A US bill in regards to the Hong Kong protests have angered China as the mood for a trade resolution between the world’s two biggest economies has soured. The AUD/CHF managed to hold on to its bullish bias, established following the breakout above its support zone after the People’s Bank of China marginally lowered interest rates by five basis points in its prime 1-Year/5-Year prime rates. The Australian Dollar is the top Chinese Yuan proxy currency while the Swiss Franc is a safe-haven asset. After the interest rate cut, price action drifted slightly below its short-term support zone where it awaits the next catalyst.

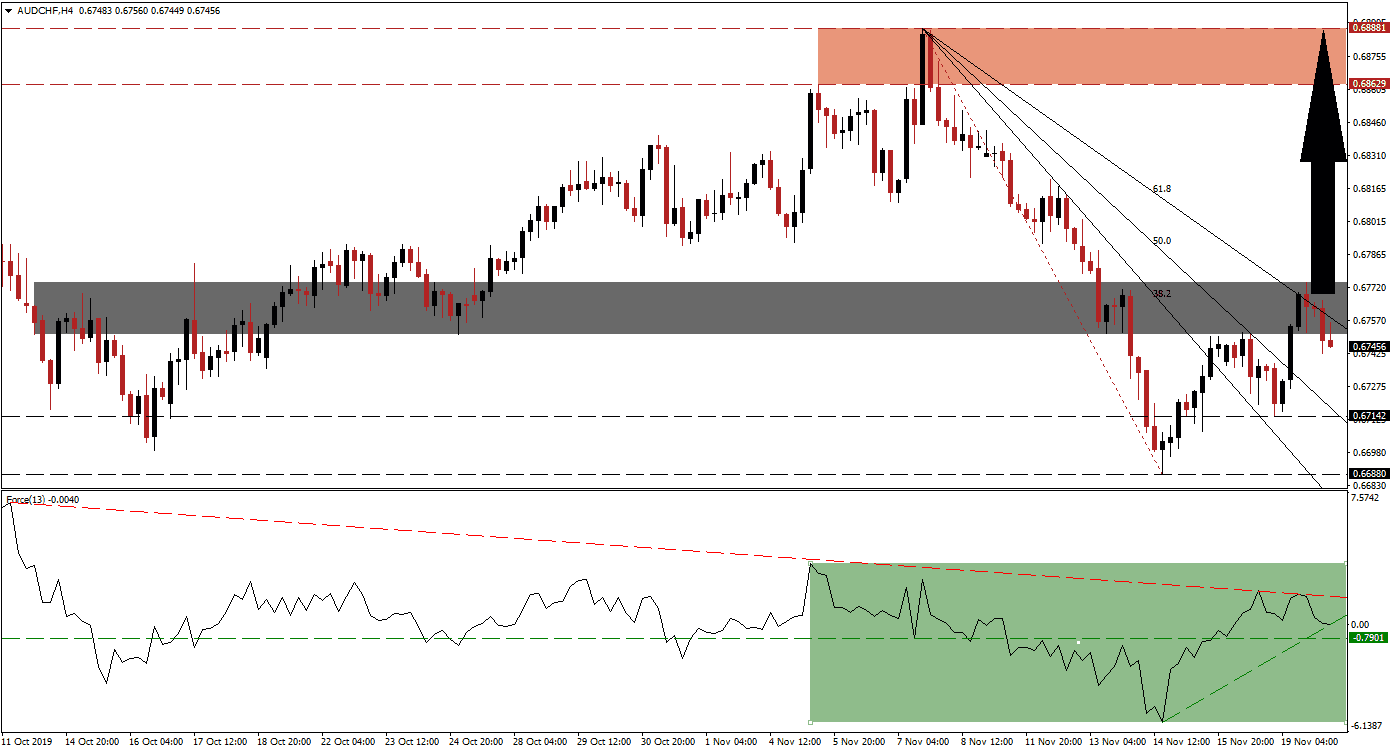

The Force Index, a next-generation technical indicator, recovered from its low as the AUD/CHF accelerated out of long-term support zone. This also took it above its horizontal resistance level and turned it into support, but the Force Index was unable to complete a breakout above its descending resistance level as marked by the green rectangle. As price action halted its advance, this technical indicator hovers above its horizontal support level and remains fractionally in negative conditions where a new ascending support level is being tested. A breakout in the Force Index above its descending resistance level is likely to lead this currency pair to a sustained move to the upside. You can learn more about the Force Index here.

A steep, Fibonacci Retracement Fan was created given the sharp sell-off in this currency pair which took it from its resistance zone into its support zone. Following the breakout above its support zone, located between 0.66880 and 0.67142 as marked by the grey rectangle, price action was initially rejected by its 50.0 Fibonacci Retracement Fan Resistance Level. The reversal took the AUD/CHF into the top range of its support zone from where it advanced to a higher high, before being rejected by its 61.8 Fibonacci Retracement Fan Resistance Level. This created the top range of its short-term support zone which acts as temporary resistance due to the drift below it; a sustained breakout is likely to follow.

Forex traders are advised to monitor the Force Index, as a push into positive territory is expected to lead to an advance in this currency pair which has displayed an orderly bullish advance since the breakout above its support zone. While a slide into the top range of its long-term support zone is possible, the increase in bullish momentum is expected to elevate price action above its short-term support zone which will clear the path for a bigger advance. The next resistance zone awaits the AUD/CHF between 0.68629 and 0.68881 as marked by the red rectangle.

AUD/CHF Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 0.67450

⦁ Take Profit @ 0.68850

⦁ Stop Loss @ 0.67050

⦁ Upside Potential: 140 pips

⦁ Downside Risk: 40 pips

⦁ Risk/Reward Ratio: 3.50

In case of a double breakdown in the Force Index, below its ascending support level as well as below its horizontal support level, the AUD/CHF could attempt to push below its support zone. The long-term fundamental outlook suggests more upside in this currency pair and any breakdown in price action should be viewed as a solid buying opportunity. The next support zone is located between 0.64993 and 0.65570.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.66650

⦁ Take Profit @ 0.65550

⦁ Stop Loss @ 0.67100

⦁ Downside Potential: 110 pips

⦁ Upside Risk: 45 pips

⦁ Risk/Reward Ratio: 2.44