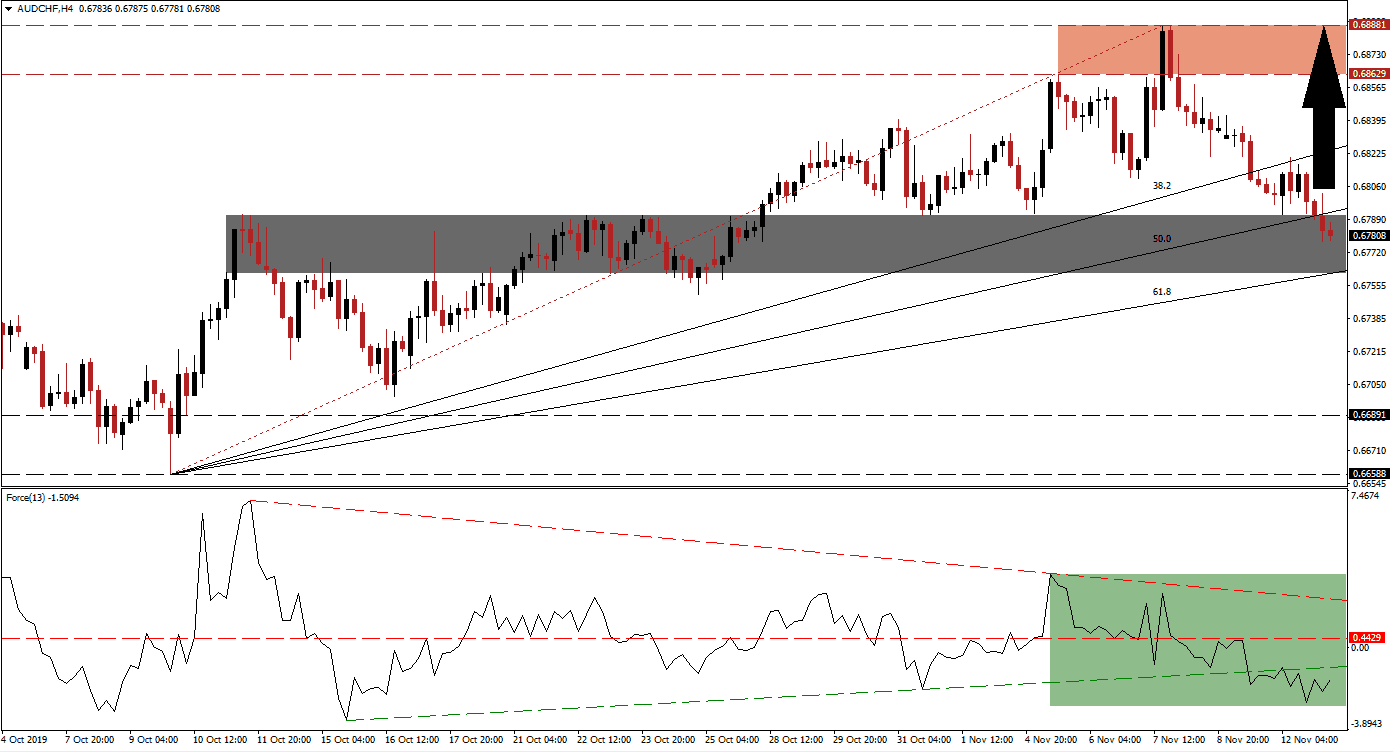

Australian consumer confidence rebounded and the wage price index showed solid growth which helped stabilize the AUD/CHF inside of its short-term support zone. Trade concerns due to conflicting messages out of the US and China have increased and uncertainty over what will happen to tariffs is on the rise which boosted demand for the safe-haven Swiss Franc; extreme bush fires in Australia have also added to the corrective phase in this currency pair. The Fibonacci Retracement Fan is expected to support price action and is likely to initiate a reversal, partially powered by a short-covering rally.

The Force Index, a next-generation technical indicator, is pointing towards a slow build-up in bullish momentum after it completed a breakdown below its ascending support level as marked by the green rectangle. After the AUD/CHF reached its short-term support zone, bearish pressures started to ease and the Force Index recovered from its lower low in negative territory. The advance is now expected to carry this technical indicator back above its ascending support level, which currently acts as a temporary resistance level, and lead price action to a breakout. You can learn more about the Force Index here.

While the correction in this currency pair has violated the long-term uptrend after reaching a lower low, the short-term support zone should provide a solid platform for another move higher. The ascending 61.8 Fibonacci Retracement Fan Support Level has just moved into this zone which is located between 0.67616 and 0.67909 as marked by the grey rectangle; the 50.0 and 38.2 Fibonacci Retracement Fan Resistance Levels have already moved above it. Forex traders should now monitor the Force Index, if the drift higher accelerates, a breakout in the AUD/CHF is expected to follow.

Since the bullish chart pattern has been broke, upside potential remains limited to its resistance zone which is located between 0.68629 and 0.68881 as marked by the red rectangle. A move above the intra-day high of 0.68024, the peak of the breakdown in the AUD/CHF below its 50.0 Fibonacci Retracement Fan Support Level which turned it into resistance, is expected to attract fresh net-buy orders in this currency pair. Price action around the intra-day high of 0.68205 should also be watched, this marks the high of a previous bounce in this currency pair, off of the top range of its short-term support zone, which was rejected by the 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a support zone here.

AUD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

⦁ Long Entry @ 0.67800

⦁ Take Profit @ 0.68800

⦁ Stop Loss @ 0.67500

⦁ Upside Potential: 100 pips

⦁ Downside Risk: 30 pips

⦁ Risk/Reward Ratio: 3.33

In the event of a reversal in the Force Index due to a failed breakout above its ascending support level, the AUD/CHF may follow through with a breakdown attempt below its short-term support zone and its 61.8 Fibonacci Retracement Fan Support Level. While a fresh fundamental catalyst would be required, such as a negative announcement in regards to the phase one US-China trade truce, the next long-term support zone awaits price action between 0.66588 and 0.66891.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.67300

⦁ Take Profit @ 0.66850

⦁ Stop Loss @ 0.67500

⦁ Downside Potential: 45 pips

⦁ Upside Risk: 20 pips

⦁ Risk/Reward Ratio: 2.25