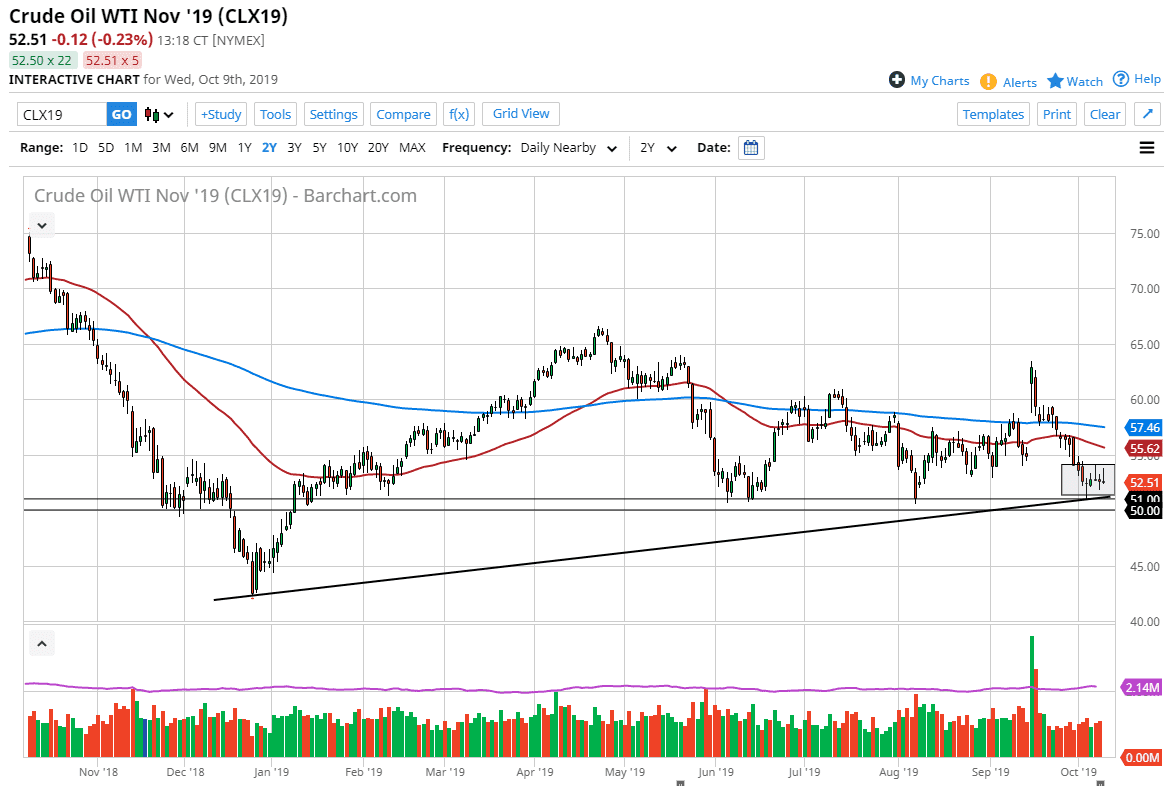

The West Texas Intermediate Crude Oil market initially shot higher during the trading session, then pulled back. A little later in the day we got the inventory number out of the way and then shot higher again only to crash back down and form a shooting star. When you look at the last five candlesticks, four of them are either shooting stars or hammers, so it makes sense that we continue to consolidate in this area as we have a significant amount of resistance above at the $54 level, and then massive support at the $51 level.

Looking at the resistance, it more than likely extends all the way to the $55 level and as a result it’s likely that the market will struggle to go higher. Beyond that, the 50 day EMA is just above and reaching towards that area as well. That being said when you look at the support, the $51 level is the beginning of support down to the $50.00 level, which of course is a large, round, psychologically significant figure. Beyond that, we also have a nice uptrend line that is slicing through the markets so it makes quite a bit of sense that we should be looking at the lower level as a very difficult to break through. If we do break down below the $50 level, then it’s likely that the market will continue to drift down towards the $45 level underneath which of course has a certain amount of psychological importance, and of course an area that we have seen buyers at previously. The crude oil markets had a poor inventory number during the trading session, and all things being equal they have acted quite well considering that they did break down and this tells me that the support underneath is quite strong to say the least.

With that in mind, if the market were to break down below that support it would be rather brutal and I suspect that the move would be rather quick. To the upside, I don’t anticipate that to be easy though, and obviously you would need some type of fundamental or news based catalyst to break this market down. I suspect the next couple of days will probably be very choppy in range bound though, so short-term traders will probably continue to be attracted to this well-defined range of $3.00 and crude oil.