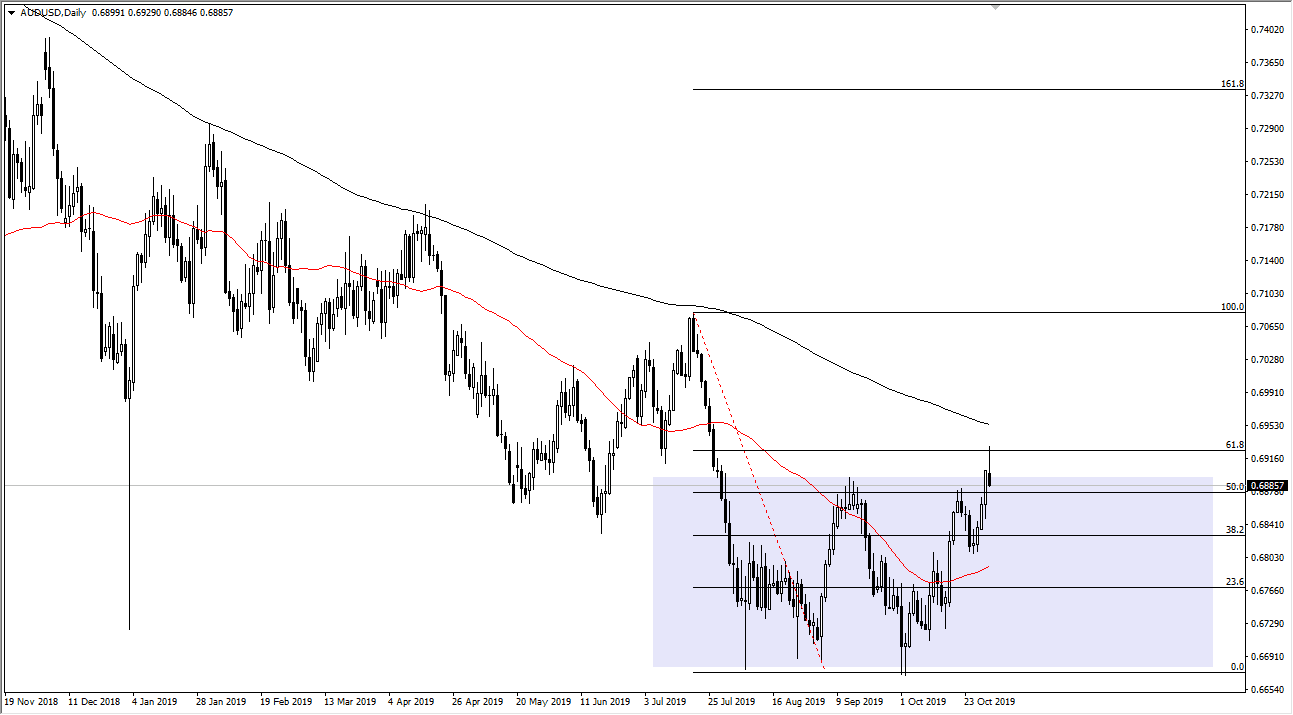

The Australian dollar has initially tried to rally during the trading session on Thursday but give back the gains at the 61.8% Fibonacci retracement level. We are now below the 0.69 level again, which is an area that I thought could be significant resistance. Ultimately, we were not able to continue to go higher, so at this point is likely that the jobs number will be the next major movement maker in this marketplace. The Australian dollar also is very sensitive to the US/China trade situation, and therefore could get disrupted by headlines. However, it does seem as if that situation is at least getting a bit better so that helps.

We are at the top of the consolidation area and just shy of the 200 day EMA so pullback makes quite a bit of sense. That being said though, the market had broken above the last highs, so I think it’s probably only a matter of time before the buyers get involved. That being the case I like the idea of buying dips as long as things don’t completely fall apart from an economic standpoint. However, that doesn’t mean that you need to jump into this market right away. If we break above the 200 day EMA, then it’s a buying opportunity. However, if the market were to break down from here and go looking for support underneath near the 0.68 level, I’d be interested in buying that as well.

I think we are trying to form a longer-term bottoming pattern, and this tends to be a long drawn out type of process. At this point, the Australian dollar is probably getting a reprieve based upon the fact that the US/China situation is at least starting to sound better, and that of course helps the entire idea of the Australian dollar gaining strength as it is a proxy for China in the currency markets, and of course Australia sends huge amounts of raw materials to China for both construction and manufacturing. Ultimately, this is a market that continues to show a bit of a basing pattern, but as is the case, patients will be needed in order to take advantage of an upward move. That being said, if we were to break down below the 50 day EMA then this will have been a false alarm for the bullish Australian dollar traders out there.