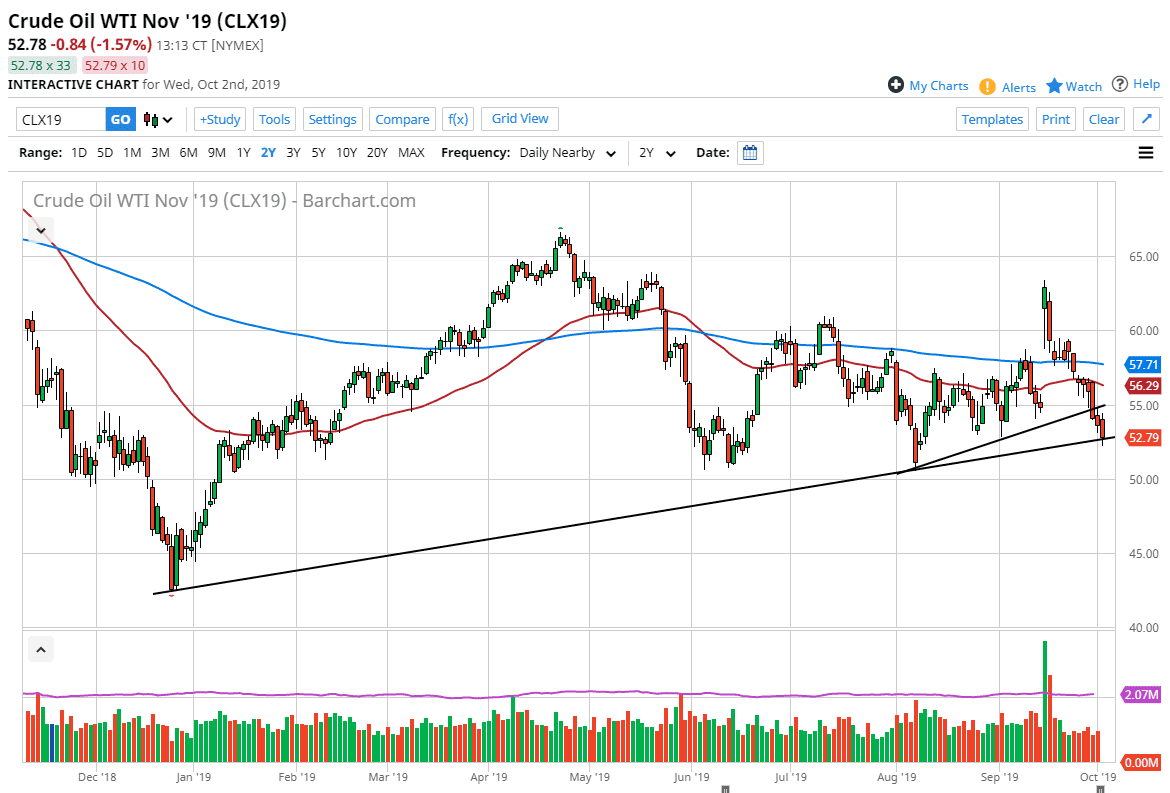

The West Texas Crude Oil market has fallen yet again during the trading session on Wednesday, breaking the back of a hammer after getting a more bearish than anticipated inventories figures coming out of the United States. That being the case though, we have bounced a bit from the uptrend line underneath that should keep the market somewhat afloat. As we are closing right there at the trend line, it is obvious that we could have a pretty significant move getting ready to happen.

I suspect we may get a short-term rally, reaching towards the top of the daily candle stick for Wednesday. Somewhere between here and there though, I would expect to see signs of exhaustion that will be sold into. Thursday may be a bit quiet though because we do have the jobs number coming out on Friday and that does tend to put a bit of a lid on the market in general. However, all things being equal anything can happen at any time so keep that in mind.

If we break down below the bottom of the candle stick for the trading session on Wednesday, then it’s possible that the market could go down to the $51 level, looking for signs of support in that general vicinity. That is an area that I think should continue to offer support all the way down to the $50 level, so keep in mind that will be difficult to break through. However, if we did break down below the $50 level, the market could drop another five dollars rather rapidly. I suspect we are going to see more of a bounce in the short term though, with the $55 level above offering significant resistance. I think we will simply continue to grind sideways overall, but the jobs number could give us the next catalyst to move the market.

Currently, the United States and Iran are bickering but starting to lean a little bit more towards the idea of trying to work out some type of agreement with the previous nuclear agreement, as the Iranians have agreed to some of the conditions laid out by the EU. That could be a major driver of where things go next, so obviously that fluid situation will have to be paid attention to. All things being equal though, the biggest problem oil has is that the global economy is slowing down and that isn’t going to change.