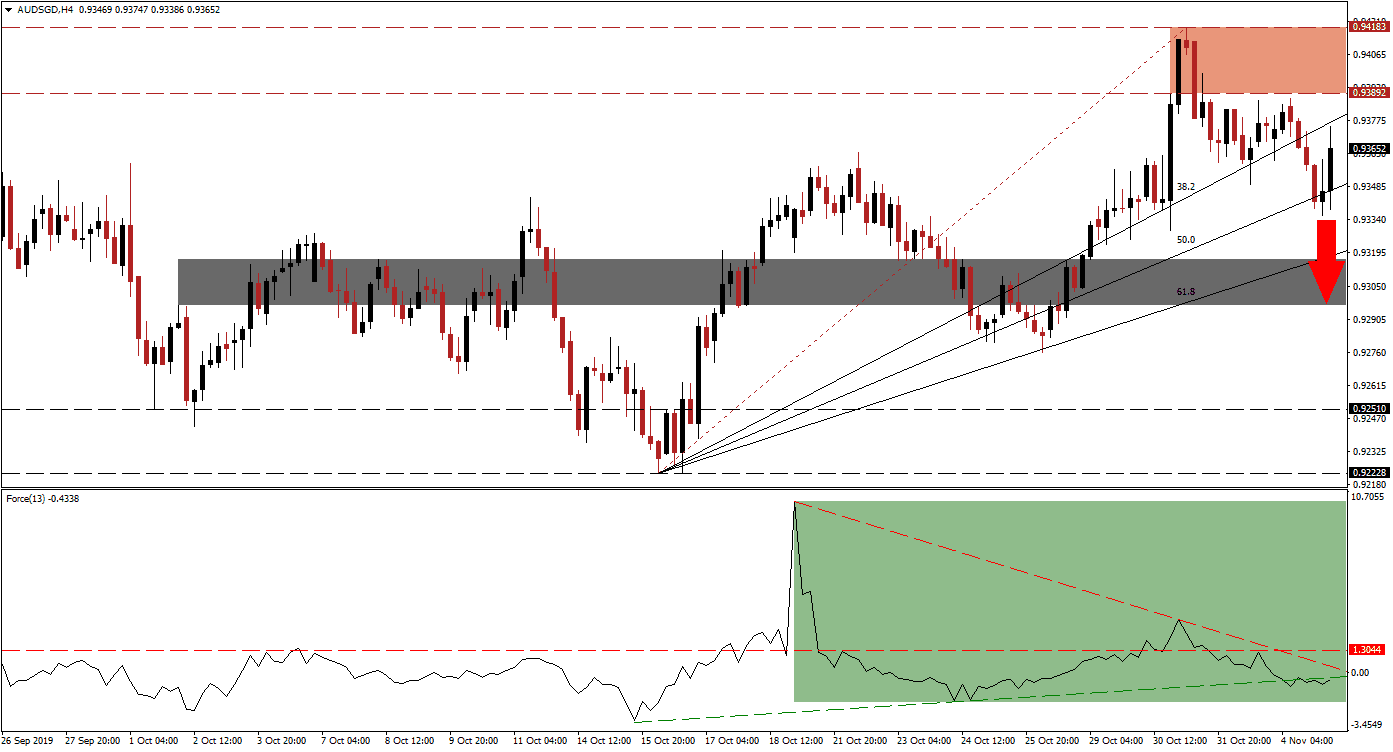

Economic data out of Australia and China showed that the slowdown has accelerated as the Reserve Bank of Australia kept interest rates unchanged as expected. Conflicting reports for the service sector were released, with one showing a healthy pick-up while another one was revised down to show a complete standstill. Chinese and Hong Kong PMI data came in below expectations as well, but the AUD/SGD bounced higher off of its 50.0 Fibonacci Retracement Fan Support Level as bearish momentum is on the rise. Given the set of fundamental data which was released during the Asian morning session, coupled with the technical picture, more downside should be expected from this currency pair.

The Force Index, a next generation technical indicator, shows the decrease in bullish momentum which collapsed after price action initially pushed above its short-term resistance zone which was converted into support. Following a small reversal, the AUD/SGD advanced while the Force Index contracted and a negative divergence formed; this bearish trading signal suggested a breakdown is on the horizon. The Force Index than completed a breakdown below its horizontal support level, turned it into resistance and has now moved below its ascending support level as marked by the green rectangle; its descending resistance level is further adding downside pressure on this technical indicator which also trades in negative territory.

After this currency pair reached its most recent intra-day high of 0.94183 and with a negative divergence present, price action reversed. Following the breakdown below its resistance zone which is located between 0.93892 and 0.94183 as marked by the red rectangle, a profit-taking sell-off further pushed this currency to the downside. The Fibonacci Retracement Fan sequence is now approaching this resistance zone and breakdown pressures are increasing. The AUD/SGD is currently trading above its 50.0 Fibonacci Retracement Fan Support Level, but below its 38.2 Fibonacci Retracement Fan Resistance Level; a pause following a major breakdown is normal before the downtrend can extend. You can read more about a breakdown here.

A long-term uptrend formed through the creation of higher highs and higher lows, following the breakout above its long-term support zone located between 0.92228 and 0.92510. This uptrend is likely to remain intact which will limit the downside potential in the AUD/SGD to its converted short-term support zone which is located between 0.92964 and 0.93168 as marked by the grey rectangle; the 61.8 Fibonacci Retracement Fan Support Level has already eclipsed this level. A breakdown below this short-term support zone is currently not expected given the health of the bullish chart pattern, unless a new fundamental catalyst will emerge. You can read more about a support zone here.

AUD/SGD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.93650

⦁ Take Profit @ 0.92900

⦁ Stop Loss @ 0.93900

⦁ Downside Potential: 75 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 3.00

In case of a reversal in the Force Index which will lead to a breakout above its descending resistance level, the AUD/SGD may attempt a breakout above its own resistance zone. This is likely to result in a higher high in accordance with its chart pattern, but the retreat from its current intra-day high was not big enough to maintain the long-term integrity of this bullish trend, and make this currency vulnerable to a bigger corrective phase. The next resistance zone is located between 0.94593 and 0.94798 which should be considered a good short-selling opportunity.

AUD/SGD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 0.94250

⦁ Take Profit @ 0.95750

⦁ Stop Loss @ 0.94000

⦁ Upside Potential: 50 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.00