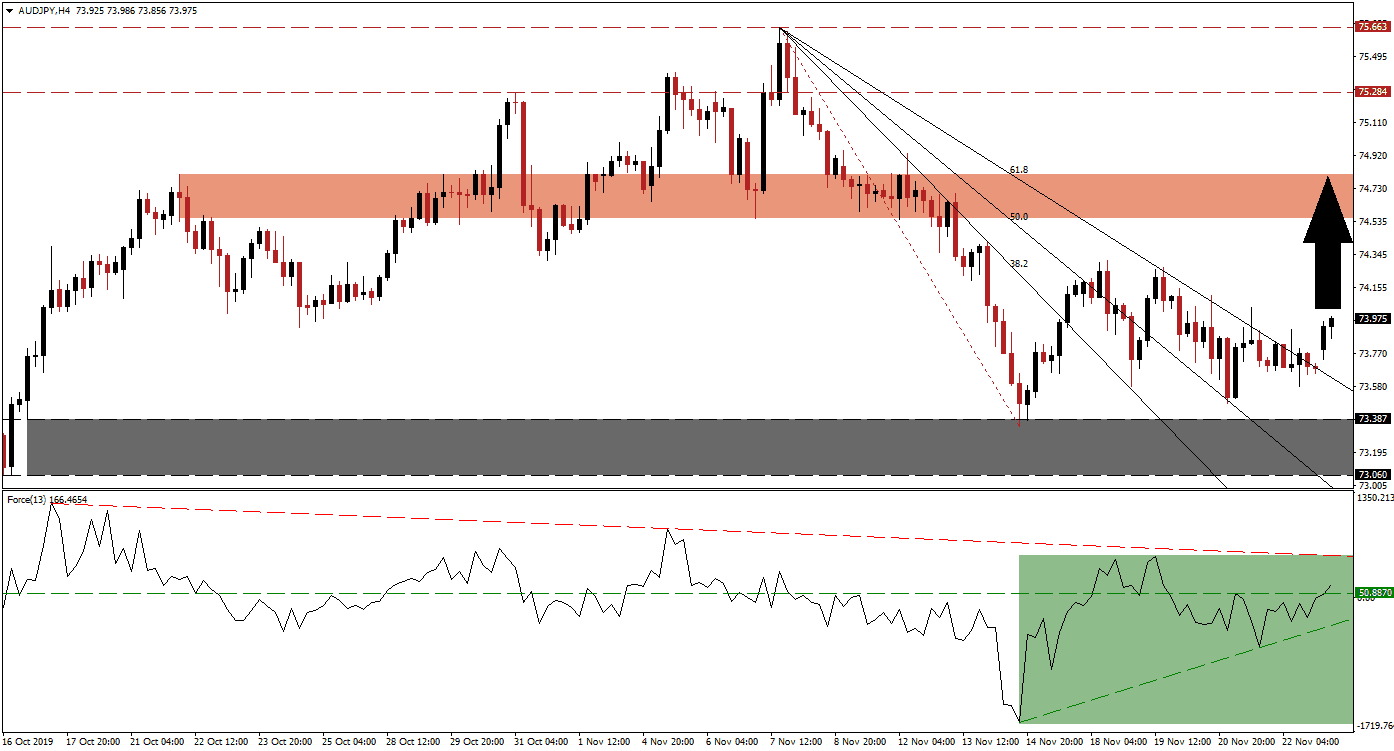

Positive developments out of China this weekend regarding intellectual property violations have allowed Asian markets to start in the green and the Australian Dollar advanced. China announced tougher penalties for IP violations in a move some analysts saw as a way to ease negotiations of the phase one trade truce. The biggest issue remains the roll-back if tariffs which the US refuses and China demands, but the news was enough to allow the AUD/JPY a breakout above its descending 61.8 Fibonacci Retracement Fan Resistance Level. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, confirmed the breakout with one of its own above the horizontal resistance level that turned it into support. An ascending support level formed and added to the build-up in bullish momentum. The Force Index is now on track to challenge its descending resistance level and the breakout has additionally elevated this technical indicator into positive conditions as marked by the green rectangle. Bulls are now in charge of the AUD/JPY and they have a clear path into the next short-term resistance zone.

This currency pair ended its corrective phase after price action reached the top range of its support zone located between 73.060 and 73.387 as marked by the grey rectangle. Due to the preceding sharp sell-off, a steep Fibonacci Retracement Fan sequence emerged and the breakout in this currency pair above it has now invalidated it. A short-covering rally is likely to follow and provide the necessary momentum to the upside. Forex traders are advised to monitor the intra-day high of 74.269, this marks the peak of a previous breakout attempt that was rejected by its 61.8 Fibonacci Retracement Fan Resistance Level. A move higher is expected to attract fresh net buy positions in the AUD/JPY.

US-China trade developments will remain in focus, but expectations grow that a potential signing of a hollow phase one trade truce may be delayed into 2020. US President Trump threatened more tariffs unless a deal is signed, the date of additional tariffs remains unchanged on December 15th 2019. Short-term bullish momentum should take the AUD/JPY into its next short-term resistance zone located between 74.556 and 74.813 as marked by the red rectangle. A breakout above this zone is possible, but dependent on fundamental developments. The next long-term resistance zone awaits price action between 75.284 and 75.663. You can learn more about a resistance zone here.

AUD/JPY Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 73.950

⦁ Take Profit @ 74.800

⦁ Stop Loss @ 73.700

⦁ Upside Potential: 85 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 3.40

In the event of a reversal in the Force Index that will lead to a breakdown below its ascending support level, the AUD/JPY may be pressured into a reversal. The downside potential is likely to remain limited to the bottom range of its support zone unless a fresh fundamental catalyst emerges. A breakdown in the Force Index will additionally bring the Fibonacci Retracement Fan back into play and serve as a potential guide for price action.

AUD/JPY Technical Trading Set-Up - Price Action Reversal Scenario

⦁ Short Entry @ 73.550

⦁ Take Profit @ 73.100

⦁ Stop Loss @ 73.750

⦁ Downside Potential: 45 pips

⦁ Upside Risk: 20 pips

⦁ Risk/Reward Ratio: 2.25